Income Statement

Most traders have come to the stock market with the only “edge” being charts. This is even the case for many of the investors, yet the chart shows nothing of what goes on inside the business. In this series we will dive into how to know which companies will make you rich in the long run. There is not a single company that has made someone rich long term that had bed financials.

In everyday life, financial statements can be compared to a person's bank account statement, credit card statement, and budget. The bank account statement shows the amount of money a person has in their account, as well as the deposits and withdrawals made during a particular period. Similarly, the credit card statement provides a summary of a person's credit card transactions, including purchases, payments, and interest charges. The budget, on the other hand, is a financial plan that outlines a person's expected income and expenses for a particular period. Picture these statements provided by the company as if you were looking at your own finances. You can also view this as a report card just like the annual reports which I will release another series just like this one.

We will be grading each company on how they handle their finances. Before we begin I want to give some insight into what the statements are along with some notable investors that use them.

What is a Financial Statement?

Financial statements are documents that provide information about the financial health of a company. They include a balance sheet, an income statement, and a cash flow statement. Financial statements are important because they help investors, creditors, and other stakeholders evaluate a company's performance and make informed decisions.

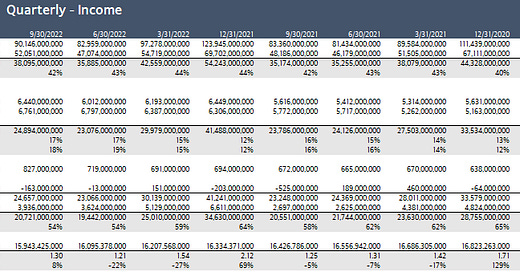

The income statement, also known as the profit and loss statement, shows a company's revenues and expenses over a specified period. It is important because it provides information about a company's ability to generate profits. Investors and creditors use the income statement to evaluate a company's profitability, growth potential, and overall financial health. The income statement can also be used to compare a company's performance to its competitors.

The balance sheet, also known as the statement of financial position, shows a company's assets, liabilities, and equity at a specific point in time. It is important because it provides information about a company's financial position. Investors and creditors use the balance sheet to evaluate a company's liquidity, solvency, and overall financial health. The balance sheet can also be used to track a company's financial performance over time and to compare it to its competitors.

Why do investors look at financial statements and who are some of the greatest investors that use this?

As many of you know Warren Buffett, who uses financial statements when evaluating a company. Some other names include George Soros, Carl Icahn, John Bogle, Benjamin Graham, and Peter Lynch. In addition, many other investors rely on financial statements to make investment decisions, including institutional investors such as mutual funds, pension funds, and hedge funds, as well as individual investors who manage their own portfolios.

This is not to say this is solely what these investors look at to make a financial decisions, but this gives tremendous insights into the company, look at it as your judging your own personal spending.

In the section below, we will dive into the Income Statement look at not only what it shows but how to build our own models to analyze the information. I want to note that these will be intimidating to someone who has never seen this but I promise it will become fluent in short time. Luckily, most of the information on them will be no help toward our analysis so we will not include them at all.

Naked Income Statements