Good evening, readers!

Let’s kick off this Newsletter with a recap of yesterdays session.

Plenty of winners trended upwards. All the indices, commodities, and equities performed favorably, revealing significant upside potential. Two particularly notable equities are Tesla and Nvidia, both of which witnessed massive rallies, closing up by more than 7%. These strong performances could be indicative of the anticipated earnings report set to be released this Wednesday.CL

GC

All the other stocks provided in the plan blasted above long levels posting major rallies which the two above were the strongest.

The results we've posted recently have been nothing short of amazing, continuing a trend we've seen in this Newsletter for the past few weeks. Remarkably, we've managed to stay on point every single day without being caught offside in our directional calls. Our consistent accuracy has been made easier due to the prevailing high volatility, which helps us remain on the correct side of the market.

One technique that's proven invaluable is the utilization of value areas divided by LVN. This provides clarity daily on market direction. While incorporating the current market trend into our analysis simplifies the process, it's crucial to note that even within overarching uptrends or downtrends, the Value Area High (VAH) and Value Area Low (VAL) are instrumental. They offer invaluable opportunities for both swing traders and scalpers. It's generally more challenging to short during an uptrend and to go long during a downtrend. Therefore, aligning with the prevailing trend enhances our accuracy. The Volume Profile effectively highlights key levels, giving us confidence in setups, such as predicting ER targets. A crucial strategy involves identifying a Value Area and referencing the Point Of Control (POC) for target-setting. Whenever there's a breach into a value area, be it higher or lower than the current price, the POC becomes a central focal point. This holds true across all value areas. Hence, on an intraday basis, instead of targeting the opposite end of a value range, it's more pragmatic to use the POC as an indicator of where buyer/seller activity might peak.

In the subsequent section titled "Session Outlook", I've detailed all the pivotal levels and value areas for every Index and Commodity we're tracking. Expect enhancements next week with a deeper dive into understanding these levels. One aspect we've identified for improvement is providing more context and explanation for each level to benefit our readers. I'd strongly advise revisiting and watching all the instructional videos we've released thus far. These resources are designed to offer an immersive experience into my analytical thought process. With over 30 comprehensive videos available, they're bound to expedite the learning curve for all enthusiasts.

