Last Weeks Recap

Weekly Timeframes

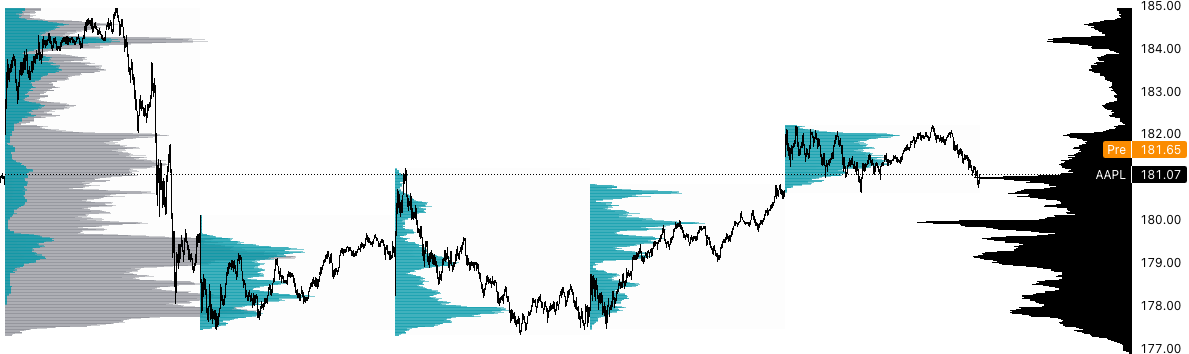

AAPL

ATH nearly achieved before writing out this post which was called by me on May 4th. As you can see we have a strong gap up into 183 off continuation of last weeks sessions. Eyes are coming off the semiconductor sector and possibly over to the likes of GOOGL, META, & MSFT. Add in stimulus passing this week and we have three strong catalyst to push Apple higher. Stimulus, Semiconductor Weakness (money moving), & Breaking over ATH!

TSLA

Approaching recent swing highs above 200 off the backs of Chinas new EV Tax Credit. This is major news and most will not add the fact that tesla has increased prices subtly in the process of dropping them. There is a new Model 3 facelift dropping soon which will drop costs on older Model 3s which will help boost sales once again. That being said I can see this getting legs up to 250 or higher as this stock is very hard to stop once direction sets in. As long as this holds above 200 I think we can see a robust move higher. Dips into 200 will offer a key support this week that may get bought.

NVDA

Holding much higher than AMD as this has closed last week inside balance and also not seeing any large gap for todays session. 380 is a key resistance this week which will be seen as a pivot for longs/ shorts. Above 380 this has ability for spikes back to 420-450. If 450 is hit on a trend day i will expect price to go much higher as long as time of the session is on our side. Say a break above 450 before noon can bring another 10-20 handles of upside for that session. Not disregarding downside, below 380 this can pick up selling down into 350s.

MSFT

Sitting up at highs to close the week but not gapping up like Apple this morning. On the chart there is key support form last week down at 328 which I will use as a pivot. Volatility is lower on this stock so my target will not be set out as far as other names. Holding above 328 I see attempt up to 350 with same thesis of Nvidia on a possible trend day up to that level.

AMZN

Robust close to last week with Fridays gap still holding this morning in premarket. Ideally price can remain above this 123.7 LVN (Low Volume Node) and continue direction up but I will look down below at the thicker volume node 120-122. As long as price can remain above 120 I will remain bullish for a move up to 140. Upon breaking below and holding i want to see a sell down into 115.

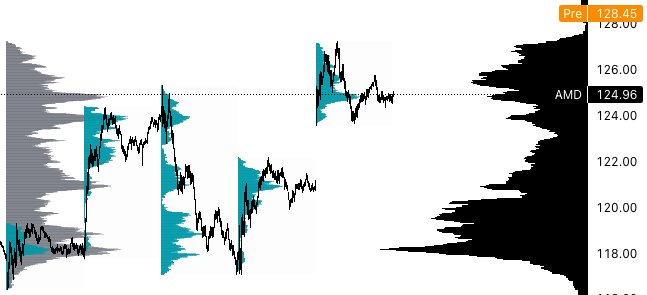

AMD

Comparing this to Nvidia it is a no brainer this stock is far weaker as of recently but this was a change from the previous sessions where AMD actually was closing up higher each day. Now this has changed I will favor downside on this stock for semiconductors even with NVDA gap up on ER. Starting the week I see selling opening up below value at 117.5 for continuation down into 108. If price can break back above 117.5 and hold i will look for a move higher up to 126-127 vale area (on chart).

