Daily Plan 8.17.23

Markets Close Lower in Line with Expectations - What’s Next? (WMT Earnings)

Good morning, readers!

As anticipated, the Emini witnessed another round of selling, catching many off guard yet again. The culmination of this downward movement materialized during the overnight session, ultimately reaching our projected 4410 target. This sell-off commenced from a starting point of 4456, effectively resulting in a significant +46 handle sell, further underscoring the volatile nature of the market.

The Nasdaq also experienced a significant downturn, falling below 15124 and initiating a sell-off right into the close, reaching a low of 15920. This marked a +204 handle collapse, accurately predicted by me, making for a session that played out precisely as anticipated. In the lead-up to the market's opening, this level provided multiple opportunities for lucrative trades, yielding gains of 20-50 handles in addition.

For Gold, the short level at 1937.3 represented the peak of both the Overnight (OVN) session and the cash session, narrowly missing the target situated at 1915. Subsequently, Gold continued its descent during the Overnight session, dropping to 1918, resulting in a +19 handle sell-off.

Oil's trajectory followed a downward path today, failing to exhibit any notable upside beyond my 81.23 short level. This ultimately translated to a substantial +229 pip sell-off, reaching my designated target of 78.9. The results achieved in today's session were nothing short of remarkable.

Another standout performer was AMD, which exceeded my expectations by rallying earlier in the week from 107 to my designated 111 swing short level. However, today witnessed a stark reversal, as the stock experienced a pronounced decline, breaching the short level and initiating a sell-off.

Both TGT and TJX aligned with my expectations by delivering earnings that matched projections. These performances led to strong rallies following the release of their reports this morning. TGT's opening saw a direct hit on my 134 target, while TJX came close to the 92 target, falling slightly short with a peak at 90.2.

