Good evening, readers!

Markets closed nearly unchanged, though the Emini displayed more weakness compared to the likes of Nasdaq. Today's levels held steady, marked by reduced volatility, even as some individual stocks witnessed significant movements. Both Tesla and Microsoft surged early in the session, registering notable gains. Semiconductors, Nvidia, and Advanced Micro Devices began the session with marked weakness. However, those declines were quickly neutralized, and we observed substantial recoveries, with both breaking their intraday highs. AMD proved to be robust, advancing directly to the key 111 level I've frequently discussed. Amazon lingered below its short level for the majority of the session, subsequently solidifying that level as resistance and failing to surpass it. Flow State's weekly levels have proven accurate, with UNP experiencing a sharp decline today. I anticipate this downward trajectory to persist.

Oil emerged as the top performer, soaring to 87. It has rallied by over +1,000 pips since turning bullish, and it shows no indications of waning momentum. As I've mentioned before, the Federal Reserve will be closely monitoring this, especially considering historical tensions that arise when OPEC cuts exports to the US. Such events are not unprecedented in these times. Conversely, gold witnessed a significant drop below its short level, which almost aligned with the peak of the overnight session, resulting in over a 15 handle sell-off.

Moving on to the rest of the plan as so much was covered inside yesterdays newsletter.

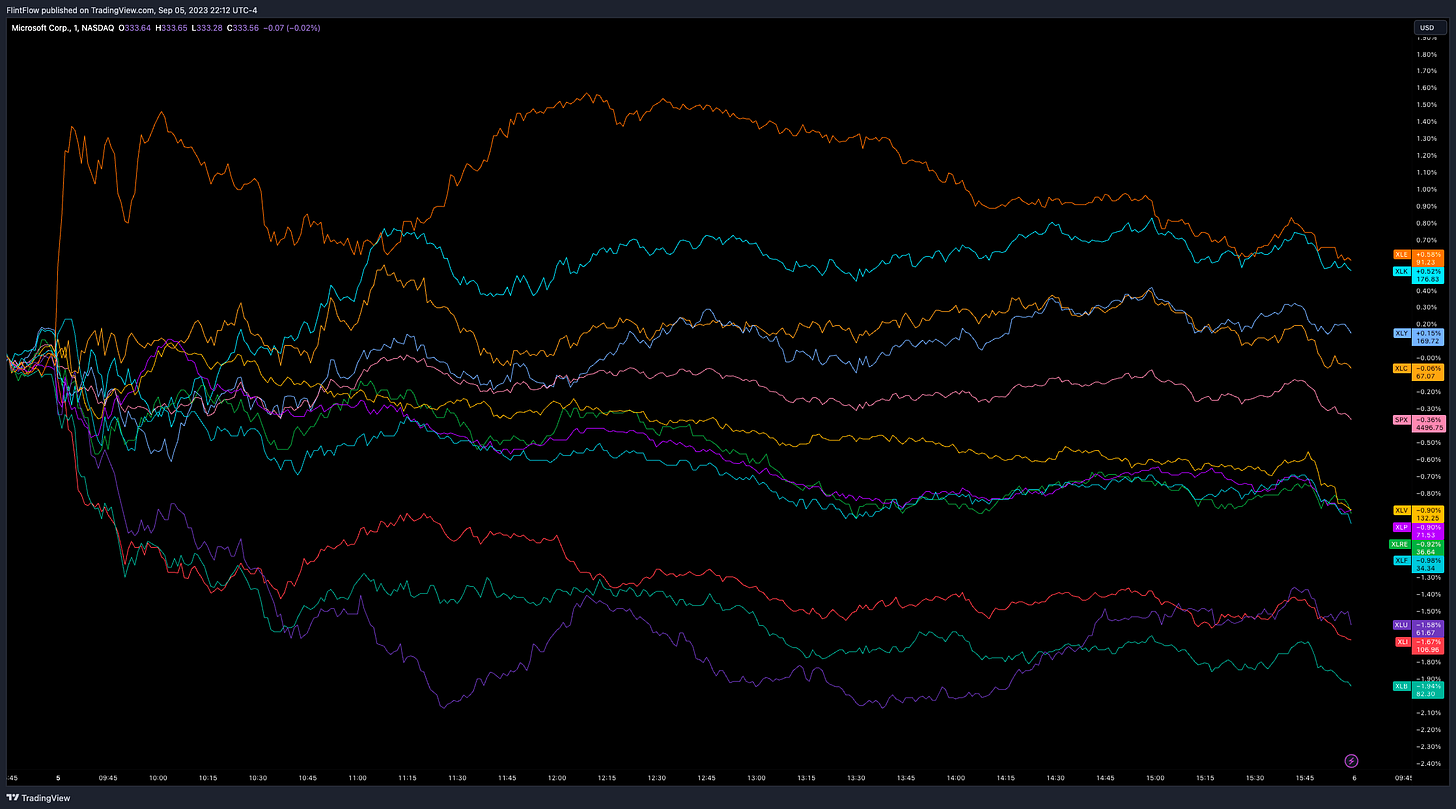

Sector Performance (Previous Session)

XLE - Energy: 2.99% The energy sector led the pack today, surging with an impressive 2.99% gain. This bullish momentum could be driven by factors like increasing oil prices, demand recovery, or positive sector news.

XLK - Technology: 0.94% Technology stocks showcased resilience, delivering a positive 0.94%. Innovations, product launches, or strong quarterly results might be playing a part in this upward trend.

XLF - Financials: -0.26% Financials experienced a minor dip of 0.26%. This could be attributed to varying interest rates, regulatory news, or the overall market sentiment affecting banking and investment institutions.

XLY - Consumer Discretionary: -0.55% Consumer Discretionary took a slight hit, dropping by 0.55%. Perhaps consumers are being more cautious with their discretionary spending, or there might be concerns about certain industry giants within this sector.

XLB - Materials: -0.68% The materials sector saw a drop of 0.68%. Fluctuations in commodity prices or global trade concerns could be influencing this decline.

XLC - Communications: -1% Communications experienced a 1% drop. Possible reasons include shifts in the telecom industry or challenges faced by media conglomerates.

XLRE - Real Estate: -1.16% The real estate sector declined by 1.16%. This could be reflective of market concerns related to interest rates, property values, or other real estate dynamics.

XLV - Health Care: -1.42% Health Care saw a 1.42% decline, possibly due to regulatory challenges, drug approval concerns, or shifts in healthcare policies.

XLI - Industrial: -1.50% The industrial sector fell by 1.50%. Factors such as global supply chain challenges, labor issues, or geopolitical concerns could be at play here.

XLP - Consumer Staples: -2.03% Consumer Staples faced a considerable decline of 2.03%. This might suggest that consumers are pulling back on essential goods, or there might be challenges faced by major companies within this sector.

XLU - Utilities: -2.74% Utilities suffered the most, with a sharp drop of 2.74%. This could be attributed to factors like changing energy prices, regulatory shifts, or broader market dynamics affecting utility companies.