GOOGL

Volatility on this name has also dragged on with plenty of rangebound sessions. This is not price action I favor as this is a very tight range to balance inside. Ideally balance consists of larger swings in price that can increase the risk reward. For this reason I do not favor this stock this week until I see volatility begin to pick up. A more favorable trade on this would be a short with a break out of value below 122. note value is built up below this level at 120 so there could be potential buyers trying to hold price.

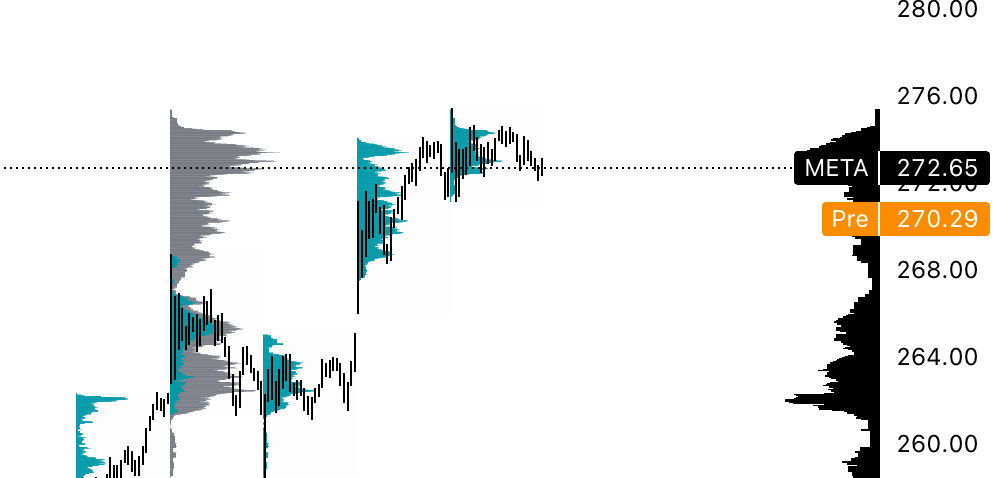

META

Very weak in premarket, dropping below Fridays cash session lows. Now unlike Google we can see the volatility along with direction in this name is much more clear. We will see large swings up and large swings down but this doesn’t mean either will change direction of the current trend. 262 will be a key level to hold for further upside with possibility of dip to this level then strong rally through previous weeks highs up to 300.

Subscriber Requested:

HD

Home Depot sits in a thick node which leads me to believe the VAH & VAL will be much harder to break above or below. That being said i want to see 297.5 coming in as resistance for a sell back down into 291 POC then possibly 283 VAL by EoW (End of Week). If price breaks above 298 this will be bullish for potential spike through last months highs. Upside can see a move up to 310 if resistance is broken.

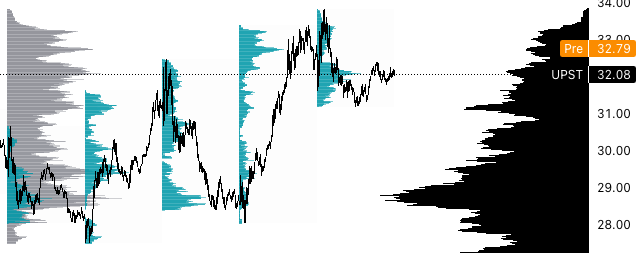

UPST

Upstart with a robust uptrend now up to 30s from 13 not long ago. This one is just like AI in terms of cheap stock with large move while also taking the stage for massive attention from retail. I like this trend along with market structure (profiles) but it will be hard to spot a specific level for getting long. Looking for VAL for dip opportunity that can take price back to highs and like Home Depot can see strong spike once through 32 for move higher to 40.

