Welcome back, everyone!

This week, we have a lot to discuss as I continue to add more valuable content to the Flow State Series. One key difference between these posts and the Daily Plans is the timeframes being used. Flow State focuses more on the entire week rather than just the upcoming session. Additionally, I've been delving deeper into my trend-following system for stock picking, and I'm excited to share more insights on that.

As we look ahead to the week, there's plenty to cover, from the usual stocks to my routine of analyzing over 200 companies. The market has been exceptionally active over the last few months, which means there are even more opportunities to explore.

Keep in mind that the format of these posts may undergo updates in the future, so stay tuned. The order of the sections is subject to change, and if you have a preference for how these posts are structured, please leave a comment! Also, if there are any specific stocks you'd like me to analyze, you can reach out to me on X (formerly known as Twitter).

To kick off #38, let's first review what happened last week and see if any insights or thoughts will carry over to this week.

In the newsletter (NL), my calls on Amazon and Booking were phenomenal, and they resulted in monster rallies. Amazon surpassed my 140 target, and Booking exceeded everyone's expectations. The Amazon contracts were up approximately 500%, while Booking saw a staggering increase of around 4,000%. If you don't want to miss out on such calls in the future, make sure to subscribe. Most of the analysis will be available below the paywalls, with some nuggets of information left for all readers.

Apart from stocks, there were significant moves in the Value area within the futures market. Oil, in particular, was red hot last week, reaching as high as 83, which smashed our target to close out the week. I accurately predicted two sessions in a row of over +200 pip rallies. The volatility in the oil market looks set to continue, whether we see further direction or a correction in price. If you want to catch up on my thoughts regarding Oil and Inflation, don't miss last week's Flow State #37, especially since we have CPI and PPI data coming up this week.

Events

Consumer Price Index - CPI

This data presents the overall Consumer Price Index (CPI), which differs from the commonly watched Year over Year (YoY) or Month over Month (MoM) figures. As you can observe, the CPI consistently reaches new highs, with minimal to no downward trends. This pattern aligns with what is considered normal since the Federal Reserve (FED) aims for a 2% YoY increase, which leads to expectations of incremental growth each year.

The data above clearly indicates the robustness of inflation, with no signs of decline. It is evident that higher prices are likely to persist, primarily driven by the extensive money printing that has occurred. Unlike before, when supply chain constraints played a significant role, the current inflation is primarily attributed to the abundant supply of the USD

When examining the Year over Year (YoY) data, a noticeable and robust retrace is evident, reaching as high as 3% since the previous release. The Federal Reserve (FED) appears to be directing attention towards this YoY figure, aiming to divert focus from the concerning inflationary surge we've experienced. This tactic may create the illusion of solid progress, but in reality, we have witnessed an irreversible surge in inflation.

I've emphasized multiple times that in order to bring down the overall Consumer Price Index (CPI) number, the United States would need to eliminate the excess supply of USD that was printed. However, historical examples show that this has never occurred, and it seems unlikely that a definitive solution will be found. Consequently, our economy continues to be driven by debt, which poses its own set of challenges and uncertainties.

Producer Price Index - PPI

The Producer Price Index (PPI) finds itself in a similar position as the Consumer Price Index (CPI), and several months ago, I identified a crucial indicator pointing towards a cooling inflation trend. Although commodity prices might not have significantly declined, the passage of time has played in favor of the Federal Reserve's (FED) efforts to control inflation.

The indicator I mentioned was when the PPI Year over Year (YoY) value crosses below the CPI YoY value, indicating that CPI will follow suit and decrease shortly after. Remarkably, this is precisely what we have witnessed! Inflation surged to as high as 9%, but now it has nearly reached the long-term goal of 2%.

Looking ahead, there might be some panic if we observe an uptick in CPI. However, the real cause for alarm will only emerge when the second CPI print reveals a change in direction, indicating that consumers are about to face significant challenges. The ongoing Oil rally has been burdensome for consumers, but as long as the fuel of US Debt continues to drive the economy, little might change. Consumers are likely to remain in debt, seemingly unaffected by the inflationary surge. This has been the overarching theme of 2023 so far, as I previously predicted, given the FED's crystal-clear intention to bring inflation down "overtime."

Earnings

Palantir - There are high expectations for this earnings report, with hopes of a breakthrough that could push the stock to highs up to 22, thereby sparking further momentum to the upside.

