(Ticker, Last Week Thoughts (inside weekly outlook), Daily Chart w/ 1 week profile, Option Contract Performance - 2 Week Exp.)

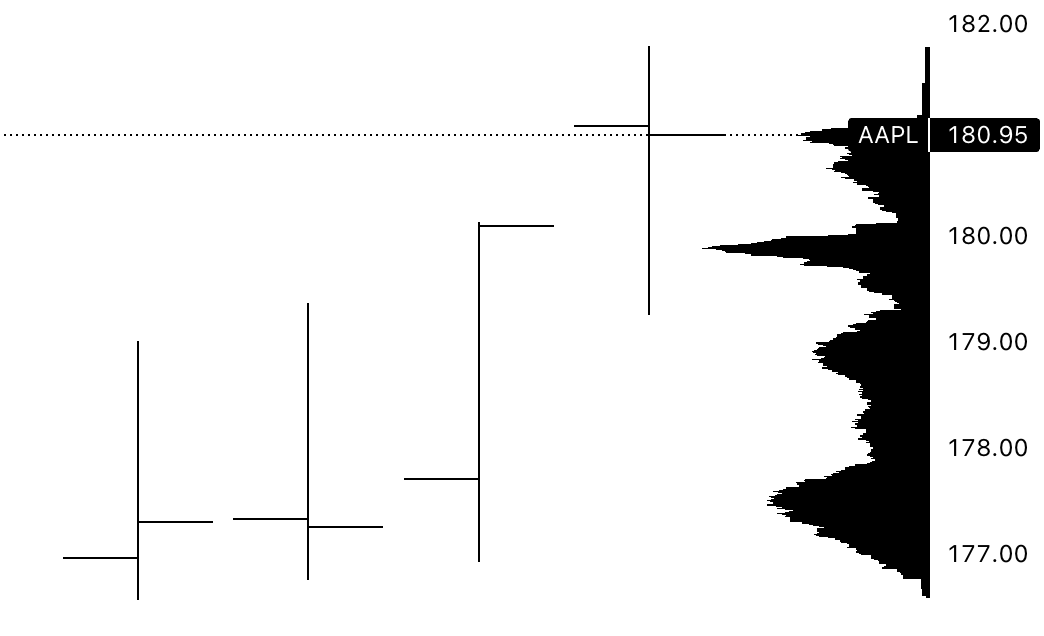

AAPL 0.00%↑ Apple - Weekly Change = +4.40%

"needs to hold above 173.5 for continuation higher to ATH. Dips in this stock have been very viable for trips back up to weekly highs."Option Closest OTM Strike to Current Price: 177.5 Calls

2.5 > 5.4 for +116%

TSLA 0.00%↑ Tesla - Weekly Change = +15.90%

"needs to hold above 187 for a push higher back above 200-212. As I have said many times this is a stock that once starts rallying, multiple sessions in a row will follow moving higher. This is exactly what happened once again!"Option Closest OTM Strike to Current Price: 195 Calls

7.8 > 23 for +194%

NVDA 0.00%↑ Nvidia - Weekly Change = +3.79%

"has hit ATH with a break above 400 OVN (Overnight). Semiconductors have been by far the hottest sector and as long as most still scream “overpriced” or “unfair” this will go much higher. Value is being built up above 380 which is the level I want to see hold this week for continuation of momentum higher up to 450 and potentially 500."Option Closest OTM Strike to Current Price: 380 Calls

11.45 > 26.95 for +135%

MSFT 0.00%↑ Microsoft - Weekly Change = +3.51%

"has value built up just like NVDA but at 331 which I will keep the same thesis with this. If price can hold above 325 and I expect continuation higher into 350."Option Closest OTM Strike to Current Price: 325 Calls

4.88 > 13.04 for +167%

AMZN 0.00%↑ Amazon - Weekly Change = +7.08%

"has a LVN (Low Volume Node) 118.5-119.7 which I think may fill in some this week as we have had seen weakness last week but ultimately saw a massive rally on Friday. As long as this holds above 118 I see momentum continuing higher into 128."Option Closest OTM Strike to Current Price: 120 Calls

