Welcome back everyone!

Another phenomenal session is behind us. Two setups were called out live in chat, one of which did not work while the other far outweighed the loss. First, I will cover the setup that didn’t work along with my thesis, and then I will follow up with the one that did.

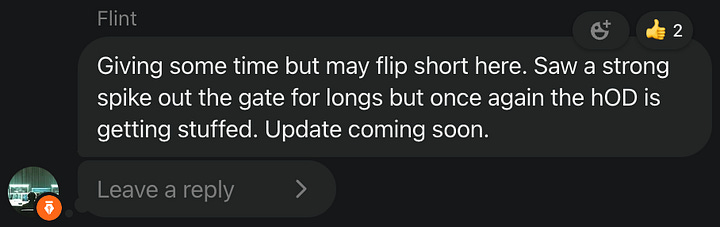

The open started off bullish with a clear uptrend brewing. Unfortunately, this was short-lived, with the upside not meeting my expectations. While the contracts did work out for a period of time, there simply was not enough upside for my liking to begin locking in.

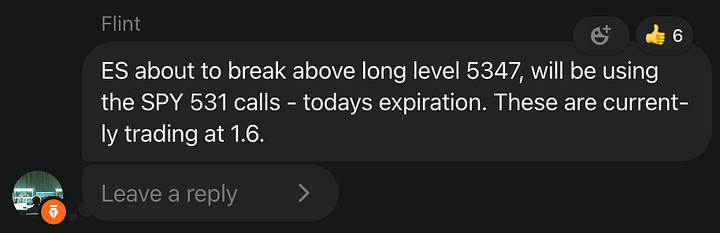

Here is what was said this morning inside the chat:

Note for readers who are not paid subscribers: I do risk the entire contract going to zero on each trade. Occasionally, I will cut for a loss, but more often than not, this isn’t the case. Depending on the amount a trader may be able to risk, the number of contracts will be based on a $160 loss per contract.

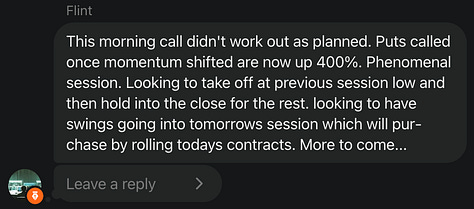

As I mentioned in the last screenshot, I was open to a short as long as there was clear follow-through from sellers once breaking the intraday low. This happened, so I swiftly sent out an update in the chat calling for SPY puts worth $90 per contract. This worked out perfectly, bringing in $570 per contract by the close, which was also updated in the chat. See below:

Now we can move on to how the indices are holding up and then discuss my thesis for tomorrow's session for the S&P and Nasdaq.

SPX, NDX, DIA, IWM

The indices saw a strong open, with each of the four setting back-to-back sessions hitting a new high since the low. On top of this, all four indices were holding above the 200-day moving average. Before they broke down, price was taking out the lows on all the indices on an intraday timeframe. There was a clear shift in trend, signaling to avoid being long. Price continued heading lower and broke the uptrend set in the last two sessions. I do not want to be bullish unless we can begin to break back above this. I will cover my thoughts on this live inside the chat.

Now let’s delve into the market structure on the S&P and Nasdaq.