Eli Lilly - The company has experienced a strong rally and maintains a robust balance at highs, indicating potential for further continuation. With a strong track record for earnings reports, there's a possibility of a parabolic move above 500 post the upcoming report.

United Parcel Service - The demand for this service remains strong due to resilient consumers. As long as we can maintain a solid base above 160, there's a likelihood of a spike up to 220 post earnings report.

Duke Energy - Expectations are high for a fireworks-like performance, especially considering the surge in energy prices that has boosted profits for companies within the sector. I anticipate this positive trend to continue for Duke Energy. There has been an attractive dip in the stock, setting the stage for a potential rally up to 110 post report.

Datadog - The stock is currently facing strong resistance, but I expect it to be broken post-report, leading to a spike up to 130. Taking a longer-term perspective, this stock shows potential for mass adoption, making it an excellent stock to own.

Walt Disney - Disney is making efforts to restructure its management and seems to be moving in the right direction to address concerns related to a "woke" mess, which has also affected Target. Despite these challenges, I see hope in this stock and believe it is attractively priced for a potential spike up to 110 post report, making it an interesting investment opportunity.

Sector Performance (2023)

Last week, the performance of various sectors in the market experienced some fluctuations. The Technology sector (XLK) saw a decline of 3.85%, making it the worst-performing sector during that period. The Communications sector (XLC) followed closely with a decrease of 2.57%.

Other sectors also experienced negative returns, albeit to a lesser extent. The Consumer Discretionary sector (XLY) was down by 1.03%, while the Industrial sector (XLI) and Materials sector (XLB) decreased by 1.83% and 2.23%, respectively.

The Real Estate sector (XLRE) and Consumer Staples sector (XLP) saw declines of 2.40% and 1.67%, respectively, contributing to the overall downturn in the market.

The Utilities sector (XLU) experienced a significant drop of 4.98%, making it one of the worst-performing sectors during the week.

On the other hand, some sectors managed to stay relatively resilient. The Health Care sector (XLV) was down by 1.31%, and the Financials sector (XLF) showed a slight decline of 1.30%.

Interestingly, the Energy sector (XLE) had the smallest decline of all sectors, at only -0.42%. This might have been influenced by factors such as fluctuations in oil prices or other energy-related developments.

Overall, the week showed a mixed performance across different sectors, with technology and utilities experiencing the most significant declines, while energy managed to maintain a relatively stable position.

Momentum Gallery

AAPL - Currently breaking down, experiencing its biggest decline for all of 2023. I believe this sell-off is overextended and expect to see a bounce this week, pushing the stock back up to 192.

MSFT - Strong rejection off its highs at 360, which I anticipate will be revisited soon as long as 317 holds as support.

CRM - Currently selling down from its 237 highs, testing strong support at 210. I expect this support level to hold, leading to a move back up to 235.

ADBE - On a weekly timeframe, 500 is a robust support level that I believe will hold, paving the way for a push through the highs and reaching 570.

META - This rally has yet to cool off, despite some selling seen last week. As long as 290 remains a support level, I expect this stock to reach new highs, potentially up to 350.

VZ - This is a weak stock that has consistently broken down to new lows. I expect this downward trend to continue as long as it remains below 36. Resistance remains valid, and there's a possibility it could go below sub 30, setting a new low for the year.

HD - The stock is curling up, with some selling observed last week. I expect this dip to be bought, leading to a move back through the highs, reaching up to 344. As the stock approaches its highs, volatility is expected to increase.

NKE - It is crucial for NKE to hold the 104 level to witness a spike up to 125.

MCD - In order to see a spike back up to the highs at 300, MCD needs to remain above 284. Any dips here are attractive opportunities for potential buyers.

TJX - The stock has just broken higher out of a balance, and I believe this will generate further momentum to the upside, potentially reaching up to 92.

ORLY - ORLY is currently holding above a key support level at 900, which I believe will ignite an uptrend continuation, ultimately leading to highs up to 1000.

RTX - The stock has sold down to a key support level at 82, and as long as the price remains above this level, it has the potential for a strong move back up to 96.

UNP - Following a strong spike up post-earnings, I expect UNP to continue higher up to 252 as long as the price remains above 219.

