Good evening, readers!

My, oh my! That session was absolutely astonishing for our subscribers. Once again, we saw a significant drop from my specified levels, surpassing even my intraday targets and descending towards my weekly downside projections. The Emini, Nasdaq, and Gold all plunged past my intraday markers, displaying no signs of recovery throughout the entire session. Regrettably, traders who attempted to capitalize on dips were left in shambles, despite my explicit warnings earlier in the week. I had been unequivocal about the market's structure and the potential dangers associated with the breakdown of the trend pivot, coupled with the looming threat of slipping down into major low volume nodes (LVNs), all of which posed a formidable risk for further declines.

Today, we witnessed the precise scenario that I had forewarned about, which underscores how my interpretation of the Federal Reserve's actions aligns with the sentiments of investors, particularly larger ones. To gain a deeper understanding of the concepts I'm referring to, I encourage you to revisit Flow State #45. There, you'll find the insights that elucidate the very dynamics at play in today's market.

For short positions, I'm looking for a break below 4370. Upon selling lower, I will target 4330.

For short positions, I'm looking for a break below 14909. Upon selling lower, I will target 14787.

AVGO, NFLX, SBUX, HD, AMT, MCD, and CMCSA have all experienced a surge in downside volatility, aligning perfectly with what I discussed in yesterday's newsletter. This prediction has materialized, extending the short opportunities and providing ample potential for our readers this week. It's worth noting how the market has consistently moved lower, reinforcing my thesis of further downside potential, with numerous stocks poised for substantial declines. While some stocks have managed to hold onto their support levels, the ones that have remained on my radar are not among them.

My intraday stock levels performed exceptionally well today, with many of the expected sell-offs gaining momentum during the session, especially in the case of Amazon. I issued a warning on stock X, identifying four stocks that were likely to see additional selling pressure after breaking fresh lows compared to last week, and the market delivered precisely that outcome. We are currently witnessing a significant shift, moving from investors heavily favoring long positions to a complete dismantling of recent buyers in the hottest stocks we've been riding for months.

Before delving into these specific stock names, I want to provide some perspective for those considering long positions once this downward movement reverses in the indices. The key strategy here is to focus on stocks that have maintained their high positions rather than those that have experienced significant selling pressure. If a stock has managed to hold up well while the indices have been declining, it's a strong indicator that when the indices start supporting upward movements, money will flow into these resilient stocks, while exiting those that have seen substantial declines. Always remember that changes in price are driven by underlying factors, so pay close attention to the context clues the market is providing and adjust your positions accordingly.

20 minutes into the session I sent this out before stocks completely fell off a cliff.

Now, let's turn our attention to my analysis for tomorrow's session!

