Good morning traders!

Yesterday was another great session as ones with winners and losers give so much to teach. Flipping bias based on profiles with explanations inside the telegram have been key recently and really look forward to expanding on this in the near future.

Overnight Emini sold down to T3 4153 only dropping 3 handles below at the time of this post.

Swing high? 4198

VAH in Weekly Outlook? 4192

Shorting VAH and Longing VAL is the bread and butter which has been served for 3 weeks straight.

Swing low? 4196

VAL in Weekly Outlook? 4095

Blue box marks VAH & VAL over the last 3 weeks, let this just show how robust Orderflow - Volume Profile levels are. A month ag I said unusual activity will be coming to an end soon. Fast forward to the present and this came true! LVN are being respected with little MAE at VAH & VAL.

More will be added soon!

In todays video I cover what my thoughts are for todays session and how we are currently positioned inside value.

Events

-

Earnings

1Q EARNINGS PER SHARE $2.88, EST. $2.87

1Q REV. $8.16B, EST. $8.17B

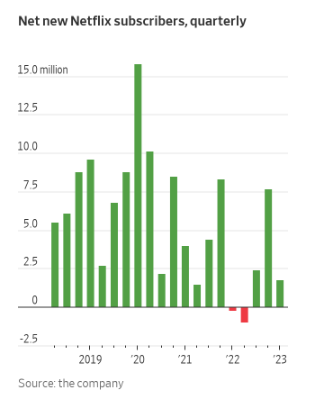

Ad supported tier brings in more revenue on a cheaper subscription, the difference is $15.99 to $6.99 yet able to make more on the lower tier. This will help compete with other streaming services on prices while also not upsetting “customers” that were using shared accounts. The company says there is over 100 million users not paying but using an account through someone else. Taking a rough estimate, 15 million of those will become paid users which can open up door to nearly $240 million. With

Ended 25 years of mailing DVDs which is where the company started.

1.75 million new users added in the quarter bringing the total up to 232.5 million.

1Q EARNINGS PER SHARE $1.23, EST. $1.23

1Q REV. $1.70B, EST. $1.59B

This quarter saw a large increase in # of robotic surgeries which brought revenue to $1.1B, a 14% increase.

Analysts are expecting $6.9B in sales this year which is on pace to be hit.

(SWING LEVELS FOR ISRG & NFLX WILL BE IN WEEKLY OUTLOOK)

Value Areas

4095 - 4192 / POC 4177

3880 - 4048 / POC 3951

3823 - 3878 / POC 3862