Welcome back everyone!

Previous Week Recap

The indices performed as expected, experiencing significant declines that matched my predictions. These rigorous sell-offs affected the stocks I had been closely monitoring over the past week. Interestingly, interest rates remained unchanged, which came as quite a surprise. However, the market's reaction to this news was negative, and it continued to follow the selling trend I had anticipated.

Throughout the week, we achieved many of my targets, particularly in the stock market. In the following discussion, I'll share my insights and observations regarding stocks. Afterward, I will shift our focus back to the indices and, finally, delve into the commodities market.

Stocks:

AVGO: There's a notable LVN (Low Volume Node) at 835.95. Should the price dip below this point, it may trigger a selling wave targeting the VAL (Value Area Low) at 793.57.

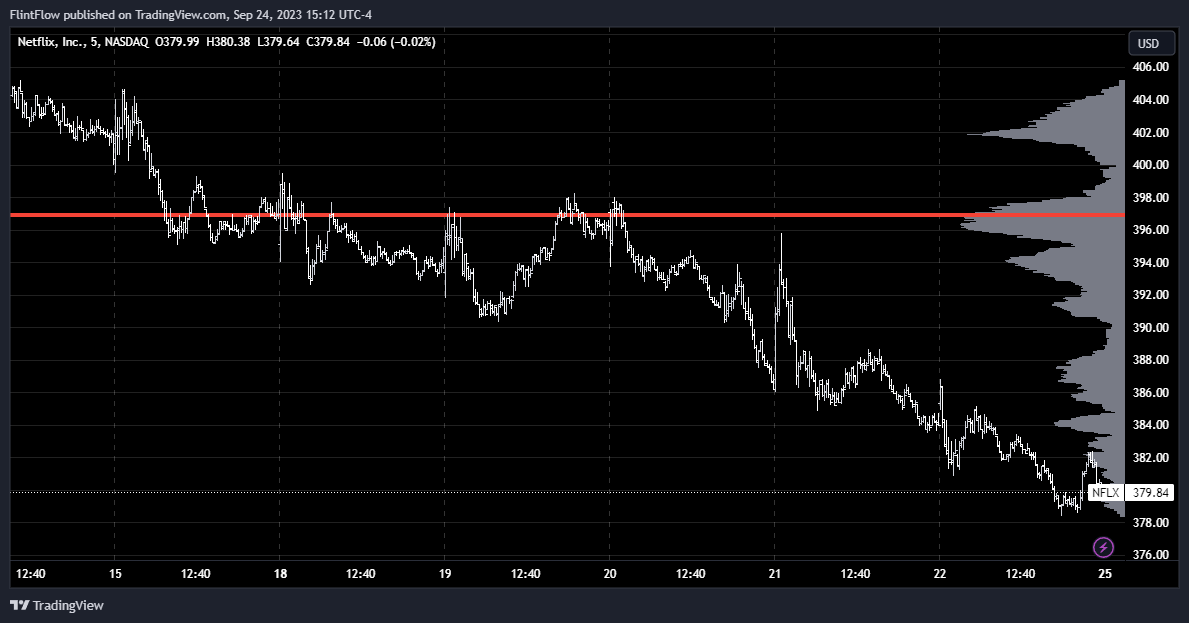

NFLX: I believe if the price consistently stays below 406, we might witness an intensified selling momentum carried over from last week, potentially driving the price down to 371.

ADBE: If the price remains under 534, I anticipate an increase in selling activity, with the next target being the VAH (Value Area High) at 489.36.

SBUX: The POC (Point of Control) has consistently acted as a major resistance level at 98.5. I'm looking for it to hold its resistance, which could pave the way for a downward move to 90.8.

BA: A maintained price below 213.83 would lead me to expect a selling pressure pushing it towards the VAL at 201.32.

Every week I post stocks on my radar in the section “Momentum Gallery”, these are subscriber exclusive levels provided. We have many more I am interested for this week so make sure to stay tuned!

Nvidia and Advanced Micro Devices were longer dated calls that have both seen significant sells this past week putting these stocks well into profit. Nvidia is now down 85 handles from when I called this out at the 500 level, which was also all time highs. Advanced Micro Devices has sold 25 handles down from 120. Nothing short of exciting developments to come and I see plenty more selling in store for these over the course of the remainder of the year.

Turning to the indices, my expectations for selling to really pick up this week and this is exactly what was provided. See the charts below!

Emini: -150 handles

Nasdaq: -600 handles

Gold: Unchanged - Upside & Downside targets achieved

Oil: 92 target held resistance all week - Value Area robust

Did the Fed just reveal it’s hand of uncertainty?

Now I want to cover the changes inside the Feds Dot Plot on future projections of the interest rates. Here is the newest release posted on the 20th of this month:

As we wrap up 2023 the projections for this year will condense into a very tight range which is expected. Fed is thinking we currently are sitting right where we need to be for them to be able to effectively use their tools is taming inflation and bringing the economy to healthy levels. The main changes seen at this FOMC was for next years 2024 projections. Members are thinking the rates will need to be higher than what had been the consensus earlier this year. I wouldn’t say this comes as a surprise as prices consumers are facing remain elevated with slight improvements in certain sectors.

In the realm of consumer prices, there have been notable shifts in various categories over the past year. Between June 2022 and June 2023, the cost of food at home saw a notable increase of 4.7 percent. However, this rise is a considerable slowdown compared to the 12-month period ending in August 2022 when prices surged by a significant 13.5 percent. On the other hand, dining out became more expensive as prices for food away from home increased by 7.7 percent over the year ending in June 2023.