Good morning traders!

In case you missed it, I sent out Last Weeks Recap this morning.

We have quite a busy week ahead so let’s jump right into what we have planned for the week.

Events

So much to touch on this week so I will point out the days that will bring the higher volatility then each Daily Plan will jump into each days events.

Monday is boring so we will look right to Tuesday, CPI! As much as inflation has taken the backseat recently, we need to be on high alert that any outlier prints will bring volatility. When we have an event with high volatility I look to the Value Areas which are posted just above the Daily Plan. this week will have NASDAQ value areas included and will be this way moving forward.

Thoughts on adding Bitcoin as well, drop them below!

For CPI there isn’t too much worry at this time which makes total sense. No data has been actually concerning to the consumers. Labor market is loosening some which can actually bring some relief to CPI. As said above, unless the print is not sticky then I think we can continue this uptrend higher. Now if that higher print comes in then we have some concern of inflation heating back up. Maximum upside off CPI will be 4467 on Emini which is the POC of the current value area we are sitting in.

Wednesday is PPI and FOMC for another session of fireworks to come. There is not much to day on this other than having same thesis with PPI as I do with CPI. FOMC is solely based on what comes the day prior with CPI. We will hear more on the labor market as FED has turned to this on taming inflation.

Thursday & Friday will be off the backs of events earlier in the week so we could see continuation or a possible reversal. More to come, one day at a time!

Earnings

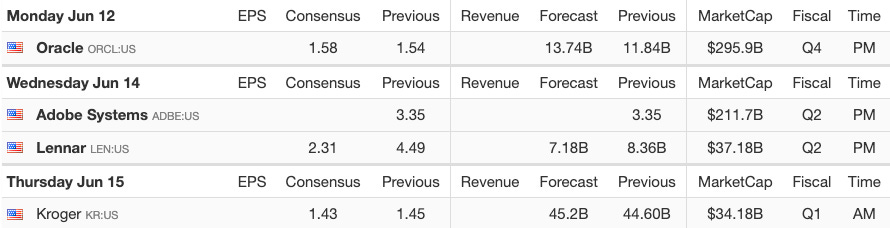

Incredible Earnings Season we have had with it wrapping up. Two tech names this week that can be possible setups to trade after earnings. Oracle and Adobe which levels will be posted on these after earnings are posted.

![500+] Sunrise Wallpapers | Wallpapers.com 500+] Sunrise Wallpapers | Wallpapers.com](https://substackcdn.com/image/fetch/$s_!zCF0!,w_1456,c_limit,f_auto,q_auto:good,fl_progressive:steep/https%3A%2F%2Fsubstack-post-media.s3.amazonaws.com%2Fpublic%2Fimages%2F0bca0de3-e795-4850-b244-05c608b93cc6_1440x900.jpeg)