Good morning, readers!

Emini (ES) established the Low of Day (LOD) and High of Day (HOD) at an optimal level (Long level), quickly aiming for the long target to capitalize on the entire session's movement.

As the trading day unfolded, Apple and Tesla experienced significant declines, breaching critical levels, whereas Meta, Nvidia, Google, Microsoft, Advanced Micro Devices, and Amazon showcased a robust rally, surging above their respective levels.

The relentless selling pressure from OVN traders drove the market back down to lows, dealing a severe blow to those who had entered late long positions.

Eli Lilly made an impressive morning ascent, soaring toward its 500 target. However, this promising momentum was dampened by the selling pressure witnessed in both Datadog and United Parcel Service. Duke Energy, on the other hand, exhibited a slight upward trend this morning, favorably aligning with our long positions. Yet, it falls short of the spectacular fireworks we've witnessed over the past weeks.

In the realm of Flow State Stocks, the closing numbers reflected a notable performance with 23 out of 31 stocks concluding the session in the green. Boeing demonstrated a remarkable 3% surge, while Automatic Data Processing recorded a commendable 2.10% increase, and Linde saw a healthy rise of 1.9%. The previous session undoubtedly provided readers with an astonishing spectacle; however, it is crucial to closely monitor the provided support levels, especially in light of the persistent selling pressure from OVN. A breach of these support levels would undoubtedly signal a clear indication to consider discontinuing long positions.

Let’s jump into sector performance before moving on to what I expect for todays session.

