Weekly Outlook + Daily Plan 7.10.23

Good morning readers!

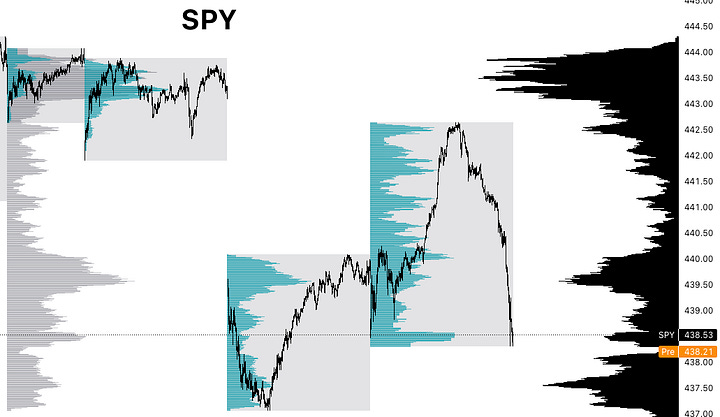

The wrap-up to the week was rather unexpected, marked by a significant and rigorous selloff. Notably, both Emini and Nasdaq experienced a decline, reaching the predetermined orderflow targets of 4410 and 15080, respectively, which ultimately turned out to be the exact market low for that particular night. By utilizing last week's pivot, we can once again position ourselves favorably in the market. Our approach remains straightforward: if the price remains above the pivot, we will adopt a long position on the value area low (VAL). This strategy requires patience but offers the most favorable risk-to-reward ratio.

To assess the current trend, I generally analyze price data from the past two weeks. If the price levels during this period overlap with the prices from the previous week, I combine the data for a comprehensive analysis. In instances where there is no historical data available, I examine the price range from the low to high points of the ongoing trend. For further insights on this methodology, please refer to the post titled "Timeframes," which was circulated approximately 2-3 weeks ago.

Moving on to last weeks chart and what the current US Data is.

Previous Week Charts & Data

Let us examine the current state of the US inflation rate, which has now declined to 4%. This aligns with the expectation of the "higher for longer" scenario, indicating that inflation will naturally recede on a year-over-year basis as long as it does not regain momentum. While this observation may appear straightforward, it is essential to acknowledge that the data is progressing according to projections, warranting no extensive analysis at this stage.

In addition, it is worth noting the gradual ascent of the jobless rate, which is steadily edging higher. Given the prevailing trend, it is reasonable to anticipate a continuation of this upward trajectory, surpassing the 4% threshold.

The chart below is the Jobless Rate in the US by month.

Events

Earnings

Stocks Weekly Outlook

AAPL: In order to maintain a bullish outlook for AAPL this week, it is crucial for the stock to sustain a level above 186.92, which will serve as a significant pivot. As long as the price remains above this pivot, I anticipate upward momentum towards previous highs, with potential targets reaching as high as 196. However, a break below the pivot would signal a shift in sentiment, prompting me to consider short positions targeting the Value Area Low (VAL) at 183. Should AAPL fail to hold above the VAL, further downside pressure could lead to a sell-off towards the next VAL at 177.

TSLA: TSLA has demonstrated exceptional strength as one of the market's leading stocks. To maintain its positive trajectory, TSLA needs to stay above 263.54 for a continuation of the uptrend towards previous highs and potentially even reaching 300. Given its strong performance, I favor long positions on TSLA this week. However, should the stock break below the pivot, I would anticipate a rapid decline towards the Value Area Low (VAL) at 244.

NVDA: NVDA has been accumulating significant volume within the price range of 375-435. As long as the stock remains within this value range, I anticipate further upward movements, potentially breaking previous highs. However, a breach below the value area could trigger substantial selling pressure, potentially pushing the stock towards the next value area. Notably, there is a significant Low Volume Node (LVN) post earnings, and if the VAL is broken, it could lead to a substantial downturn with a target of 310.

