Weekly Outlook + Daily Plan 6.26.23

Good morning traders!

I hope you all had a restful weekend and are ready to dive into the exciting world of the markets. As we begin a new week, let's take a moment to review the key events that lie ahead. But first, let's set our focus straight. While there may have been a plethora of news over the weekend, we must filter out the noise and keep our attention on what truly matters—the markets.

This week, we don't have a significant number of high volatility events on the calendar, and that's precisely because the market doesn't seem to care about them. When data becomes sticky, meaning it lacks significant impact, there's not much we can do or say to influence the market. However, we mustn't forget that outlier prints can still cause notable price movements. So, keep your eyes peeled for unexpected surprises.

Now, let's turn our attention to the main events of the week. We have a few crucial releases and announcements that could impact various sectors. First on the list is the highly anticipated FED Powell speech, where any hints or clues regarding monetary policy could influence market sentiment. Additionally, we'll be watching New Home Sales, Pending Home Sales, and the US GDP report to gauge the health of the housing market and overall economic growth. Jobless Claims, Core PCE (Personal Consumption Expenditures), and Personal Income & Spending figures are also worth monitoring for their potential impact on market dynamics.

Beyond these events, let's discuss the current market landscape. The week opens with an interesting setup—an uptrend in the indices following a week of selling. The Emini has retraced to a key pivot level, which will play a critical role in validating the continuation of the uptrend. Consequently, we can expect some explosive moves both to the upside and downside, particularly within the tech sector.

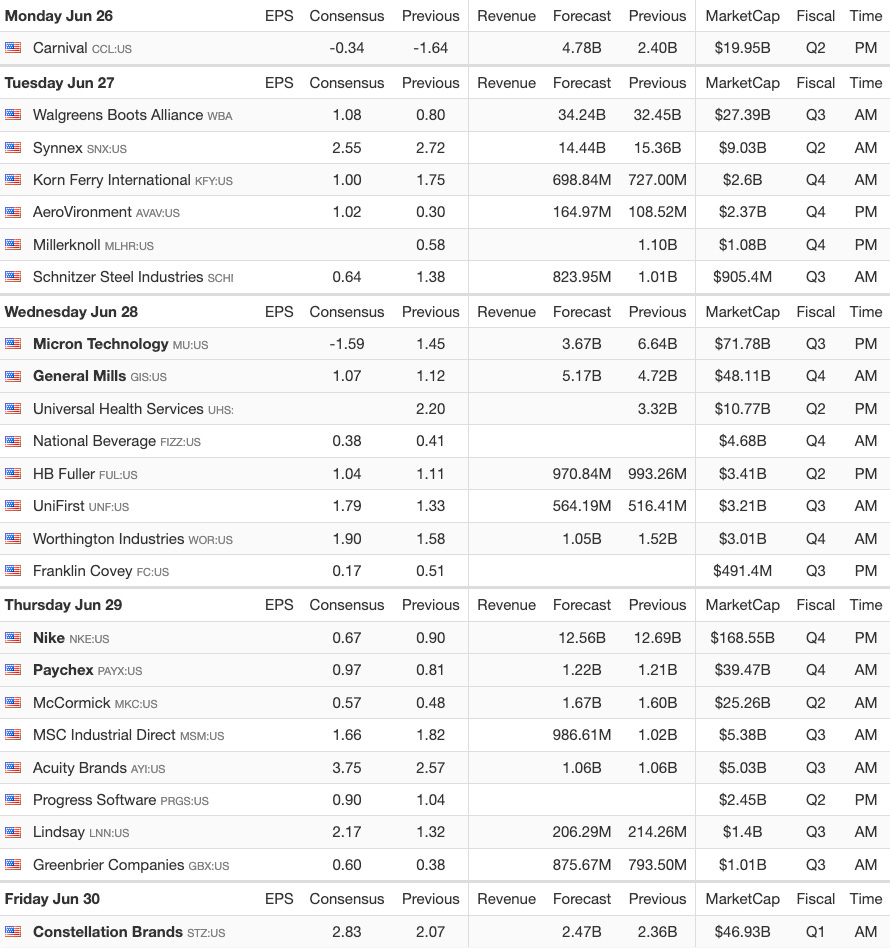

To navigate these movements effectively, I recommend focusing on the strongest stocks in the upward trajectory and identifying those that are already weak for potential downside opportunities. As we commence the week, Meta, Apple, and Tesla appear to be on the strong side, displaying promising potential for further gains. However, keep a close eye on Nvidia and Advanced Micro Devices (AMD) as they exhibit a split correlation, with AMD experiencing a rather challenging close to the previous week. Lastly, the upcoming earnings release from Micron could introduce additional volatility to the sector, warranting our attention.

Micron

Micron is currently situated within a significant value area. Despite a notable decline in earnings and the impact on Costs of Goods during the last quarter, I believe the stock is undervalued at its current price of 65. I anticipate potential upward movements in the range of 72-75. However, we should remain prepared for increased volatility as a result of the upcoming earnings release.