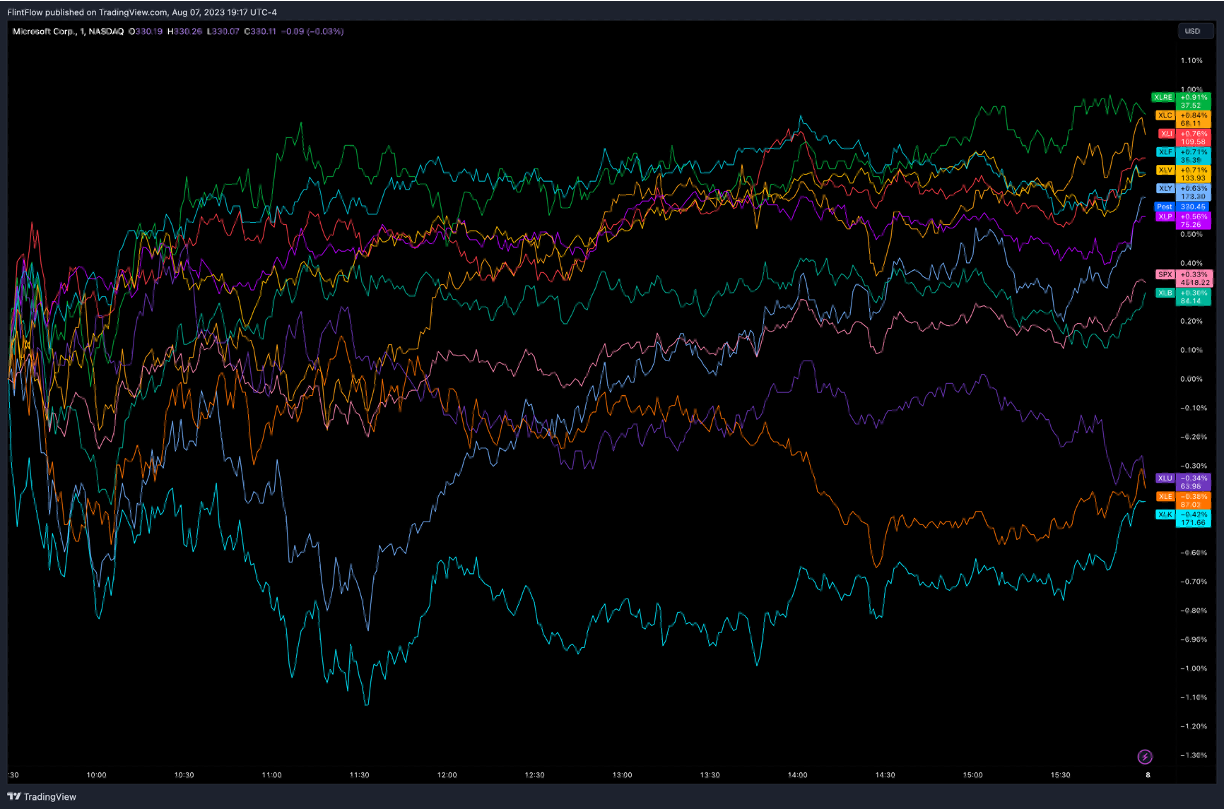

Sector Performance (Current Week)

Examining the sector performance at the start of the week provides valuable insights into the overall market dynamics and investor sentiment. Each sector's movement reflects the underlying trends and influences shaping the trading landscape.

In the realm of technology, represented by XLK, a marginal decline of -0.42% is observed. This performance suggests a nuanced interplay of factors within the tech sector. It could be indicative of profit-taking following recent gains or potential concerns about regulatory developments. Tech stocks, known for their volatility and growth potential, often exhibit fluctuations as market participants navigate evolving industry landscapes and macroeconomic conditions.

On the other hand, the communications sector, as represented by XLC, displays a notable increase of 0.84%. This surge may signify a positive outlook for companies engaged in media, entertainment, and communication services. The rise in XLC could be driven by various factors, such as increased consumer engagement with digital platforms, heightened demand for content, and new opportunities emerging within the communication sector.

Consumer discretionary stocks, encompassed by XLY, demonstrate a solid uptick of 0.63%. This suggests a favorable sentiment toward non-essential consumer spending. A rise in XLY could be attributed to improved consumer confidence, robust retail sales, or innovative product offerings within the consumer-oriented industries.

Moving into the industrial sector, represented by XLI, a rise of 0.76% is noted. This performance may reflect optimism surrounding infrastructure projects, manufacturing activities, or global economic recovery efforts. XLI's gain could underscore the potential resilience of the industrial sector as it responds to shifts in supply chains, technological advancements, and trade dynamics.

The materials sector, symbolized by XLB, experiences a modest increase of 0.30%. This movement points toward ongoing demand for raw materials and resources used in construction, manufacturing, and other industries. The performance of XLB may provide insights into the health of the broader economy, as materials are integral components of various sectors.

In contrast, the real estate sector (XLRE) sees a noteworthy surge of 0.91%. This could be a reflection of renewed investor interest in real estate assets as economic conditions stabilize and market participants seek stable income-generating opportunities.

Consumer staples, denoted by XLP, showcase a rise of 0.56%. This performance could indicate a preference for essential goods and services, highlighting the sector's defensive characteristics. XLP's gain might suggest that investors are positioning themselves to weather potential market fluctuations by investing in stable, recession-resistant industries.

Meanwhile, the utilities sector, represented by XLU, experiences a marginal decline of -0.34%. This movement could be linked to shifts in interest rates or changes in energy demand patterns. Utilities are often considered a defensive sector due to their consistent revenue streams, and fluctuations in XLU could be influenced by broader economic trends.

Health care, represented by XLV, displays a solid increase of 0.71%. This performance underscores the continued significance of health-related services and innovations within the market. The rise in XLV may reflect ongoing advancements in medical technologies, drug development, and health care delivery systems.

The financials sector, symbolized by XLF, matches the health care sector's increase of 0.71%. This parallel movement could suggest a synchronized sentiment between these two sectors or potential interactions between financial and health-related developments.

Lastly, the energy sector, represented by XLE, witnesses a minor decline of -0.38%. This performance may mirror fluctuations in oil prices, geopolitical factors, or shifts in energy consumption patterns. XLE's movement could provide insights into global energy demand dynamics and the sector's responsiveness to various external factors.

In summation, the diverse sector performances at the beginning of the week offer a mosaic of market trends and investor sentiments. The mixed movements reflect the intricate interplay between economic indicators, industry-specific developments, and broader macroeconomic influences.