BA - After a strong spike up post-earnings, I see the potential for BA to continue its upward trajectory up to 250 as long as the price remains above 220.

CAT - Following a robust spike up post-earnings and breaking recent swing highs, I expect a strong rebound up to 305 as long as the price remains above 260.

GE - GE has been displaying a consistent uptrend, arguably the cleanest in terms of respecting trend line support. As long as the price remains above 108, I anticipate this trend to continue higher, reaching up to 122.

DE - After a strong rally above the downtrend and returning to highs around 440, I expect a strong spike up to 470 as long as the price remains above 400.

ADP - With a strong breakout of a multi-month balance area at 216, I anticipate further continuation with volatility picking up, leading to a move up to 266, as long as the price remains above 240.

LIN - Another strong stock with a robust uptrend throughout 2023. Given its choppiness, I will allow for some wiggle room down to 365 as support, expecting a continuation through highs up to 405.

SHW - Consistently respecting a trendline, SHW is likely to find strong support again. As long as 260 holds, I anticipate a strong move through the highs, reaching up to 295.

COST - The stock is starting to curl up out of heavy resistance, and I believe this will bring further momentum, potentially pushing it up to 600. However, for this to materialize, 530 will need to hold as support.

BABA - Showing signs of curling up, backed by strong support at 88. If this support level holds, I anticipate a spike higher, potentially reaching up to 112.

AMSC - This stock has displayed incredible strength over the last two months and could continue its upward trajectory as long as it remains above 8. With earnings being posted this week, there's a possibility of a strong spike back up to highs at 17.

COIN - Currently experiencing selling pressure from recent swing highs but has a robust support level at 78. If this support holds, the price may bounce right back up to highs at 112, paving the way for further continuation.

MARA - Despite being off its highs, MARA is holding well with strong support just below at 13. If this support remains intact, there is potential for a strong upward move through the highs at 20.

