Good morning traders!

This will be yet another eventful week with FED speakers and economic releases. First lets lay out these events before jumping into what we expect for volatility.

Markets have been very dull recently with FED speakers and I do not expect they can say much to move prices right now. The trend remains up which will need a strong catalyst to knock this move off its tracks.

Emini beginning to build up value near VAH 4192 which if holds I expect a move back up through Fridays highs up at 4227 and extension further to 4280. Failure to hold above VAH may bring a sell down into 4140 POC. At the time of this post, Emini is trading above 4192 VAH at 4205.

Quick note: References to value is based on the profiles. Areas with the most volume are fair value but are subject to change as market conditions change. The break away from 4140 last week was a clear signal that fair value is higher. Let’s use a quick example to picture what this means.

In this image, 4140-4150 has much more volume then all other prices with a very balanced profile from top to bottom. At those prices there is the most activity and as these value areas build up they get stronger and stronger. Look at it as once we get the the upper and lower end of these needs as if gravity is pulling price back to the POC. As you move further the gravity gets stronger. Where volume begins to drop off ( 4170 to 4190 or 4115 to 4090) it’s telling you less traders/ investors find these prices attractive with sellers over powering buyers at VAH and buyers over powering sellers at VAL. If shorting the VAH it only makes sense to have main target at POC as this price has been then most accepted inside the value area.

I always say look for value to remain valid (price stays inside VAH-VAL) as you will get so many more opportunities than waiting for a breakout. To also add there is plenty of false breakouts which spark large moves from one side of value to the other.

Back to this weeks events…

Manufacturing & Services PMI

Both of these have seen notable declines since Jan 2022 but now starting to bounce. These need to remain below 50 so we can start contracting back the the FEDs goal of lowering demand. Acceleration of these higher can bring some pain ahead and will only lengthen the time of how long rates will remain at peak.

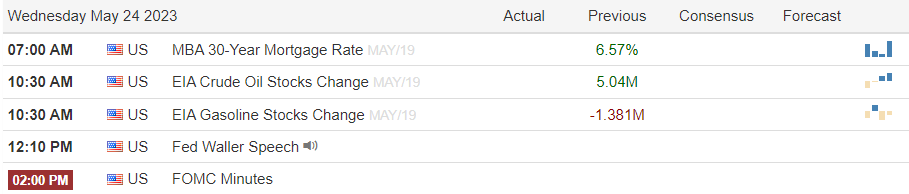

FOMC Minutes

Here is a forward looking statement from Wells Fargo on the recent FOMC Meeting which FED hiked rates 25 bps to 5-5.25%.

The FOMC statement sets the stage for a pause at the upcoming June FOMC meeting, but ultimately economic data will determine if the terminal federal funds rate has been hit for this cycle. In the coming months, data will need to show that the Fed’s goal of returning inflation to 2% over time can be met.

The FOMC is taking into account the cumulative tightening of monetary policy, the lags with which monetary policy may affect economic activity and inflation and economic and financial developments. In the past five Fed tightening cycles since 1990, long-term U.S. Treasury yields have peaked before the end of the tightening cycle but did not begin a clear declining trend until the tightening cycle was over. We acknowledge that, although the current Fed tightening cycle may still not be over, we believe long-term rates have already tested their peak for this cycle.

Source: Wells Fargo Advisors

There will not be much to expect from this and focus will shift more toward debt ceiling. I do not want to talk much on the debt ceiling as it is all a game to these politicians to get this approved last minute. Keep it simple, default is very bearish and raising limit will be bullish. To bring or to not bring stimulus.

Jobless Claims & Job Offerings

Job offerings declining while Jobless claims increasing. This will help toward bringing down total consumption and later relief to prices. I do see Jobless claims starting to make a large uptick higher into 500-750k and Job offers also taking hit down into 6.5-7.5 Million. While in the moment this will not be good for the people, the economy will need this.

