Welcome back everyone!

To kick off today’s newsletter, I want to cover the ISM Services PMI, which provided intraday support that held the market up the entire session. This release was extremely strong, posting a reading of 51.4 after being at 48.8 previously.

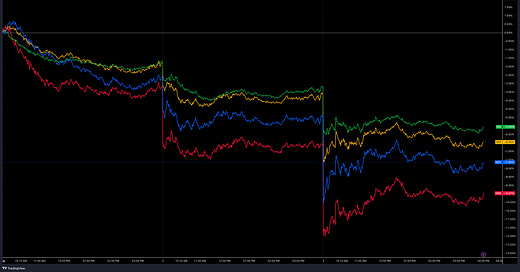

SPX, NDX, DIA, IWM

As you can see above, the indices are making a strong rebound after a large gap down at the open. The Nasdaq specifically formed a double bottom, with tech seeing a strong rally at the open. You will not be able to see this unless you look at a chart showing after-hours trading. Additionally, there were clear inflows of selling for the majority of the session, yet we put in a strong trend day to the upside. This is a clear divergence in the market, which we have not seen since the sell-off started from 5600 on the S&P and the other indices.

What do bulls have going for them moving into tomorrow’s session?

• Strong selling divergence

• Nasdaq double bottom with strong tech

• Indices bouncing off 200-day moving averages

• Japan/China strong recovery overnight

As most of you know by now, I gear this newsletter to pay close attention to the volume profile, which influences the levels. On the flip side, it’s undeniable that when larger timeframe moving averages are hit, this will be a major area where institutions support the market. As we are closing above the 200-day moving averages, this shows a sign of strength and, at a minimum, a stall of further selling. From here on out, I do not want to see the indices fall below these levels. Below, I will cover the volume profile structure on both the E-mini and Nasdaq for tomorrow’s session with the key levels.

Before moving on, note there will be no key economic releases tomorrow.

Now let’s delve into the market structure on the Emini and Nasdaq.