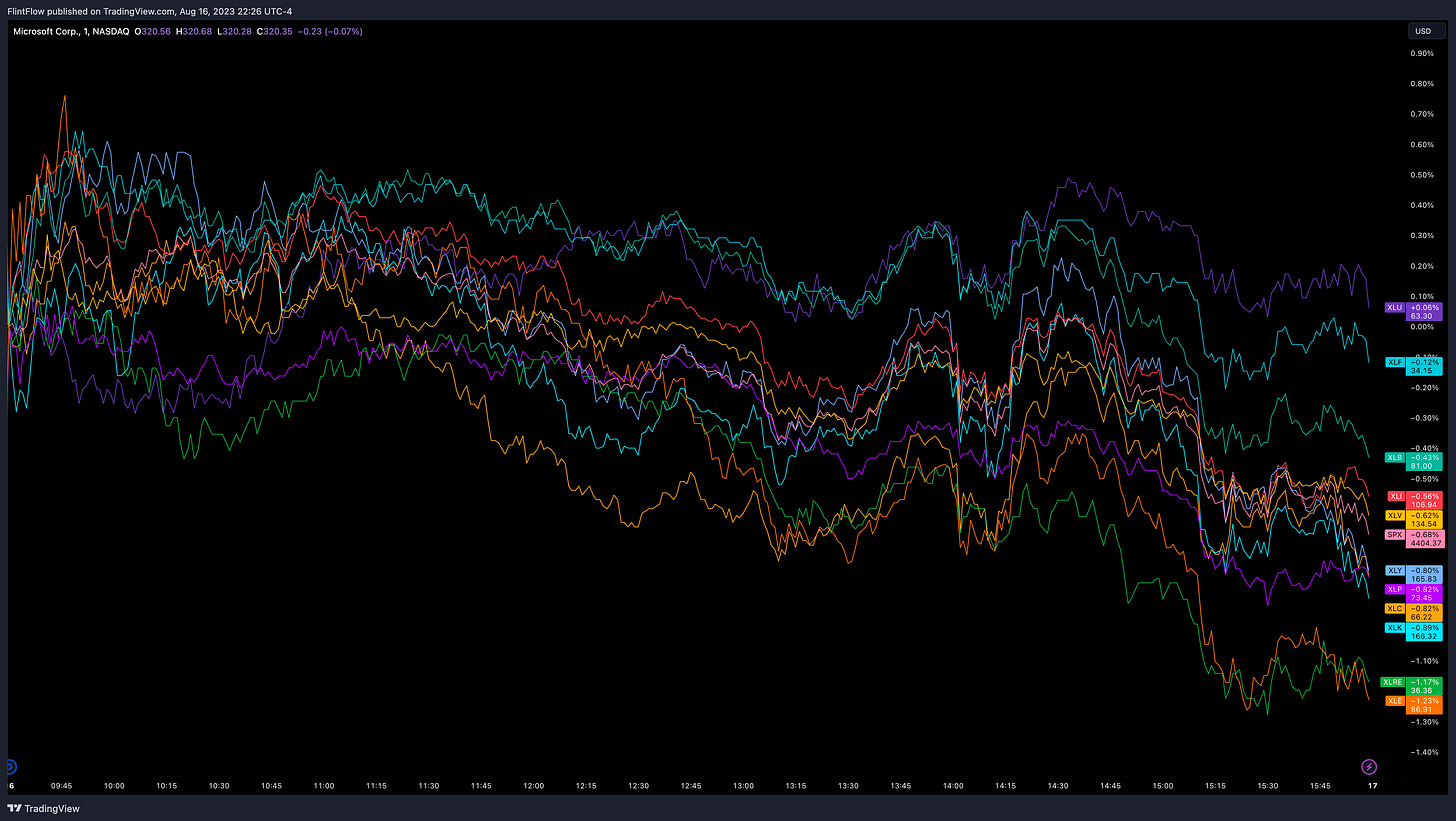

Sector Performance (Previous Session)

Negative Performers:

The Energy (XLE) sector experienced a significant decline of -1.23%, indicative of notable challenges within the energy landscape. This pronounced dip could be attributed to a blend of supply chain disruptions, fluctuating commodity prices, and intricate regulatory intricacies. The substantial decrease underscores the sector's susceptibility to external influences, potentially signaling broader economic obstacles.

The Consumer Discretionary (XLY) sector saw a noteworthy downturn of -0.80%, pointing to a notable drop in this segment. This downward trajectory could potentially mirror evolving consumer spending patterns and shifting behaviors. Given its diverse range of industries spanning from retail to entertainment, such performance shifts offer insightful glimpses into consumer sentiment and the broader economic panorama.

The Communications (XLC) sector encountered a notable decline of -0.82%, signifying significant challenges within this domain. This could encompass factors such as evolving technological trends and potential regulatory shifts. The sector's performance might offer insights into shifts in communication dynamics and the evolving role of technology.

The Health Care (XLV) sector experienced a decrease of -0.62%, indicating a setback in a domain that encompasses a wide range of healthcare-related industries. This decline could reflect various influences, including regulatory changes, pharmaceutical trends, and shifts in consumer preferences for healthcare services. Such performance fluctuations provide a lens through which we can analyze evolving health care dynamics.

Moderate Decliners:

The Technology (XLK) sector observed a moderate decline of -0.89%, indicating a setback in an arena renowned for its rapid innovation. This dip could be attributed to a variety of factors, such as profit-taking strategies and concerns about potential regulatory changes. Nevertheless, the sector's overarching significance in our digital-centric world remains pivotal, and its enduring potential to drive innovation and shape market dynamics is undiminished.

The Consumer Staples (XLP) sector faced a decrease of -0.82%, illustrating a modest decline within a domain centered on essential goods and non-cyclical demand. While the decrease is noteworthy, the sector's focus on stable products and consistent demand could contribute to its enduring role within the market.

The Real Estate (XLRE) sector encountered a decline of -1.17%, indicating a more pronounced setback in this particular category. Despite this, the sector's role in providing stable income and long-term investment opportunities remains evident. The broader trend aligns with investors' preference for stability, even amid more substantial fluctuations.

Neutral Performer:

The Utilities (XLU) sector experienced a minimal increase of 0.06%, signifying a modest rise within a domain that encompasses essential services. While this uptick is slight, it underscores the sector's role in providing indispensable utilities and services, contributing to its stable reputation.