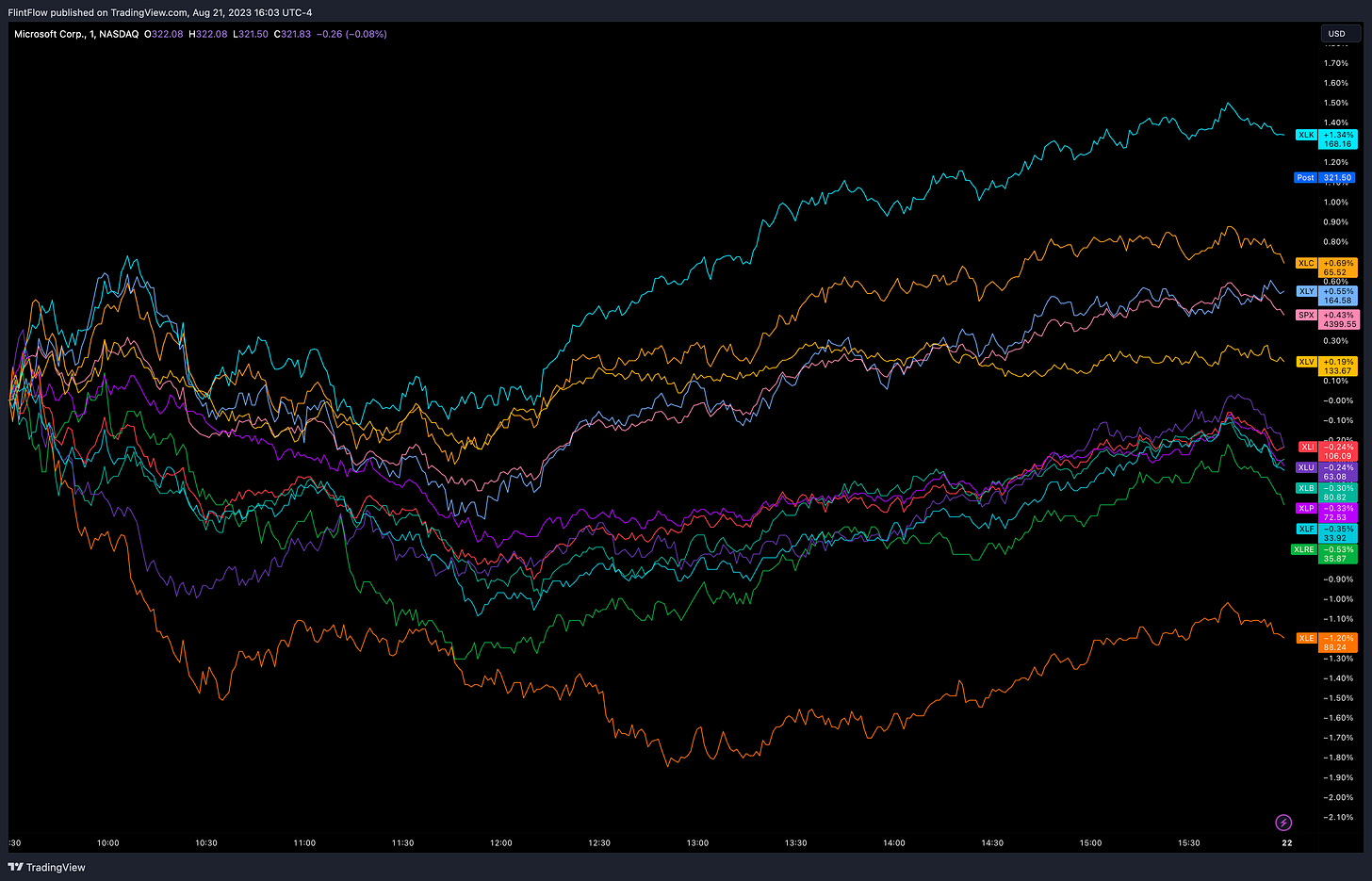

Sector Performance (Previous Session)

XLK - Technology: The technology sector saw a robust performance today, with the XLK posting a gain of 1.34%. This uptick indicates that tech stocks were among the market's frontrunners in today's session.

XLC - Communications: Communications had a positive day with the XLC advancing by 0.69%. The sector showed steady growth, reflecting confidence among investors in this space.

XLY - Consumer Discretionary: XLY, representing the consumer discretionary sector, edged up by 0.55%. This suggests a moderate spending appetite among consumers and a favorable view of non-essential goods and services.

XLI - Industrial: The industrial sector faced a minor setback, with the XLI dipping by 0.24%. This decline hints at some caution or profit-taking among investors in this space.

XLB - Materials: Today was a somewhat challenging day for materials, as the XLB retreated by 0.30%. This suggests potential concerns about the sector's near-term outlook.

XLRE - Real Estate: The real estate sector faced a downward trajectory with the XLRE dropping by 0.53%. This could be indicative of market concerns related to property values or interest rates.

XLP - Consumer Staples: The XLP, which covers the consumer staples sector, fell by 0.33%. Given that staples are often considered defensive stocks, this decline might point to broader market dynamics.

XLU - Utilities: Utilities, represented by the XLU, also experienced a minor dip of 0.24%. It seems investors might be reallocating assets or responding to specific news within the sector.

XLV - Health Care: Health care, under the XLV, saw a marginal rise of 0.19%. This demonstrates that the sector remains resilient amidst other market fluctuations.

XLF - Financials: Financial stocks faced some headwinds, with the XLF retreating by 0.35%. Factors such as interest rate concerns or broader economic indicators might have influenced this decline.

XLE - Energy: The energy sector had a tough day, with the XLE falling by a significant 1.20%. With the highest decline among today's sectors, it's clear that there are pronounced concerns or shifts affecting energy stocks.