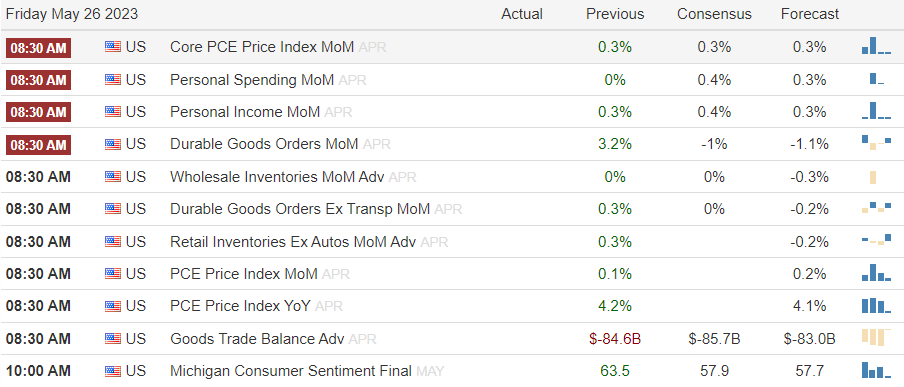

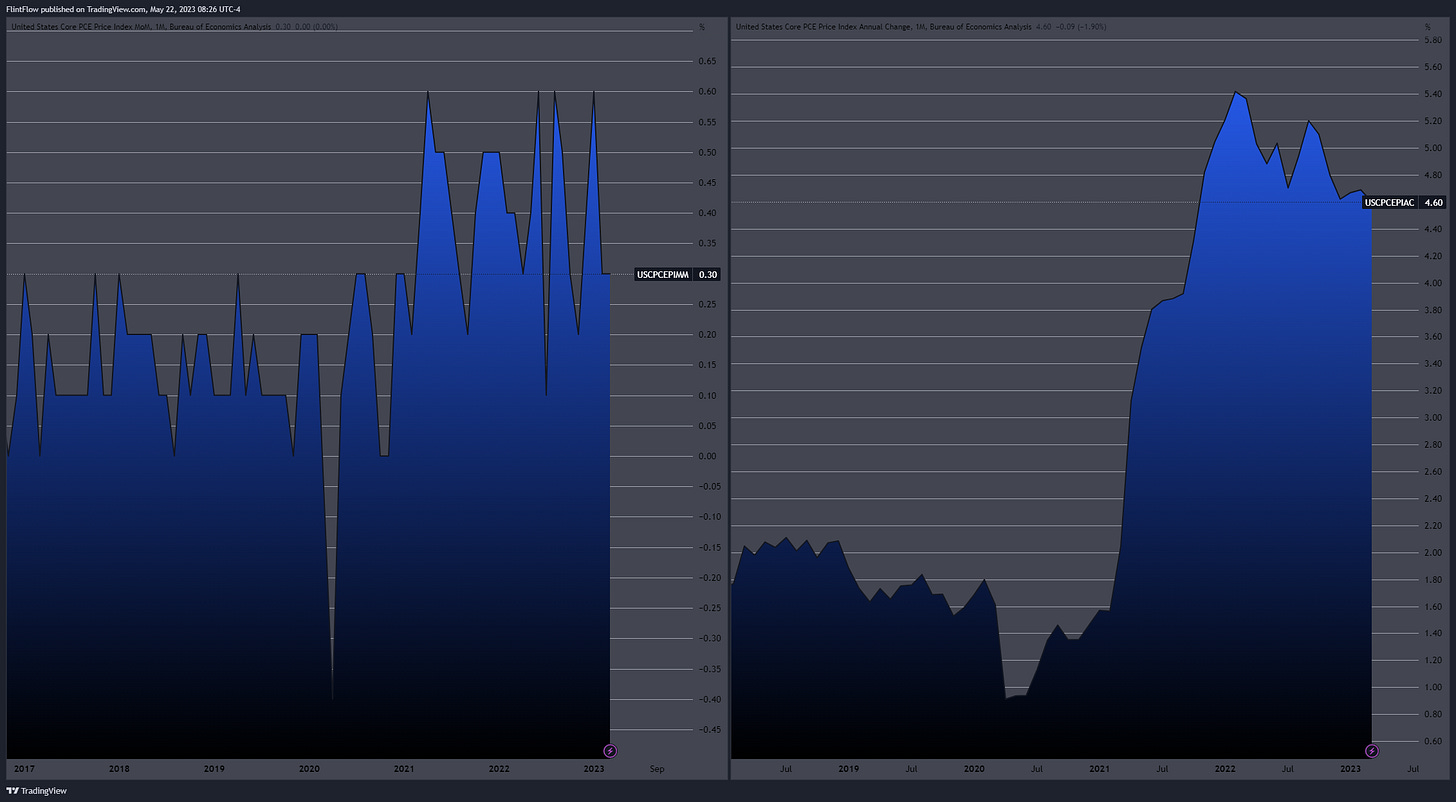

Core PCE

Core PCE has yet to come down significantly indication prices excluding food and energy are not budging down. Not good at all for consumers as it remains a very tight market for personal spending. Personal spending should stay relatively the same and I don’t think this will change much based on Core PCE unless we saw a break of highs on the annual change (right chart).

Now data is out of the way lets take a quick glance at the earnings calendar to see if there’s any names we may want to focus on this week.