Good morning readers!

I hope this message finds you well and that you have had a successful week in the world of finance. Once again, I am delighted to provide you with clear and precise guidance for the upcoming week. My diligent analysis over the weekend has identified several stocks poised to make significant moves in either direction. I strongly encourage you to remain engaged with this Newsletter in order to capitalize on these opportunities.

As we find ourselves in the current stages of an uptrend, it is important to note that stock prices are approaching levels that have the potential to trigger substantial spikes. To ensure you are well-informed, I have meticulously outlined these key levels below, as well as identified the levels that would invalidate the uptrends once breached.

Similar to the previous week, our focus will be on stocks displaying strength and resilience, particularly those that have managed to sustain their value. Given the abundance of companies surging past all-time highs, there is little reason to divert our attention towards weaker stocks. Instead, we will concentrate our efforts on those demonstrating robust performance.

I would also like to draw your attention to the fact that if prices fail to break out of the levels outlined in the weekly outlook, I will consider utilizing them for the following week, provided there is no significant change in the value area. Consistency and adaptability are vital qualities in navigating the dynamic nature of the market.

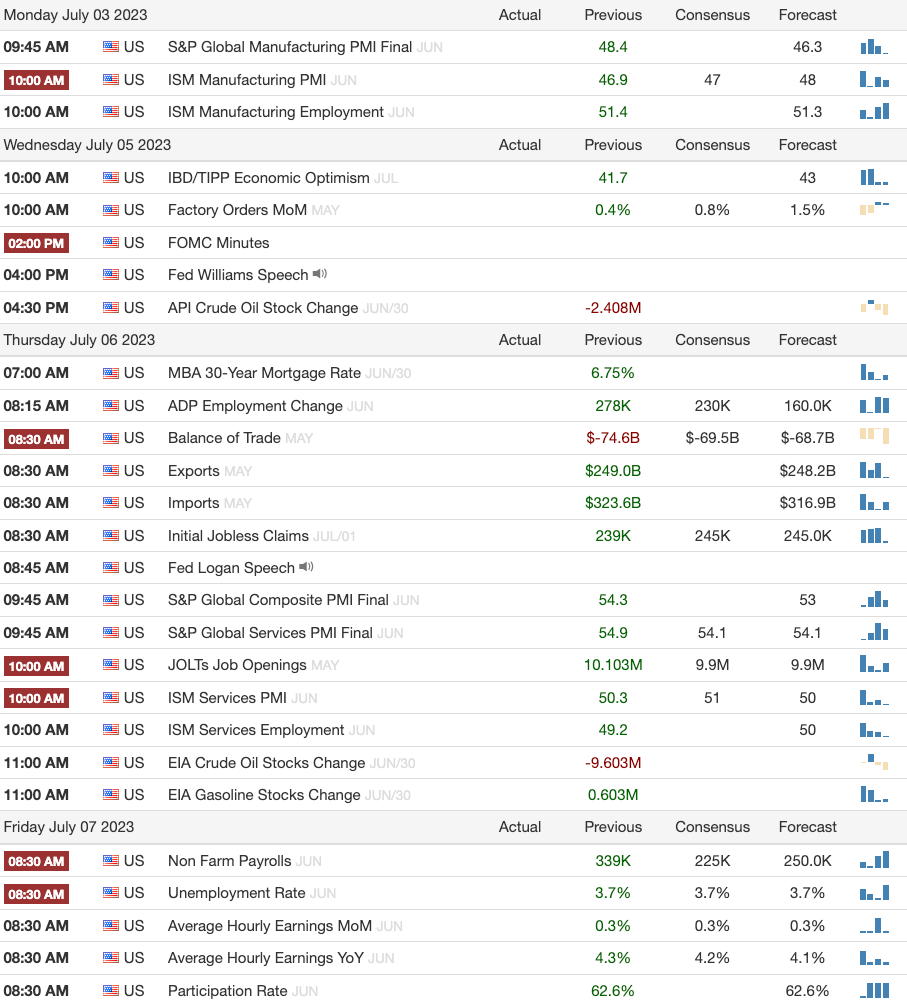

Furthermore, it is important to acknowledge that this week will be shorter, with a half day today and a full day off tomorrow, in observance of the 4th of July. I extend my best wishes to each and every one of you for a wonderful and safe holiday.

Much love to everyone!

Previous Week Charts & Data

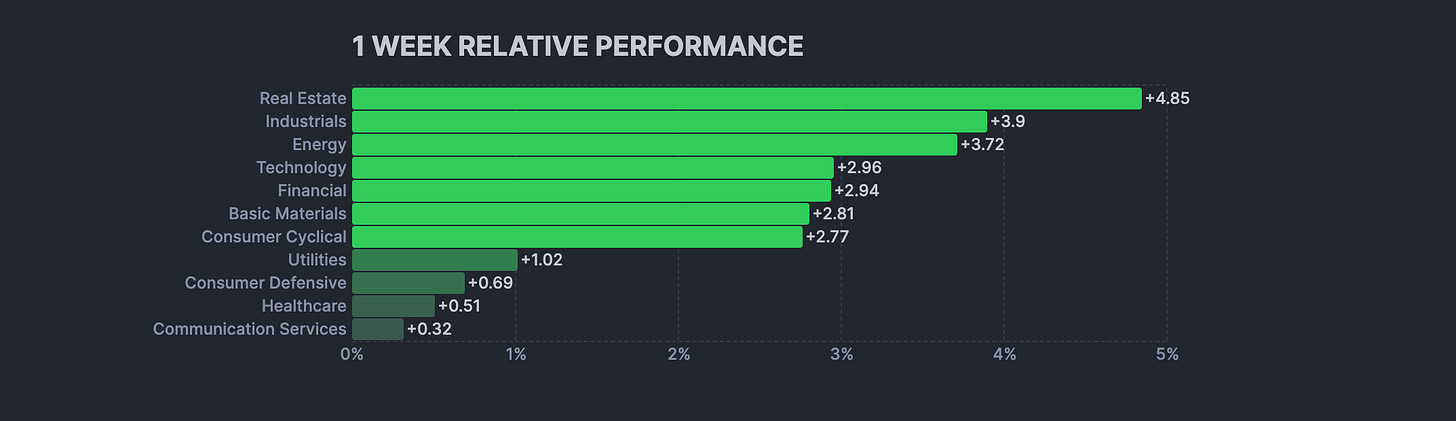

The current market conditions exhibit a widespread optimism across various sectors, as evidenced by the strong Buy and Hold ratings observed. In light of this, it is advisable to prioritize your investments in sectors that demonstrate considerable strength and potential for long-term growth. Concurrently, it would be prudent to identify sectors that exhibit weaknesses, presenting opportunities for short positions.

However, it is crucial to remain attentive to potential shifts in market dynamics. As the trend undergoes a reversal, it becomes pertinent to monitor the performance of high-flying stocks and their ability to surpass critical thresholds. At such junctures, it may be opportune to consider initiating short positions.

Nonetheless, until a discernible change in market sentiment occurs, the prevailing focus should be directed towards long positions. This strategy aligns with the prevailing bullish sentiment and emphasizes the pursuit of investments that are expected to yield positive returns over an extended time horizon.

Scanner

Computer Hardware: SMCI 0.00%↑

Semiconductors: NVDA 0.00%↑ AMD 0.00%↑ ENTG 0.00%↑

Software: PLTR 0.00%↑ IOT 0.00%↑ MDB 0.00%↑ HUBS 0.00%↑ PANW 0.00%↑

Travel: CCL 0.00%↑ RCL 0.00%↑

Auto: TSLA 0.00%↑ LI 0.00%↑