Good morning, readers!

Another fantastic session lies behind us, where we successfully called the moves in various indices and accurately predicted Starbucks and Advanced Micro Devices earnings. This has been the prevailing theme throughout this earnings season for us, and as I've mentioned before, sticking to our areas of expertise empowers us to make better decisions. If given the opportunity, wouldn't you choose to invest or trade in companies that you truly understand? To me, it seems like the most sensible choice!

The tech sector has been shining brightly with impressive results, while on the other hand, stocks like Chipotle, once a regular source of daily meals for many, have become excessively expensive. Additionally, the recent significant rally in oil prices only adds more strain on consumers. Unfortunately, they will continue to bear the burden of pricey products that keep them entertained at home, discouraging them from venturing out.

It's worth noting that despite the abundance of earnings reports, we will employ simple logic rather than delving deep into financial reports. Such in-depth analysis is essential for long-term investors who want to ensure the companies they invest in are on the right track. However, on a quarterly basis, we prefer to focus solely on the current conditions we are facing.

Reflecting on yesterday's levels, both Emini and Nasdaq sold right to our short targets, establishing the low of the night. This serves as a testament to the significance of Volume Profile levels, but it also highlights the challenge in navigating them effectively.

Oil has indeed surged past the 82 target, and this development is likely to create ripples at the Federal Reserve. While numerous voices are asserting that this will impact the Consumer Price Index (CPI), and I share the same sentiment, we must exercise caution and wait for the official CPI print. Instead of approaching the release with preconceived expectations, our focus should be on confirming the data's indication of a potential trend change. Patience and reliance on solid data are key in these situations.

Evident from recent developments, Oil's performance has aligned with my previous predictions, wherein I confidently projected a robust session leading up to 82. Moreover, our accuracy extends to calling major rallies from lows and successfully identifying corrections, like the sell-off that occurred around the 80 mark late last week. To stay updated on all my insights across various markets, I highly recommend reading the Flow State series.

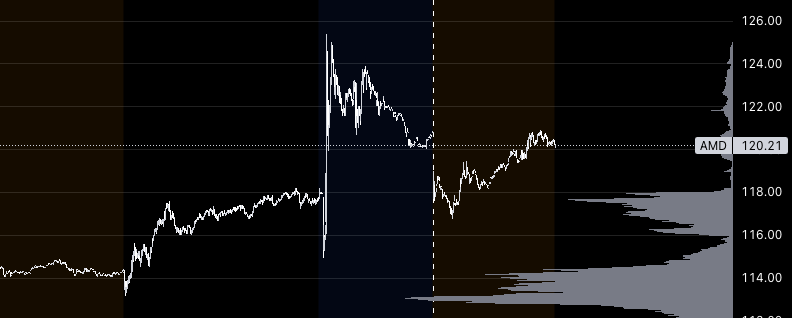

Currently, we have Advanced Micro Devices (AMD) scheduled to report earnings after hours today, and I anticipate a strong performance from them. The semiconductor sector, in general, has been resilient, as evidenced by ON Semiconductor's impressive report yesterday. This trend is likely to continue, with Nvidia being a standout stock to watch for potential upside moves.

However, when it comes to Starbucks, I am more cautious in my outlook for this quarter. The prevailing inflationary pressures have not subsided, and consumers have voiced their financial concerns. While Starbucks products may be addictive to some, the increasing cost may render them unaffordable for many, leading to a potential decrease in daily purchases to once or twice a week. Consequently, a drawdown in earnings is expected this quarter, and I anticipate a possible sell-down towards the 95-96 price levels.

AMD up while SBUX down as we predicted!

Today's plan will be refreshingly straightforward since we find ourselves right back inside the critical value area, which has consistently presented numerous long setups. Additionally, the Overnight (OVN) break below the Value Area High (VAH) reinforces our position. Here's an essential point to bear in mind as we move ahead: once this crucial event occurs, we will be able to witness the real-time shift in trend. This key insight will prove to be invaluable.

Before we proceed, I'd like to offer a quick refresher on the current US economic data we are observing. It's essential to stay informed about the latest economic indicators to make well-informed decisions going forward.

![500+ Sunrise Pictures [Stunning!] | Download Free Images on Unsplash 500+ Sunrise Pictures [Stunning!] | Download Free Images on Unsplash](https://images.unsplash.com/photo-1470252649378-9c29740c9fa8?ixlib=rb-4.0.3&ixid=M3wxMjA3fDB8MHxzZWFyY2h8M3x8c3VucmlzZXxlbnwwfHwwfHx8MA%3D%3D&w=1000&q=80)