Good evening, readers!

First, let's delve into the GDP data released today and its alignment with the recent statements from the Federal Open Market Committee (FOMC).

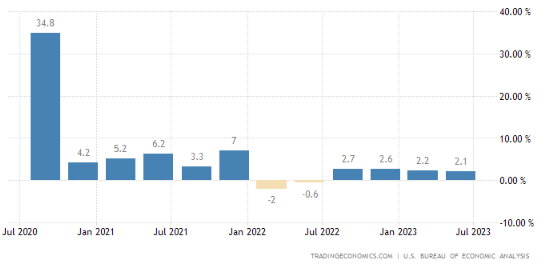

The Fed had projected a 0.1% decrease in GDP, setting an end-of-year target of 2.1%. The data we received today closely mirrors the Fed's forecast, confirming the accuracy of their predictions. At present, we are firmly on course to meet the year-end target, provided the economy can maintain this performance over the coming months. This data release serves as a validation of the Federal Reserve's earlier economic growth outlook. Their foresight in anticipating a minor GDP dip followed by a rebound that leads to the 2.1% target has been substantiated by the numbers.

Now, let's shift our focus to the performance of my earnings calls.

KMX had lackluster earnings, in line with my expectations, which prompted a sell-off from $80 all the way down to my $68 target, hitting the exact low. This brings my earnings calls to a 3/3 success rate for the week. However, even as we enjoy a string of positive outcomes, it's essential to recognize that, inevitably, good runs must come to an end. In this case, NKE (Nike) posted a robust report that significantly boosted the stock in after-hours trading. Overall, this has been an exceptional week for earnings calls, despite my recent hesitation to take positions due to uncertainty about post-report stock movements. As soon as I resumed posting these calls, the results have been outstanding. The year 2023 has been an exceptional one on the earnings front, and I eagerly anticipate all the forthcoming quarters, whether they bring positive or negative reports.

On the indices front, we once again witnessed some downward movement relative to my levels. However, the market eventually rallied above the key LVN (Low Volume Node) that I mentioned, triggering a sharp upward squeeze. Everything unfolded as per the plan I communicated yesterday, and once again, readers found themselves on the right side of market volatility. This was exemplified by the Nasdaq rallying all the way up to my target of 19954, reaching the High of Day (HOD) here before retracing nearly 100 points. This serves as another prime example of the precision of these orderflow levels, from entry points to targets, all of them have proven to be remarkably robust.

Turning to commodities, both Oil and Gold exhibited substantial moves. Gold, however, lost some of its shine, experiencing another significant drop below the critical 1900 level. Gold reached a peak right at my specified level of 1896 before sliding further, dropping down to 1975. As for Oil, it failed to maintain strength above the long level after extending yesterday's upward move to $95. It broke down below my key short level of $93.43, resulting in a robust sell-off down to my $91.81 target, nearly setting the low of the day in this range.

It's worth noting that the highs and lows of the day continue to align with my long and short targets, underscoring the remarkable accuracy provided in every trading session.

Let's now turn our attention to the intraday stock levels that I provide daily for AAPL, TSLA, NVDA, MSFT, AMZN, AMD, GOOGL, and META. I offer clear call and put levels based on Volume Profile analysis and the expected direction of the indices. Let's dive into today's developments:

AAPL: The stock dropped by 4 points from my put level, resulting in significant gains on related contracts.

AMZN: Similarly, AMZN fell by 4 points from my put level, leading to substantial gains on contracts.

AMD: In contrast, AMD saw a rally of 6 points above my key level, resulting in substantial gains on contracts.

GOOGL: Both the put and call levels for GOOGL worked out well, with 1-point movements in both directions.

For more details on the remaining stocks, you can refer to yesterday's post to review the outcomes.

Flow State Swings, as previously detailed in Flow State #45, continue to demonstrate robust and favorable movements. Notably, PSA experienced a 4-point drop directly from my specified short level, essentially retracing to price levels observed earlier this week. In the case of SBUX and NFLX, they have maintained proximity to their respective lows, hinting at the possibility of a sharp downward move tomorrow as we approach the end of the trading week.

Now, let's turn our attention to my analysis for tomorrow's session!