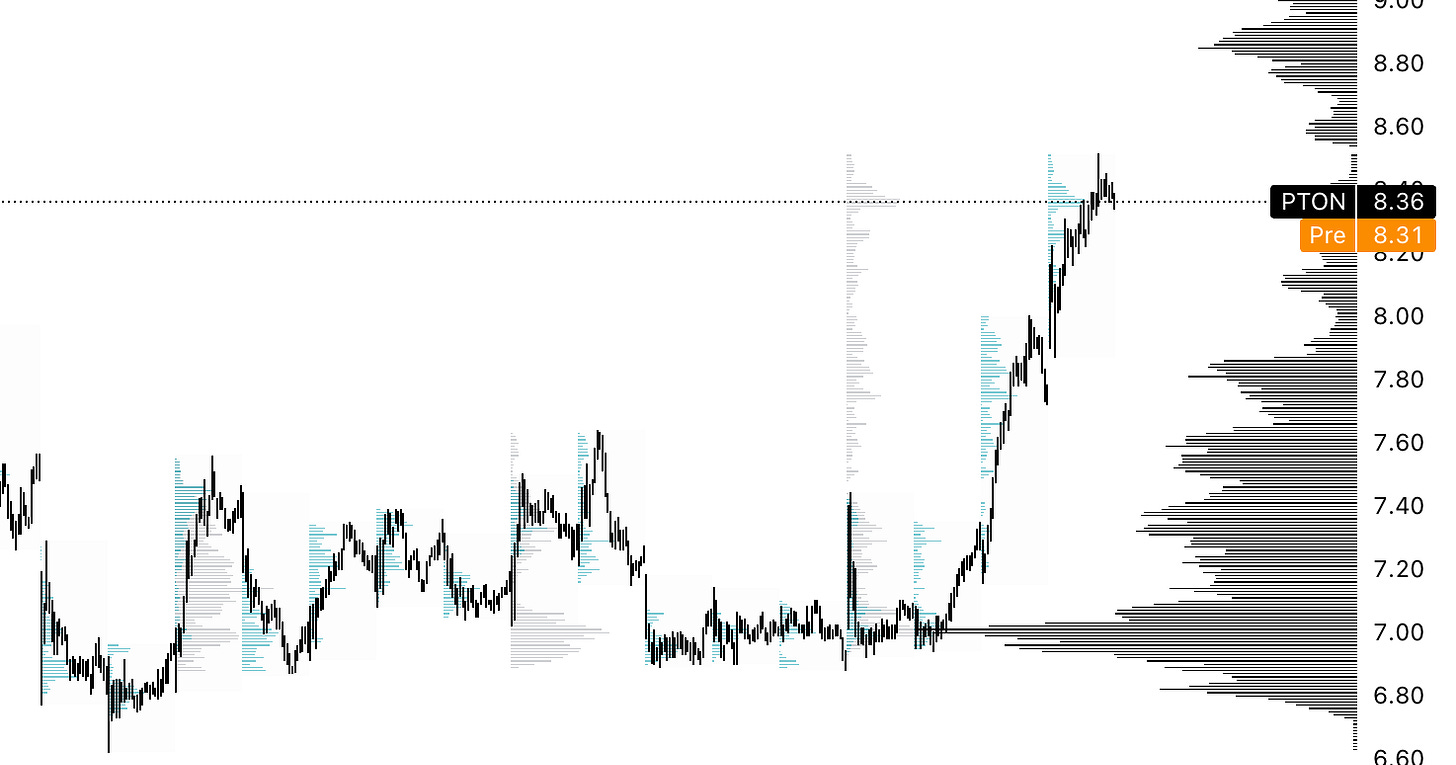

PTON

Robust rally off lows with easy to spot trend up. This has provided areas where price will need to hold to keep the uptrend intact with momentum. Once volatility begins to drop then i will not be as attracted to a stock that recently was in a trend. For continuation to start the week I want to see price remain above 8. For trend to be completely invalidated then i would need to see a break below 8 and a break below 7.7. Dips between these levels are attractive as a buyer.

Daily Plan Levels

Monday:

Tuesday:

Wednesday:

Thursday:

Friday:

Missed out on pulling the contracts on Friday which are expired now so I will make sure to get them done on Friday so they can be included for next week.

Make sure to not miss out this mornings Weekly Outlook that will be sent out soon!

-Flint

Disclaimer: This post is not trading or investment advice, but for general informational purposes only. This post represents my personal opinions which I am sharing publicly as my personal blog. Futures, stocks, bonds trading of any kind involves a lot of risk. No guarantee of any profit whatsoever is made. In fact, you may lose everything you have. So be very careful. I guarantee no profit whatsoever, You assume the entire cost and risk of any trading or investing activities you choose to undertake. You are solely responsible for making your own investment decisions. Owners/authors of this newsletter, its representatives, its principals, its moderators and its members, are NOT registered as securities broker-dealers or investment advisors either with the U.S. Securities and Exchange Commission, CFTC or with any other securities/regulatory authority. Consult with a registered investment advisor, broker-dealer, and/or financial advisor. Reading and using this newsletter or any of my publications, you are agreeing to these terms. Any screenshots used here are the courtesy of Ninja Trader, Think or Swim and/or TradingView. I am just an end user with no affiliations with them.