Notable levels from last week (Stocks & Futures)

First we need to look back to what was expected from last week.

4095 - 4192 value area remains valid with a strong reclaim EoW to 4153 POC. To start the week I want to see continuation of momentum to the upside target 4181. From here I think sellers will keep a lid on prices until we move into CPI which will bring direction outside of this value area. For CPI if above 4192 I will be bullish and below 4095 extremely bearish. CPI is the last data release that can bring this sell lower else we cruise up through highs. I have no expectations on one side to break but will go accordingly with how data is released.

All week we once again remained inside value area 4095-4192 even with the highly anticipated CPI. Off the release emini spiked higher but I did not trust this rally especially with lack of strength to tack out VAH 4192.

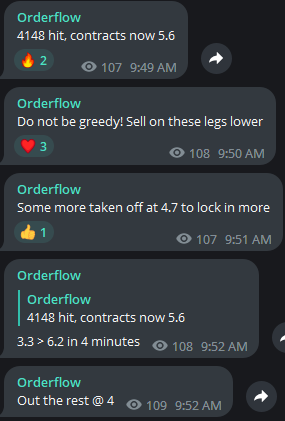

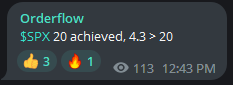

$SPX Contracts while chopped up many times during the week, 3 times last week alone we saw over 500% returns. Unfortunately I was stopped out at LOD Friday on the 4116 long for -4 handles which ended up dropping 0.5 handles below LIS then rallying exactly as expected up to 4153 POC. Unfortunate but looking back it was barely off with only 0.5 selling below LIS before massive reversal.

A few contracts ran up over +100 and some in the 200-400% range.

Here are some of the calls made in telegram last week.

Plenty more to cover but you will have to check them out inside the telegram!

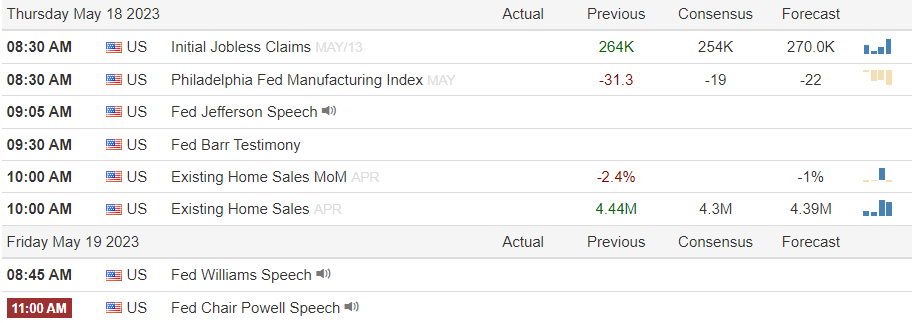

Previous Week Economic Data Recap

CPI - April

Previous: 5%, Consensus: 5%, Actual: 4.9%

Progress continues to be made on inflation even if the decline is small it is progress. What can be concerning is the labor market moving forward as this needs to fall off a cliff for inflation to begin to make some real declines. To an extent I do believe inflation target will be moved up form the long term 2% FED goal. Prices have a higher floor now and we will not see prices go back down to COVID pre-COVID levels.

Why?

Simply how much debt the government has put us into with the mass amounts of printing going on.

PPI - April

Previous: 2.7%, Actual: 2.3%

Both CPI & PPI saw minimal declines which sets off alarms on the pace of bringing down inflation. Slowing down is okay as long as we do not give back any of the progress being made.

Comparing the two:

I do think the FED will achieve its goal on lowering inflation as long as the PPI YoY change is not higher than CPI again. Every time we have crossed PPI below CPI it has brought a cooling of inflation shortly after.