Weekly Outlook + Daily Plan 4/3/23

Good morning traders!

Before jumping into thoughts on this week I want to cover last weeks session recaps. This will be a good refresher as we prepare todays Daily & Weekly Plan.

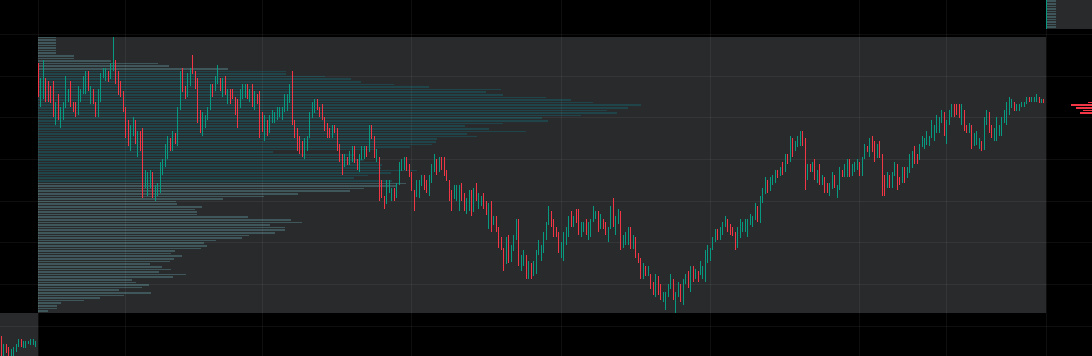

Weekly Recap

Monday

Emini remained between levels OVN with another attempt to take out the 4000 LVN but no follow through.

4034 long target ended up being HOD but I need to be clear we never traded down to long level all session to initiate the trade. This is to note how well the target played out yesterday.

Now let’s dive into why I wanted lower to get long rather than the 4000 LVN.

Tuesday

The exact setup I was looking for on Monday showed up yesterday but there was no follow through on sell. 3984 HVN was anticipated for potential area for buyers but once I saw how weak tech was going into the day I felt we may begin to open up the range.

Around the same time emini approached 3984, most of tech began to bounce if not already bouncing back to the upper end of its intraday consolidation. What was anticipated on Monday worked out exactly as planned on Tuesday. While this wasn’t what was the setup I was looking for it was a clear warning sign to shorts that we may revert back above 4000 and potentially make way to 4034.

Wednesday

Emini gapped up through our 4000 long level trading all the way up to 4050 where I anticipated sellers to step in. Reasoning was this is where value begins to drop off and once again a event was lacking for the session. Upon hitting 4050 and turning lower, dips were bought at the level used earlier in the week 4034. From here we saw 2 more 12 handle sells from 4050 before breaking higher and closing the session up around 4060.

Thursday

Our 4080 long has a small window to work which I posted in the telegram an update to this level.

Right out of the open emini broke above 4080 but only had upside of 1.25:1 risk reward for 7 handles but not a trade I was looking for. As soon as this broken back below, LIS was hit and I was no longer looking for a long.

For the next two hours we worked our way down near where I wanted to start taking off risk and move LIS to B/E as usual.

4058 was nearly LOD before a move back above near highs to close the session. What I also want to add to this is how well we navigated GDP report solely based on how we traded on the last release. Here is a comparison of the previous GDP session to last weeks.

Friday

Another session where volatility starts before the open with the highly anticipated PCE release. Over in twitter and in the telegram I sent out updates calling for a push up to 4129 and as the morning went on we began to setup for a trend day. See below.

3 hours after we achieved 4129 target with this level turning into support for a rally into the close up to 4140. To also add to being on right side of direction, PCE data was pointed out to be bullish as soon as it was released.