AMZN: For AMZN to sustain its upward momentum this week, it needs to hold above 122.78. This level is significant as it marks a drop in volume and a point where buyers may start to panic. Ideally, the stock will remain above 124 throughout the week. However, if it falls below the pivot shortly after breaching 124, it could create a scenario where most investors are caught off guard. Holding above the pivot, I expect a move towards previous highs, potentially reaching 140. AMZN has exhibited a gradual upward grind, and an upside breakout could result in a significant price movement, similar to the meta market.

META: META has become another favored stock recently, displaying resilience throughout the previous week and even opening strongly this week. To maintain its positive trajectory, I will set the pivot at a major LVN level of 277.37. A break below this level would indicate that buyers who entered above the pivot are underwater and may need to liquidate positions, potentially leading to a move down towards the Value Area Low (VAL) at 262. Conversely, holding above the pivot would support a continued strong upward movement, potentially pushing META above 300 and towards 315.

MSFT: Similar to AMZN, MSFT has experienced a more range-bound trading pattern. However, a clear breakout could result in a significant upward move. While both AMZN and MSFT present favorable setups, AMZN appears to be the more advantageous choice. For MSFT, I will consider 327.77 as a pivot, with a preference for price to remain above this level for a higher break towards the 350s. However, a failure to hold above the pivot could open up a sell-off towards 316.

UNH: The healthcare sector has experienced a notable downturn, and UNH has been a preferred stock for short positions. The stock has consistently sold off since breaking below the key level of 476. Given the established downtrend, my pivot for UNH will be set above the current price. For the downtrend to continue, the price needs to stay below 472. I believe there is significant room for further selling, potentially even breaking recent lows at 446.

RIVN: RIVN has nearly reached the target of 28, which represents a 100% return from 13.5. I maintain a positive outlook on this stock and anticipate further upside potential this week. The trend in RIVN is crystal clear and likely to persist until the pivot is broken. To monitor the stock's performance, I will set the pivot at 21.49, as there is a significant LVN just above this level that has been supporting prices. As long as RIVN remains above the pivot, I anticipate a strong upward move towards 32. However, a failure to hold above the pivot could result in substantial selling pressure, pushing the stock lower to 18.5.

RIOT: Similar to RIVN, RIOT is breaking out to the upside and exhibiting a strong upward trend. Applying the same approach, I will set the pivot at 12.69, as this price level opens up the value lower, indicating that sellers are in control. A move to the Value Area Low (VAL) at 10.20 becomes favorable if the price remains above the pivot. Conversely, if the price manages to stay above the pivot, I see the potential for a significant upward surge, possibly reaching 20.

OPRA: OPRA represents a hidden gem in the market, characterized by a crystal clear trend and high volatility. It is a stock that has caught my attention. To assess its performance this week, I will set the pivot at 22.11. This level is positioned below a major Low Volume Node (LVN) that formed during the stock's ascent in the current trend. OPRA is likely to attract significant attention this week, potentially leading to a surge in volume. I favor a move up to the range of 35-40 for this stock.

XPEV: XPEV is another strong stock that has already demonstrated upward movement, distancing itself from previous levels. As long as the price remains above 12.5, a major Value Area Low (VAL), I anticipate a continuation of the uptrend. Should the price hold above the pivot, I foresee further upside potential, potentially reaching 18.

CCL: Identified as a promising swing trade from the travel sector weeks ago, CCL has flourished and displayed phenomenal upside potential. To sustain its upward momentum, CCL needs to remain above 16.95, which will be utilized as a pivot. My target for the upside this week will be 23, while the downside is set at 14.

Value Areas

S&P500 (ES)

4381 - 4540 / POC 4467

4206 - 4304 / POC 4280

4095 - 4192 / POC 4153

3880 - 4048 / POC 3951

NASDAQ (NQ)

14741 - 15225 / POC 15116

14301 - 14618 / POC 14484

13817 - 14177 / POC 13861

12813 - 13461 / POC 13080

GOLD (GC)

1958 - 2042 / POC 1997

1906 - 1947 / POC 1924

1762 - 1888 / POC 1844

OIL (CL)

84.74 - 90.29 / POC 88.07

68.04 - 83.79 / POC 80.42