Welcome back everyone!

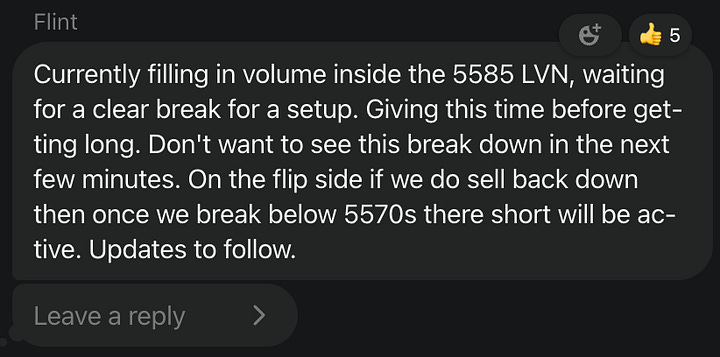

Markets took a major hit after opening up today looking bright and sunny. In a short amount of time, we saw a collapse below the low after Powell spoke yesterday. This was a key spot where buyers held the market up, pushing the Emini up to 5600. In the morning, we had a very active chat, firing off ideas for both the long and short sides. The key was being patient and waiting for the market to identify which way the trend would go. Unfortunately, we saw massive buying by retail investors, only for them to miss an over 120-handle sell-off. Roughly 30 minutes into the session, we began to sell below the 5570s, which I identified as an area that needed to hold above for the bulls. Last night's newsletter contained a blueprint for today's session. Not only was guidance provided live in the chat, but the details in last night's newsletter were the exact roadmap that today panned out. 5570 is an important VAH that will be shown below, along with the exact thesis sent to subscribers last night.

The Emini has formed a large value area between 5470 and 5570, with Low Volume Nodes (LVNs) both above and below this range. Currently, the price is at the Value Area High (VAH), which will guide short positions into tomorrow's session. As long as the price remains below 5570, I expect a sell-off down to 5500. Considering the interest rate decision yesterday, it is likely that we may continue to decline further, potentially reaching 5480, another key level from this week.

The two main levels for the session, other than the low set during Powell's speech (5570), were 5500 and 5480. 5500 was the first spot where the price saw a slight bounce, but it was short-lived as expected. The second key level, which has been significant all week, was 5480, which halted the EOD bounce, bringing a sell-off back to the lows at the time of this post. With the large selling today, I wasn’t confident in posting an earnings thesis on AAPL and AMZN, which dodged a bullet. I was bullish on AMZN, which would have made ER contracts go to zero, and bearish on AAPL. A clear IV crush occurred on AAPL, at least at the moment, as we failed to break higher and lower, bringing an after-hours close just above even. This has led to further selling back to the lows, which was my main thesis as covered inside the chat. Puts on the SPY were called out in the chat for this, but let me first cover the major wins on SPY/SPX that both moved over 1,000%. First, I will cover the updates sent out in the morning, and then I will move to the swings for the overnight session.

Now for the overnight swings which are set to open green at the time of this post, obviously anything can happen by tomorrows open.

That will be all for the recap and now time to move on to the analysis for tomorrows session.