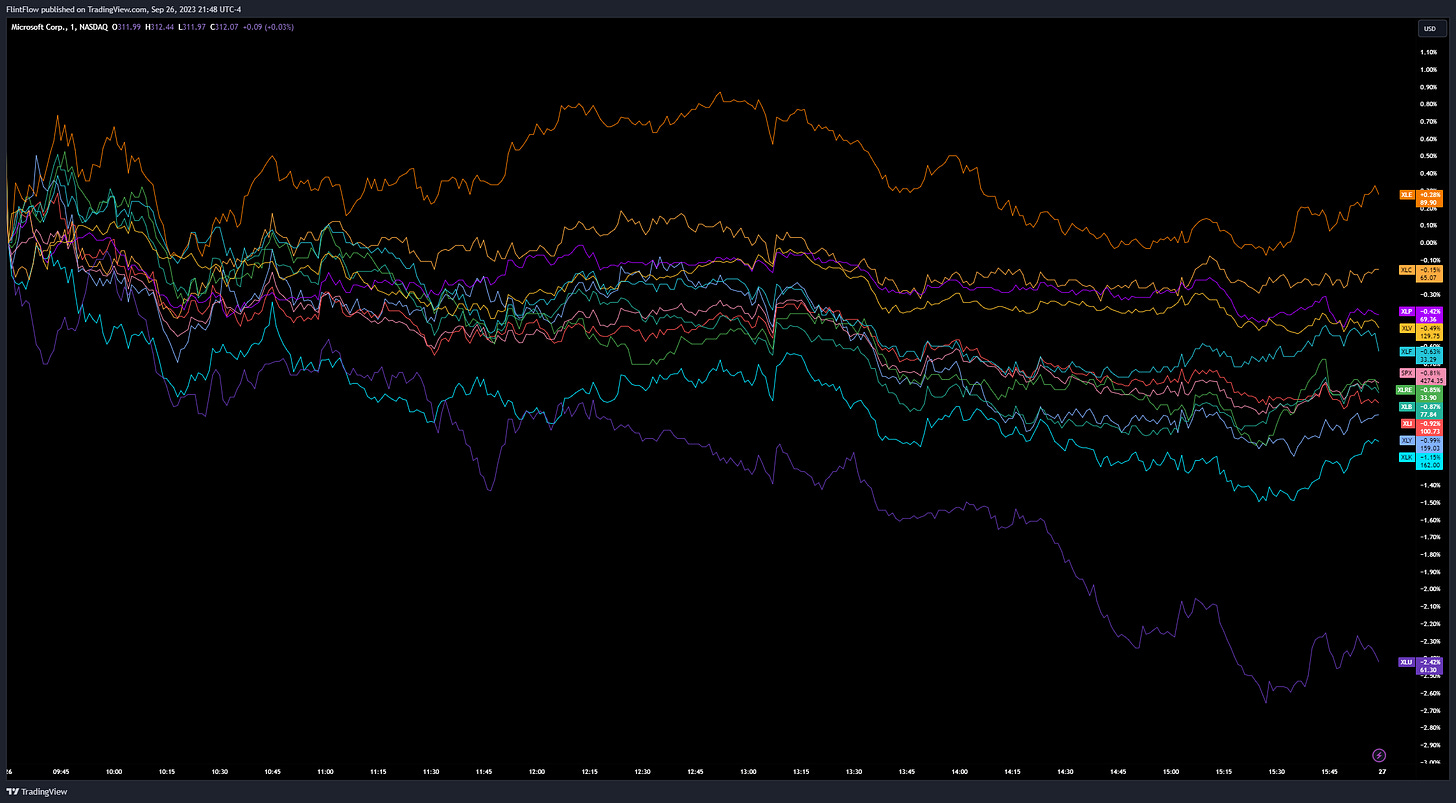

Sector Performance (Previous Session)

XLE - Energy: 0.28%

The energy sector demonstrated resilience, posting a positive return despite broader market challenges. This suggests that energy stocks might be benefiting from certain macroeconomic trends or specific sector dynamics.

XLC - Communications: -0.15%

The communications sector experienced a marginal decline. Though down, its performance has been relatively stable compared to other sectors, indicating a level of resilience in the face of market fluctuations.

XLP - Consumer Staples: -0.42%

Consumer staples witnessed a modest decline. This could reflect that consumers are holding steady on essential purchases amidst broader market pressures.

XLV - Health Care: -0.49%

The health care sector saw a slight drop, possibly influenced by regulatory shifts, drug approvals, or broader market dynamics.

XLRE - Real Estate: -0.85%

Real estate experienced a dip. This could be indicative of shifting consumer preferences, interest rate influences, or other economic factors impacting the housing and commercial property markets.

XLB - Materials: -0.87%

The materials sector is down slightly, perhaps reflecting global trade dynamics, supply chain disruptions, or other industry-specific factors.

XLI - Industrial: -0.92%

The industrial sector registered a near 1% decline. External factors like supply chain challenges, global economic slowdowns, or shifts in manufacturing might be playing a role.

XLY - Consumer Discretionary: -0.99%

The consumer discretionary sector dipped just under 1%, hinting at consumers possibly being more conservative with their non-essential spending in the current economic climate.

XLK - Technology: -1.15%

The tech sector, a perennial leader in recent years, faced a drop exceeding 1%. This could be due to market valuations, regulatory concerns, or shifts in tech adoption patterns.

XLF - Financials: -0.63%

The financial sector was on a downtrend. Potential factors include interest rate decisions, lending patterns, or broader economic indicators affecting banking and financial services.

XLU - Utilities: -2.42%

Utilities saw the most significant decline among the sectors listed, suggesting potential pressures from rising operational costs, regulatory factors, or shifts in consumer demand.