This educational post will be solely based on Futures so if you are looking to learn Options I would go to the other post which will be coming out tomorrow. If you are reading this after 1/14/23 then it most likely has already been released! Highly recommend reading both so you can understand the benefits of trading Futures. Now many don’t even know what Futures is so let me dive into this before talking on risk.

What is Futures?

*I pulled this from Investopedia as they explain it very well. Link: Investopedia

Futures Market

A futures market is an auction market in which participants buy and sell commodity and futures contracts for delivery on a specified future date. Futures are exchange-traded derivatives contracts that lock in future delivery of a commodity or security at a price set today.

Examples of futures markets are the New York Mercantile Exchange (NYMEX), the Chicago Mercantile Exchange (CME), the Chicago Board of Trade (CBoT), the Cboe Options Exchange (Cboe), and the Minneapolis Grain Exchange.

Originally, such trading was carried on through open outcry and the use of hand signals in trading pits, located in financial hubs such as New York, Chicago, and London. Throughout the 21st century, like most other markets, futures exchanges have become mostly electronic.

There is a long list of the physical commodities traded on the Futures Market so we will break it into sectors as so, Agricultural (Grans, food and fiber / livestock and meat), Energy, Forestry, Metals (industrial, & Precious. Lets break them down into what each sector trades.

Agricultural

Grains, Food and Fiber

Corn, Oats, Rough Rice, Soybeans, Rapeseed, Soybean Meal, Soy Meal, Soybean Oil, Wheat, Milk, Cocoa, Coffee, Cotton & Sugar.

Livestock and Meat

Lean Hogs, Live Cattle & Feeder Cattle.

Energy

WTI Crude Oil, Brent Crude, Ethanol, Natural Gas, Heating Oil, Gulf Coast Gasoline, RBOB Gasoline, Propane & Purified Terephthalic Acid.

Forestry

Random Length Lumber, Hardwood Pulp & Softwood Pulp.

Indices

S&P500, NASDAQ100, DOW & Russell2000.

Metals

Industrial

LME Copper, Lead, Zinc, Tin, Aluminum, Aluminum alloy, LME Nickel, Cobalt & Molybdenum.

Precious

Gold, Platinum, Copper, Palladium & Silver.

Now that we have an idea of what these Future contracts are based on, we can start to form an idea why these contracts are traded in the first place. The first futures exchange opened in 1710 out of Osaka, Japan. It is said that Futures have been around since the 1500s but there isn’t too much evidence to solidify this nor does it really matter. US currently has the largest Futures Exchange in the World in Chicago known as the CME Group. This was a hub for transportation, distribution, and trading of agricultural products. A problem arose to the system when shortages came and merchants, processors, and companies wanted a way to cut out the volatility in prices and sell the goods for a locked in price. This is when the idea of forwarding payment came for a product which would be the purchase of a futures contract. The difference in prices will then be passed on to the buyer of the contract. So futures contracts came about solely for the reason of having security.

Many traders will use these contracts to form a thesis on the market like using Gold and Oil to form thesis on ES trade. I would look into these and learn how each market trades or even find out which markets have correlation to a market that you trade.

What makes them different?

As we all know each contract is based on a physical commodity so that is a clear difference. What may not be as clear is the difference in tick sizes each commodity trades and the value of price movement per tick. This post will be solely on NQ & ES Futures.

Tick size

ES & NQ both trade in 0.25 tick increments meaning that if price was 4000 on either of the two, the prices above go as so 4000.25, 4000.50, 4000.75, 4001, 4001.25.

Now that we know price moves by 0.25, what does that mean for our contracts when we move 0.25 in price? ES & NQ are different when it comes to tick value.

Tick Value

Each Contract will have a different value per tick which means if the contract moves up a tick in price, depending on the commodity being traded, the $ value of P/L will be much different. Not only this but these value are set and do not change unless you change the size you are using. So lets dive into the difference between ES & NQ.

