Good morning, readers!

Yesterday's session was quite turbulent as the indices struggled to determine which value area to remain within. The Emini managed to break above 4527 (VAL), but the Nasdaq faced resistance multiple times and couldn't surpass 15547 (VAL). For today's session, deciding where to place levels will be easy, but before we do that, let's review the good and the bad from yesterday.

Gold performed well, finding support above a our level throughout the entire session, which prevented any significant downside and allowed for multiple bounces. On the other hand, oil witnessed a monstrous rally, surpassing its target and rallying over 200 pips. However, this raises concerns about inflation, and we will wait for the actual data release before making any decisions. As we approach that event, I will share my thoughts on whether we might see another cooling print or finally get the hot print that the bears have been anticipating.

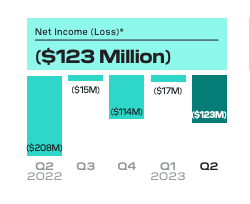

Now, let's delve into the Square and Apple earnings reports, both of which started on a positive note with both companies posting a revenue beat. Beginning with Square, the overall numbers were impressive, except for the fact that they experienced a decline in net income, which dropped to $123 million. Last quarter, this number was only a loss of $17 million, which is not a welcoming sign for investors.

Moving on to Apple, they also reported a beat in revenue, but there was a decline in sales of the iPhone, iPad, and Mac. However, there were significant increases in wearable sales and services, which caught my attention and indicates strong earnings potential. Overall, I don't believe this sell-off will hold for today's session, and I expect Apple to rebound in the coming days. While there were no extraordinary fireworks in the company's report, there's nothing to be overly concerned about.

Airbnb delivered excellent earnings, and the stock closed unchanged. This positive performance could lead to a strong upward movement today. They surpassed expectations with a 22% beat in EPS and a 2.6% surprise on Revenue. It's yet another double beat from the list, but overall, it wasn't anything extraordinary.

Now we can move to the winners!

Both Amazon and Bookings reported monster earnings, resulting in surges after hours. Amazon experienced a remarkable rally, reaching as high as 143 with an 84% surprise on EPS and a 2.2% surprise in Revenue. With yet another double beat, the stock soared to new swing highs. Considering this impressive performance, I anticipate further continuation today to close out the week on a high note.

Contracts are expected to open up 500%.

Bookings experienced a much stronger rally, with the stock closing up a staggering 11.9%! This remarkable performance was driven by an incredibly robust earnings report. They exceeded expectations with an impressive 30% surprise in EPS and a significant 5.7% surprise in Revenue. As anticipated, this led to a massive spike, given the red-hot state of the travel sector in Q2.

Bookings contracts are expected to open up over 4,000% this morning, making it one of the most successful calls in the history of this Newsletter. The foresight on this trade has proven to be exceptionally accurate and rewarding.

Earnings

Events

Session Outlook

ES