Good morning traders!

Make sure to check out Last Weeks Recap if you haven’t already!

Earnings

Events

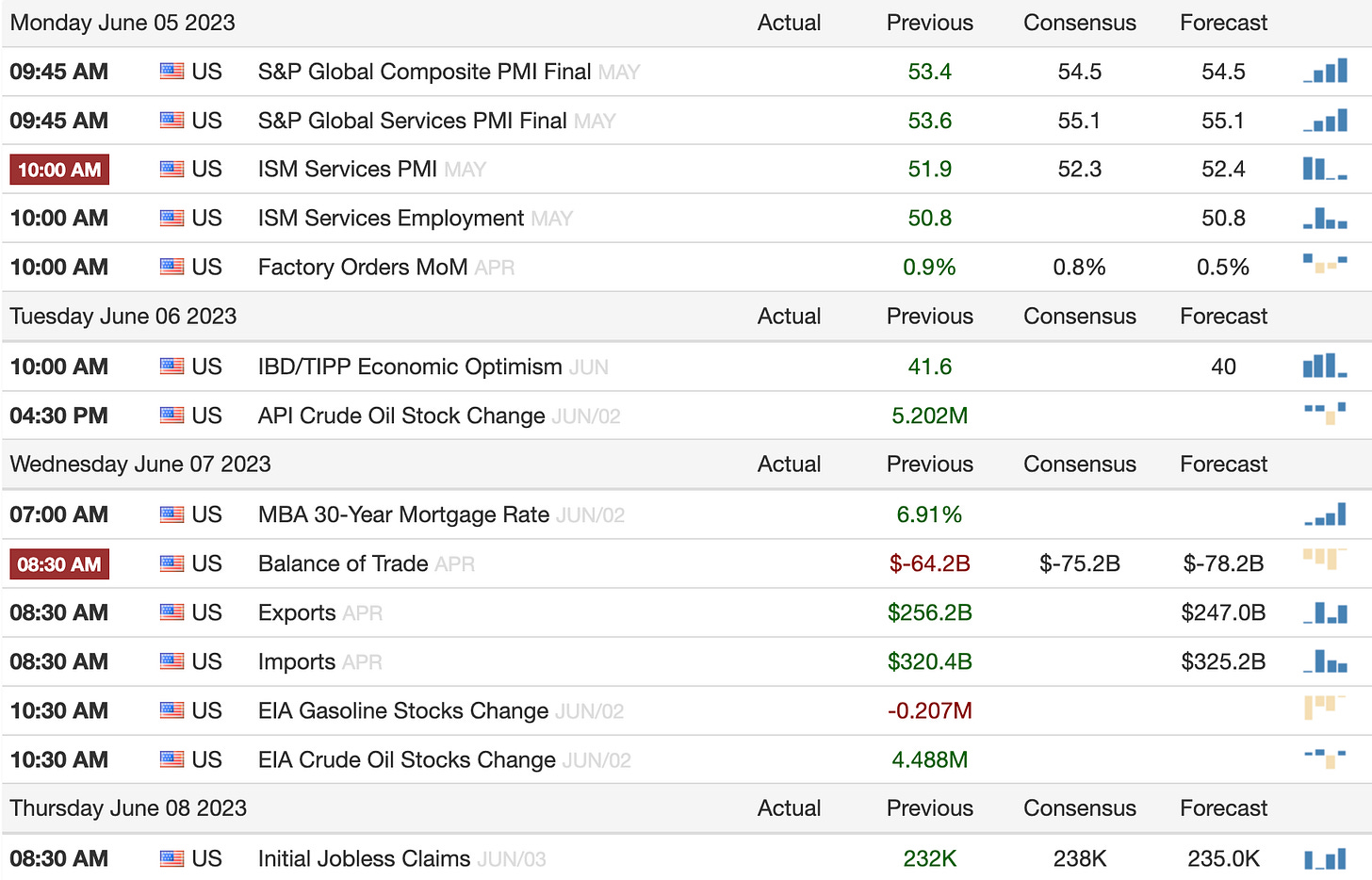

ISM Services PMI

Services sector has seen growth for four consecutive months now (over 50) and recent readings have pointed to further growth as consumers remain strong. Once again I do not seeing much reasoning to change upward momentum in indices. Either way there will be levels pointing to which way to be positioned if price were to start to slip lower. At the time of this post, Emini is trading at 4289.

Balance of Trade

Initial Jobless Claims

Jobless claims on the rise for three consecutive months with anticipation it will once again rise. This is one of the data releases that has been utterly shocking to the FED. Every FOMC you will hear Powell make claims of how tight the labor market is and nothing has changed but rather improved when talking of a thriving economy. It will not be a matter of if but when will jobless claims begin to spike up?

Stock Weekly Thoughts

AAPL

ATH nearly achieved before writing out this post which was called by me on May 4th. As you can see we have a strong gap up into 183 off continuation of last weeks sessions. Eyes are coming off the semiconductor sector and possibly over to the likes of GOOGL, META, & MSFT. Add in stimulus passing this week and we have three strong catalyst to push Apple higher. Stimulus, Semiconductor Weakness (money moving), & Breaking over ATH!