ES contracts move $12.50 per tick

NQ contracts move $5 per tick

This may sound very odd to many but understand that Futures markets run on extreme leverage. ES contracts move 50x more than if you had same price movement in commons. Let’s say you bought Tesla at 4000 and ES at 4000. They both then go up 10 to 4010. Tesla you are up $10 on your shares while ES you are up $500. This is because you take the price movement and multiply it by the tick value(Using $50 tick size as we used 10 handles rather than 40 ticks in this example) 10 x $50 = $500. Most traders will think automatically wow I can make so much money with that leverage but that’s just not the case. More money is more problems and if you can’t handle trading will small sums of money, you will fail with larger sums. Not only that but the pain you will go through will be far greater than you have ever thought you could feel. Be very careful if you look to trade futures as there is so much risk involved and that goes for all trading. So many will see the $50 and either think they will be rich or that’s way too much risk. Well good news for you! These aren’t the only contracts we can trade on Futures when using ES & NQ.

Micro Futures

Nobody should start out using ES or NQ to trade with as they will not be able to handle the volatility and their account size is not ready. So exchanges have something for you so you can not miss out. We call these contracts Micro Futures and they are based on the same commodity but these are 1/10 the value of ES. Micro Futures will have a M in the front of the handle signifying this is a micro contact. So you can trade using MES or MNQ.

MES 10 lots = ES 1 lot

MES Tick Value: $1.25

MES Handle Value: $5

MNQ 10 lots = NQ 1 lot

MNQ Tick Value: $0.50

MNQ Handle Value: $2

Now that look’s much more affordable! These are great to use when learning proper risk management. Highly recommend if you trade 1 ES lot to start trading 10-20 MES lots so you can set multiple profit targets and work your position. I will dive into this more as you continue to read on.

Takeaway: Stick with MES until you can trade at least 3 ES lots

Account Management - Futures Risk Calculator

Highly recommend going to the link above to map out your trades, note this was found on the internet today but I will show how to easily set this up on a spreadsheet.

Variables you NEED to know when planning a trade:

Account Size + % Risk of Account per trade

These are the key elements into keeping a consistent system allowing you to profit. Personally used and recommended by most is risking no more that 1% of your account per trade. Now they say it takes 100 trades in a row to run out of money, that’s so far from true. The size you take can change as the account size grows or gets smaller. Your averages will move around but will be minimal as your account will not have any major fluctuations other than larger upswings. If you have $100,00 then lose $75,000 you should not use same 1% risk off $100,00. 1% risk of $100,000 is $1,000 per trade. Now once you lose money and the account is at $25,000 you will take that 1% from the current account value. So instead of risking $1,000 which would now take 25 trades to lose it all, the risk is $250. If you continue large size when account is taking a hit you will more than likely put yourself in a much deeper hole.

Now you know how much you should be risking per trade so let’s jump into how to know what size to use on each trade as it will be based on the two variables above.

Let me point out that you need to have at least 2:1 risk reward and a winrate of 50%. You can have higher risk reward with lower winrate but higher winrate and lower risk reward isn’t what I would go for. Remember you will work with what best fits you! Ideally stick with the numbers I gave above and overtime improve on them. Now anything I say in the post feel free to ask as many questions as you like, also feel free to shoot me a DM on Twitter. These posts are for you and It’s my job to give you a fluent and thorough understanding.

Sizing

The reason I pointed out Risk Reward and Winrate is because this is how you will find what setups you will be trading. All my trades are planned to profit twice as much as I can lose. So if I take a loss and a win then I will be positive on the day.

Loss = -$50

Gain = +$100

Overall = +$50

Repeating this in the long run will result in a major uptrend to your P/L. Just to show how this works I will show data for a $10,000 account risking 1% ($100) with 2:1 risk reward and 50% winrate.

As you can see within 200 trades you will be well into the profit nearly up 400% on your account. Now this doesn’t account for sizing up once the account begins to grow so note this is keeping same exact system the entire time. Now we need to zoom in and wee how this all started out. You will be shocked at the results from the beginning to the end but looking in the moment you would think that nothing is working.

Within the first 20 trades you would be up $2,000 but this looks like an ugly P/L and most would say this would not turn out profitable in the long run. I will show one more example but using an account at PDT $25,000 using same variables.