2.31 > 6.77 for +193%

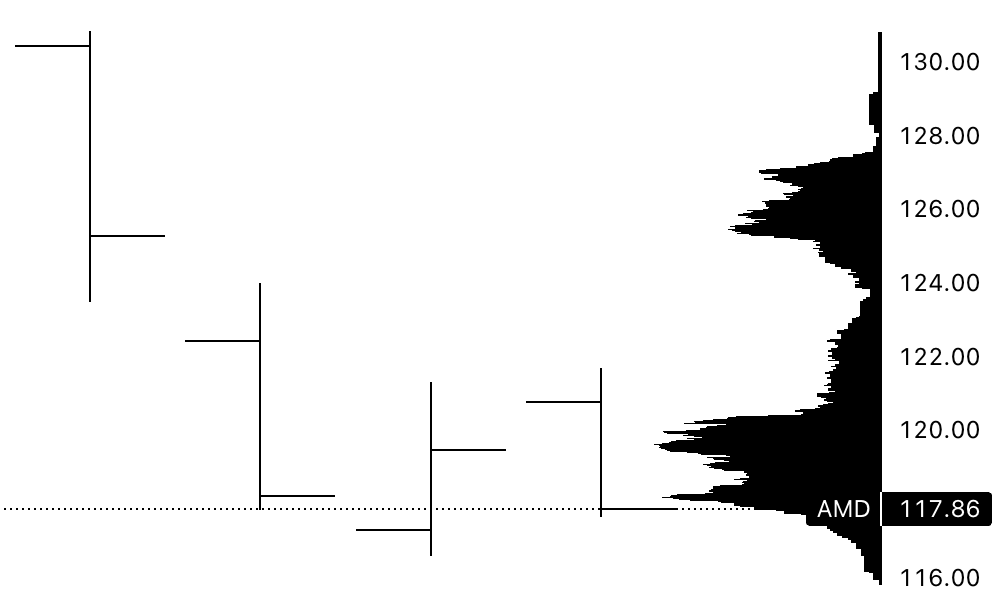

AMD 0.00%↑ Advanced Micro Devices - Weekly Change = -3.76%

"on a hot streak with little to no downside on this stock. Parabolic price action on the chart below which can continue higher up to 150 as long as price remains above 122."Option Closest OTM Strike to Current Price: 122 Puts

4 > 6.75 for +68%

GOOGL 0.00%↑ Google - Weekly Change = +1.22%

"seeing resistance coming in with value building up 122.5-125.5. If price can remain above the VAL 122.5 I expect continuation higher up to 140. once we break above this VAH we may see a very strong session to break above 130."Option Closest OTM Strike to Current Price: 122 Calls

2.79 > 4.4 for +57%

META 0.00%↑ Meta - Weekly Change = +7.78%

"gapping up above the prices below (268) but hasn’t sat at any single price to build up value. You can see near the close 261-261 has volume but there isn’t much to work with. This is only common when the stock is trending, whether up or down. As there is lacking volume I do think we may revisit Fridays prices without invalidating the uptrend. As long as price remains above 258 I can see this stock making a run for 300 by end of week."Option Closest OTM Strike to Current Price: 257.5 Calls

6.85 > 17.55 for +156%

Stay tuned for this weeks weekly outlook as the same thoughts will be provided once again. Tremendous week with nearly all the levels being Low Of Week and Apple nearly hitting ATH which was called by me and very few others! More to come…

-Flint

Disclaimer: This post is not trading or investment advice, but for general informational purposes only. This post represents my personal opinions which I am sharing publicly as my personal blog. Futures, stocks, bonds trading of any kind involves a lot of risk. No guarantee of any profit whatsoever is made. In fact, you may lose everything you have. So be very careful. I guarantee no profit whatsoever, You assume the entire cost and risk of any trading or investing activities you choose to undertake. You are solely responsible for making your own investment decisions. Owners/authors of this newsletter, its representatives, its principals, its moderators and its members, are NOT registered as securities broker-dealers or investment advisors either with the U.S. Securities and Exchange Commission, CFTC or with any other securities/regulatory authority. Consult with a registered investment advisor, broker-dealer, and/or financial advisor. Reading and using this newsletter or any of my publications, you are agreeing to these terms. Any screenshots used here are the courtesy of Ninja Trader, Think or Swim and/or TradingView. I am just an end user with no affiliations with them.

Thanks Flint. As always great info. Are you still on Telegram? I remember there was a poll on Twitter, but don't know where to find the intraday anymore.

Please send the new monthly link or cancel my subscription. This changing rooms every month is getting old.