Monthly Checkup: ES, NQ, CL, GC, NG, DXY

ES

Trend: Up

Trend Pivot: 4450

Value Area: 4375-4495, 4527-4615

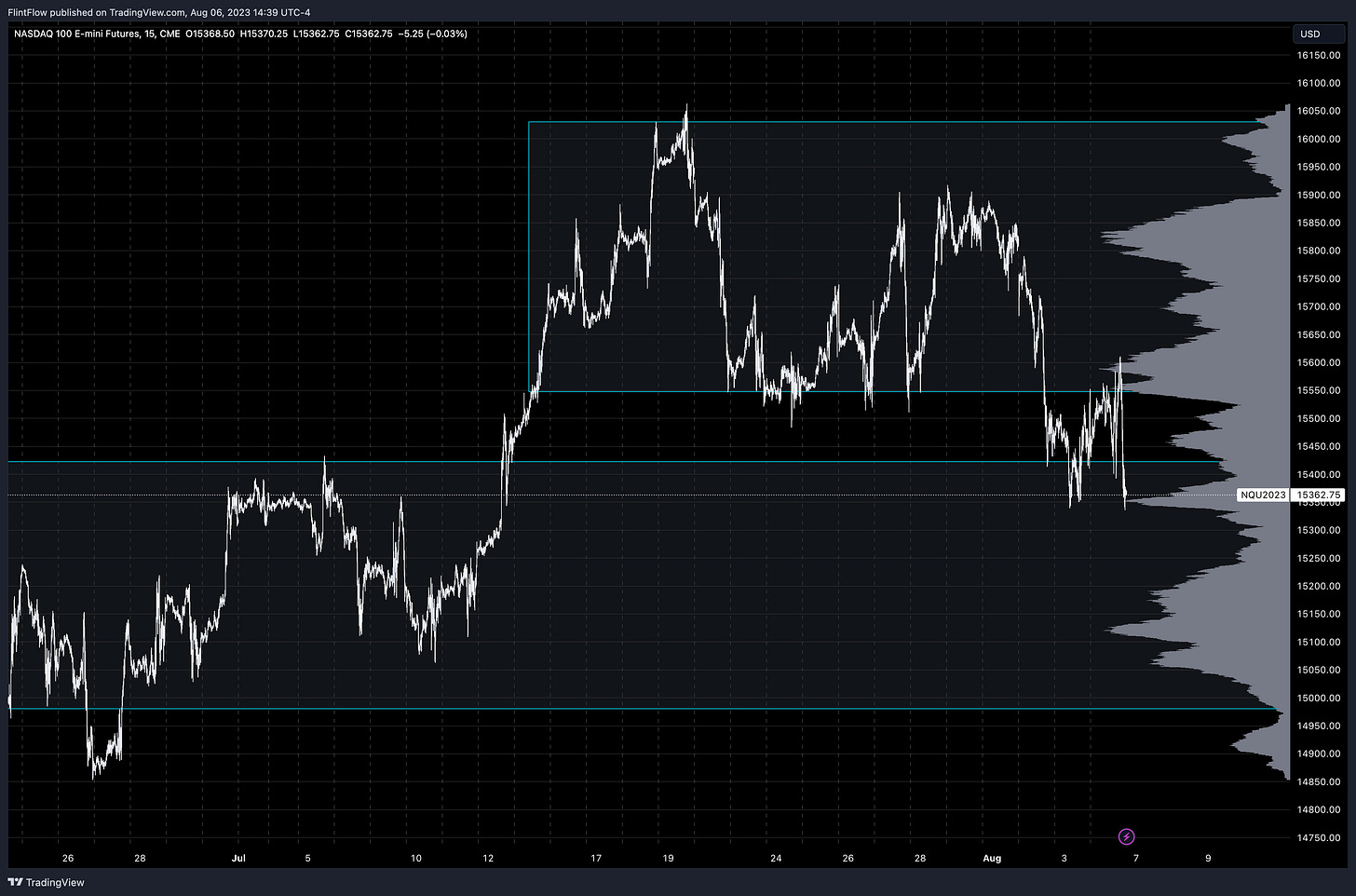

NQ

Trend: Up

Trend Pivot: 14938

Value Area: 14276-14640, 14980-15422, 15547-16030

CL

Trend: Up

Trend Pivot: 73.12

Value Area: 67.61-73.82, 75.08-77, 78.62-80.54, 81-82.20

GC

Trend: Up

Trend Pivot: 1912

Value Area: 1912.1-1949.9, 1954.1-1997.9

NG

Trend: Balance

Trend Pivot: Up = 2.90 / Down = 2.29

Value Area: 2.16-2.40, 2.51-2.78

DXY

Trend: Down

Trend Pivot: 103.30

Daily Plan 8.7.23

These are setups I see from Volume Profile perspective, any trade taken by you is accepting all risk at stake! Always know what is at risk before entering any trade. The purpose of these are to show what a Volume Profile trader is looking at.

ES Long 4509 > 4539 / Short 4488 > 4453

NQ Long 15450 > 15589 / Short 15378 > 15240

GC Long 1969.8 > 1988 / Short 1964.5 > 1956

CL Long 82.64 > 84 / Short 82.10 > 81.22

SPY Calls above 447.70 / Puts below 445.85

AAPL Calls above 182.87 / Puts below 181.40

TSLA Calls above 254.74 / Puts below 249.62

NVDA Calls above 444.23 / Puts below 437.29

MSFT Calls above 327.81 / Puts below 324.87

AMZN Calls above 138.71 / Puts below 137.12

AMD Calls above 116.74 / Puts below 114.45

GOOGL Calls above 127.99 / Puts below 126.89

META Calls above 307.38 / Puts below 303.81

-Flint

Disclaimer: This post is not trading or investment advice, but for general informational purposes only. This post represents my personal opinions which I am sharing publicly as my personal blog. Futures, stocks, bonds trading of any kind involves a lot of risk. No guarantee of any profit whatsoever is made. In fact, you may lose everything you have. So be very careful. I guarantee no profit whatsoever, You assume the entire cost and risk of any trading or investing activities you choose to undertake. You are solely responsible for making your own investment decisions. Owners/authors of this newsletter, its representatives, its principals, its moderators and its members, are NOT registered as securities broker-dealers or investment advisors either with the U.S. Securities and Exchange Commission, CFTC or with any other securities/regulatory authority. Consult with a registered investment advisor, broker-dealer, and/or financial advisor. Reading and using this newsletter or any of my publications, you are agreeing to these terms. Any screenshots used here are the courtesy of Ninja Trader, Think or Swim and/or TradingView. I am just an end user with no affiliations with them.

Would love to see what you think about PCT

Thanks for making my weekend more prepared for the coming week Flint. Appreciate your insights...