As you can see within first 20 trades having 10 wins and 10 losses the P/L is keeping a steady pace higher. How about 200 trades down the road?

So we can clearly see what the possibility is if you can sustain these statistics on you trades for a long period of time. As much as we can see it on this chart this doesn’t at all mean you will follow to this. All these numbers are set and can not change which is not how the market will work at all. There will be many unforeseen events that will take place and can cause unexpected slippage on positions. There is a way around this and everyone should use this as you will find yourself sticking with plans and can keep level head avoiding large losses.

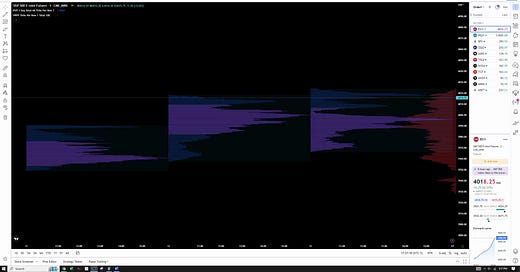

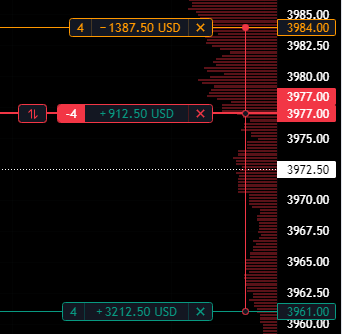

Trading Templates

There’s an endless number of systems which all use unique templates to execute trades. A template is simply having your stop loss and profit take already placed into the market. A very basic example can be used from Twitter today. I took a Short ES at 3977 which I then placed my stop loss at 3984 and profit take at 3961. I let the market do it’s thing and let the levels work. Now I manually will place my stop loss and profit take as my system changed daily in terms of how wide stops and targets are from entry. That’s solely based on the profiles and value we currently sit in. Some days will have events and I will use wide stops and some we will balance and my trades will be extremely tight. You need to pay attention to the volatility to know where the market can reasonably trade each session. A template for Long/ Short that’s very basic would be stop loss 40 ticks from entry and profit take 80 ticks away (numbers can change but need to be 2:1 no matter what while going above is best). This hits our 2:1 risk reward minimum while also accounting the setup being traded has been back tested. Later I will release a post on building a setup and how to back test it. So accounting this you will always be taken out of the market and will not sit there holding a bag while position moves further against you.

How can you make a template more complex?

Splitting up the take profit orders which goes hand to hand with using MES rather than 1 ES lot. This is when you shine with the MES lots even if you take same size as if you had position in ES. Using 1 lot on ES you only have 1 price to take profit and your out of the trade. Where If I use let’s say just 3 MES lots I can now set 3 take profit orders. Now some might wonder why you would do this. Taking off size while moving to the target will for one lock in gains and two take off risk. What I like to do is set 1/3 position to sell half way to my target, 1/3 at the target and 1/3 same distance of halfway point but beyond the target. In the end once you are all out and all targets are hit you will come out of the trade with same profit if you used 1 ES lot and sold at the target. Why wouldn’t you want to take off risk and lock in gains? No brainer to me to do so.

To add to this I want to speak on Stop Losses and when to move it.

Many traders fall victim of moving stops away from entry as price continues to go against their position. First off you will automatically change the risk reward of your trade the moment you move your stop further away from entry. Anytime you do this you need to cut the trade and reflect on why you needed to move the stop further away and why you will not do it again. There is never a reason to move a stop further away as this will invalidate the trade plan. Anytime a trade plan is invalidated you need to exit immediately. You have no idea what will happen and odds are you will continue to be wrong and risk far more downside. So when can we move our stop? I will only move it once we have moved to the halfway point of entry to target. This is where I sell 1/3 of my position and I will move my Stop Loss, also known as LIS (Line In Sand), to my entry so the rest of my position will no matter what be breakeven and I will come out with a profit. To add to this if we hit main Target I will once again move my Stop Loss to my first take profit level which is also halfway point from entry to target. Unfortunately ones using 1 lot ES will lock in no gain when moving Stop if price were to trade back to entry. I can’t stress this enough, start out with MES and more than likely you will stick with it until you are trading 3 contracts minimum which is 30 MES contracts… Long ways away from that point.

