Welcome back, everyone!

Bearish Tides Rising in Global Markets

The recent movements in the market raise several crucial concerns. Both the S&P 500 and Nasdaq breaking below the 50 EMA is a significant bearish signal. Historically, such a move often precedes further selling, and this is undoubtedly on the minds of many investors. These developments make it essential for investors to be on guard for potential shifts in the market dynamics.

China's stock market has also been in the spotlight recently, with a significant slide observed last week. Big names, such as BABA, have faced severe selling pressures. Historically, when major companies in a significant market like China face such pressures, it tends to create ripples globally. The abundance of unoccupied construction, largely fueled by stimulus, could necessitate more monetary injections just to maintain these infrastructures. Historically, such underutilization coupled with a stimulus-backed growth often leads to inflationary pressures. This, in turn, can affect the nation's exports, making them less competitive on the global stage.

Geopolitical tensions are also on the rise with developments over Taiwan. The U.S.'s concerns over a potential invasion and its proactive step to deploy troops overseas are notable. This move, alongside declining U.S. investments in China, can have historical parallels with Cold War-era tensions. Such geopolitical skirmishes, in the past, have often been detrimental to global economic growth and cooperation.

China's demographic challenge is another pressing concern. With an aging population and an imbalance in the workforce, we might recall Japan's "Lost Decade" in the 1990s when a similar demographic shift, coupled with economic stagnation, played out. The projections by Capital Economics, suggesting China's growth could plummet to 2% by 2030, starkly contrasts Xi Jinping's ambitious targets. Such mismatches between projections and policy targets have, in previous instances, led to rushed reforms or even economic missteps.

The specter of the pandemic continues to loom large. Rumors of the U.S. reintroducing previous COVID restrictions and China expanding its quarantine measures align with past occurrences where resurgences led to market panics. However, unlike the initial wave, global economies now have the experience and potential tools to better navigate any resurgence.

Michael Burry's significant short positions against both the S&P500 and the Nasdaq harken back to his infamous bet against the housing market before the 2008 financial crash. Such moves by prominent investors can act as a canary in the coal mine, hinting at underlying market vulnerabilities.

Corporate reactions to socio-cultural events, such as Target's recent consumer spending decline post their Pride Month activities, underscore the delicate balance companies must maintain. Aligning with or opposing social causes can have tangible financial impacts. Bud Light's sales decline post its own controversial campaign serves as a reminder of such market dynamics.

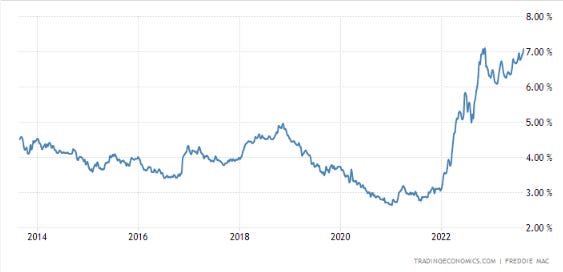

Finally, the mortgage rates surge to their highest in two decades cannot be understated. Historically, prolonged high mortgage rates have cooled housing markets, leading to decreased home values. Although falling housing prices may seem beneficial for new buyers, skyrocketing rates can negate those advantages, leading to an overall stagnation in the housing market.

Market Sentiment

Indices

ES (S&P 500 futures): Commercials, typically hedgers, have been trimming their long positions, signaling a cautious approach. On the flip side, small speculators, often seen as retail investors, seem optimistic and maintain their bullish stance. Interestingly, large speculators, usually institutional players, are also showing a shift in sentiment, reducing their short exposure. This dynamic suggests a mixed sentiment in the market, with potential underlying concerns from commercials.

NQ (NASDAQ futures): A marked change in position has been observed. What once was a bearish sentiment by large speculators has flipped to a bullish one. Simultaneously, commercials, who were previously bullish, now lean bearish. Such a polarity suggests a potential divergence of viewpoints on the tech sector's immediate future.

S&P Financials: Last week was notable for this sector. A surge in commercial short positions suggests hedgers are preparing for a potential decline. The simultaneous growth in long positions from both small and large speculators indicates disagreement on the sector's trajectory. Your expectation of an imminent hit to the sector, particularly in bank stocks, may align with the hedging strategy adopted by commercials.

Fixed Income

2-Year to 5-Year Bonds: The bullish stance in this segment, noticed a fortnight ago, seems to have played out well, as they've marked new highs. Their continued bullish positioning hints at the possibility of more gains. However, the implications for equities could be significant. A rise in bond prices could put downward pressure on indices. As bond yields decline (an inverse relationship to bond prices), it could drive investors towards the equity markets, seeking better returns. But if the equity markets become too volatile, bonds may seem a safer option, thus, balancing out the dynamics.

Energy

NG (Natural Gas): Large speculators, traditionally seen as trend followers, are maintaining a more significant short position. In contrast, both commercials (hedgers) and small speculators are leaning long. For a bullish trend to cement, alignment between the positions of small and large speculators is essential. Currently, the setup doesn't exude confidence in a sustained upward movement, pointing towards possible volatility.

CL (Crude Oil): The energy scene is heating up here. Commercials are rapidly increasing their short positions, signaling a potential downturn. Concurrently, both large and small speculators are amplifying their long exposure. If commercials begin a large-scale shift from shorts to longs, it may foreshadow a significant movement in oil prices over the coming period. However, until then, the bearish sentiment from commercials could lead the narrative.

Moving on to this weeks events!

Events

Jackson Hole Symposium

The Jackson Hole Economic Symposium is an annual event hosted by the Federal Reserve Bank of Kansas City since 1978. It takes place in Jackson Hole, Wyoming, and has evolved to be one of the most prestigious and closely-watched gatherings of central bankers, policymakers, academics, and financial market participants from around the world.

The symposium provides a forum for the discussion of long-term trends and structural changes affecting the global economy. The subjects discussed often relate to challenges and opportunities faced by central bankers. These can range from monetary policy, financial markets, and the global economic system. Each year has a specific theme, and leading academics often present papers, which are then discussed by key policymakers and scholars.

The effect of the Jackson Hole Symposium on markets when interest rates are above 5% (or any other level, for that matter) largely depends on the economic context and the messages delivered during the event.

In the past, when interest rates were high, market participants looked for signs or hints at the symposium about potential changes in monetary policy, especially any signals of rate reductions. Even subtle changes in tone or emphasis from central bankers could lead to significant market reactions. For instance, if the prevailing sentiment at the symposium leans towards easing monetary policy, markets might anticipate future rate cuts, leading to rallies in bond and equity markets.

Earnings

LOW -