Previous Week Economic Data Recap

(All data is from Trading Economics)

Manufacturing PMI

This has shown another contraction print below 50 but has seen a relatively larger increase over the previous month. Moving on it will be important to keep a lid on this below 47.5 and attempt to soon make a new yearly low.

JOLTS

Last week printed the lowest number since 2021, dropping 384,000 to a total of 9.6 million. Powell has come forward on how tight the labor market has been which expectations of a cool off coming in the second half of the year.

Sector changes

Transportation, Warehousing, & Utilities: (-144,000)

Educational Services: (+28,000)

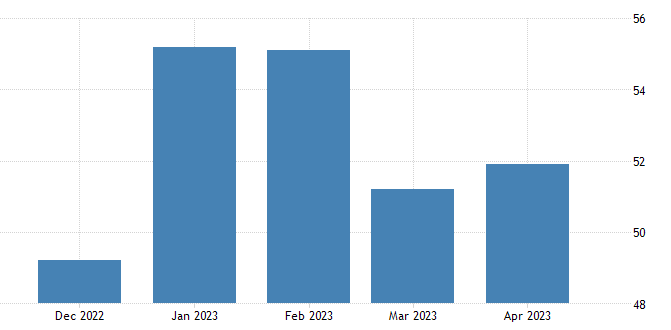

Services PMI

Increase seen MoM while all of 2023 has seen above 50 which is putting worry on the FED if we will get the economic slowdown. The closer we get to terminal rate the more significant the data will be as it will be the clear signs on when to being cutting rates. Inventory during COVID was loaded up as stimulus was pushing consumer spending to new heights. As this was hard to offload and brought major sales in stores, it has pushed back showing companies are meeting the demand and fulfilling orders. The key problem here is how are we going to bring prices down with these conditions? We need to see this get below 48 for progress to be made and then continuation of negative (below 50) releases.

Sector changes

New Orders: (56.1 vs 52.2)

New Export Orders: (60.9 vs 43.7)!

Delivery Performance: (48.6 vs 45.8)

Production: 52 vs 55.4)

Employment Growth: 50.8 vs 51.3)

Price Pressures: 59.6 vs 59.5)

Backlog Orders: (49.7 vs 48.5)

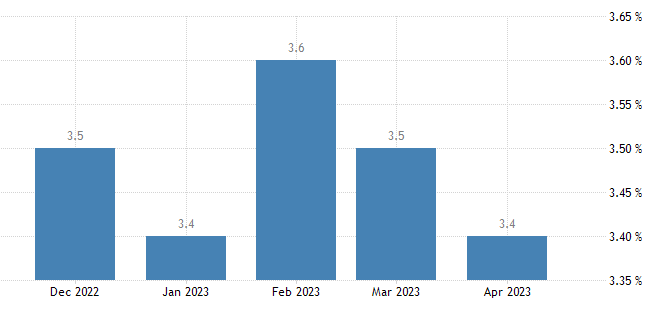

Interest Rates +25bps & FOMC

As of right now Futures are pricing in terminal rate being here right now and I think this mostly has to do with Powell touching on how much the data lags. JOLTS dropping is showing good signs ahead along with slow down in overall economic activity. I do not put any emphasis on what is expected with rates as I am just like the FED, data dependent as everyone else should be.

Non Farm Payrolls

Plenty of jobs out there for people to be working which has shown not only with the increase in JOLTS MoM but the consistent decline of unemployment. The FED is trying to bring unemployment up yet nothing is working as of right now. Higher job creation is not going to help in bringing unemployment up.

Sector changes:

Professional & Business Services: (43k)

Health care: (40k)

Namely Ambulatory Services: (24k)

Leisure & Hospitality: (31k)

Food Services & Drinking: (25k)

Social Assistance: (25k)

Financial Activities: (23k)

Government: (23k)

Mining, Quarrying, & Oil and Gas Extraction: (6k)

Unemployment rate

Upcoming Events

There are no events on Monday.