Depending on what platform you trade on, paper trade previous days sessions or even live. Practice taking losses and sticking with you plan. Understand when price hits your stop the trade is invalidated and you should analyze what has changed, if anything.

To speak on how I learn and this goes with everything in life, I learn the hard way. I grew up with a single mom and was much easier to argue with a female then a male. Dads tend to be the leader of the house and have the say. For me my mom struggled to keep my brother and I disciplined. This was to bite me in the ass later on as I was not used to being held accountable for my actions. Now I was no bad child but everything that has happened to you will shape how you trade today. Rewiring your brain will be the only way to change the norms to what actually works in the market. From what I kept track of I have blown many accounts somewhere north of $100,000 in losses before I started to fins success. To come into trading and expect to not lose money will never blossom to be true. No trader in the history of the stock market has made it through a whole career without taking losses. The struggle is the losses and lessons come more in the beginning, a time when you have no idea what’s going. Everyone start’s in the same boat whether that’s me, you, Tic, or your 7th uncle. If you want to be a trader you must learn why we keep a solid system and do not venture away from it. So important to journal all mistakes whether they’re transparent now or not. Many ideas that I came across meant nothing until months to years down the road. I had to feel the pain. As much as I can speak on my downswings, it will not make you avoid the same mistakes. Your now aware of them but it is YOU who has complete control of everything.

In a normal work environment 99.99% of the workers listen to orders of the their boss and even at home listening to parents growing up. In trading you control all of your results with nobody to tell you when your right or wrong. You putting your hand on a hot stove will have no warnings on it other than the ones you create overtime. I can give you tested strategies but in the end it may not suit you. From there you can either alter the system or create one based on your own strengths and weaknesses. For example I can do just as good long as I do short. If for whatever reason you struggle to go short or long, focus on refining your trading for shorts while taking most trades long until it’s fixed. Trade what work’s and the best way to know this is to back test a strategy and trade it! You may learn a lesson that I have never even thought of. Never look down on yourself, have confidence with healthy ego and get ready to get to work. Never give up, show support, learn from mistakes and blossom in to the trader you look to be.

Out of everything I have said above this is all of what I have found to be helpful and can give a foundation to think how create or solidify your system, some traders will know all of this already and others it will be brand new. The goal is to know what you can be capable of and what is needed to do so.

Have any questions on your system or this post?

DROP THEM BELOW IN THE COMMENTS OR DM ME ON TWITTER!

Hope this post will help guide you into risk management and can allow you to not only cut losses quickly but soak the meat of the move on most of your winners. Applying everything above has dropped much of the stress while holding a positions.

Make sure to now use this information and build a solid risk management system using volume profile.

If you haven’t already read the Introduction to Volume Profile, click me.

Stay on the lookout for the next post to add onto Risk Management trading Futures and tomorrow post on Risk Management - Options

Much love everyone!

-Flint

Disclaimer: This post is not trading or investment advice, but for general informational purposes only. This post represents my personal opinions which I am sharing publicly as my personal blog. Futures, stocks, bonds trading of any kind involves a lot of risk. No guarantee of any profit whatsoever is made. In fact, you may lose everything you have. So be very careful. I guarantee no profit whatsoever, You assume the entire cost and risk of any trading or investing activities you choose to undertake. You are solely responsible for making your own investment decisions. Owners/authors of this newsletter, its representatives, its principals, its moderators and its members, are NOT registered as securities broker-dealers or investment advisors either with the U.S. Securities and Exchange Commission, CFTC or with any other securities/regulatory authority. Consult with a registered investment advisor, broker-dealer, and/or financial advisor. Reading and using this newsletter or any of my publications, you are agreeing to these terms. Any screenshots used here are the courtesy of Ninja Trader, Think or Swim and/or TradingView. I am just an end user with no affiliations with them.

Share this post