Daily Plan 8.16.23

Markets Close Lower in Line with Expectations - What’s Next? (TJX + WMT Earnings)

Good morning, readers!

Let's kick off this Plan with a recap of yesterday's performance, then launch into the subsequent sections. We'll begin by delving into Sector Performance, followed by Events, Earnings, and, of course, the Daily levels that will serve as our compass for tomorrow.

The Emini saw a decline from the 4994 level, subsequently reaching the 4450 target, which notably closely aligned with the exact low of the day, resulting in a substantial +44 handle sell-off.

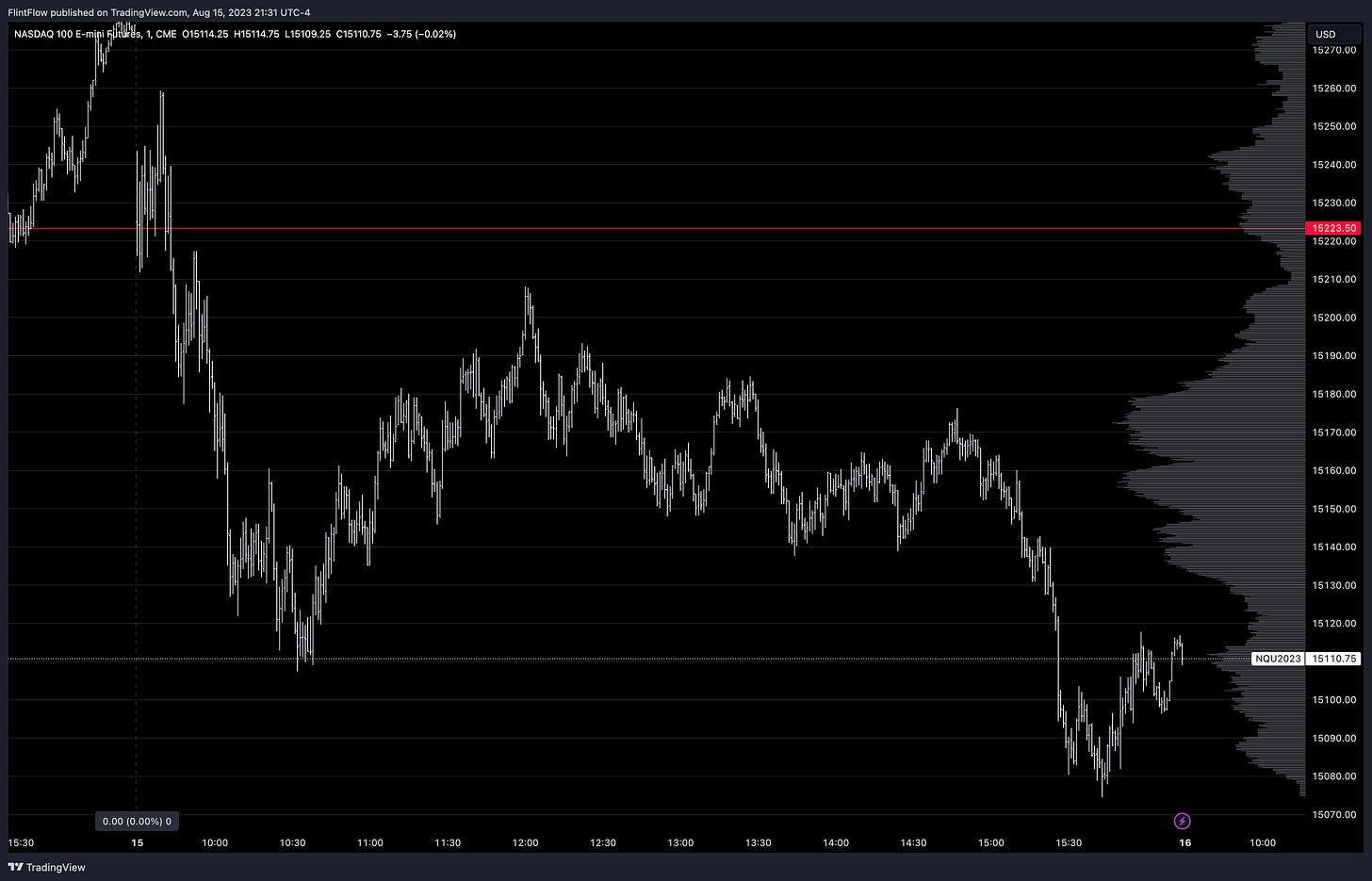

Meanwhile, the Nasdaq experienced a similar downtrend, dropping from its position at 15223 and coming tantalizingly close to hitting the designated target at 15040, though not quite reaching that level. This movement ultimately translated to a significant decline of +140 handles, encompassing the span down to the day's low.

Turning our attention to the realm of commodities, Oil exhibited a pronounced decline, slipping below the 82.23 level and resoundingly surpassing my 81 target. The descent culminated in the attainment of the day's lowest point at 80.4, marking an impressive +177 pip drop.

Gold underwent a shift as well, with a decisive break below the 1941.4 threshold leading to a subsequent collapse down to the targeted level of 1928. During the cash session, Gold experienced a repeat of this trend, as 1941.4 was once again encountered, triggering another descent that concluded at 1933.

Among the individual equities, LLY remained a standout amidst a sea of red. The stock continued its parabolic ascent, a trend that had been identified weeks earlier when it was called to surpass the 500 mark.

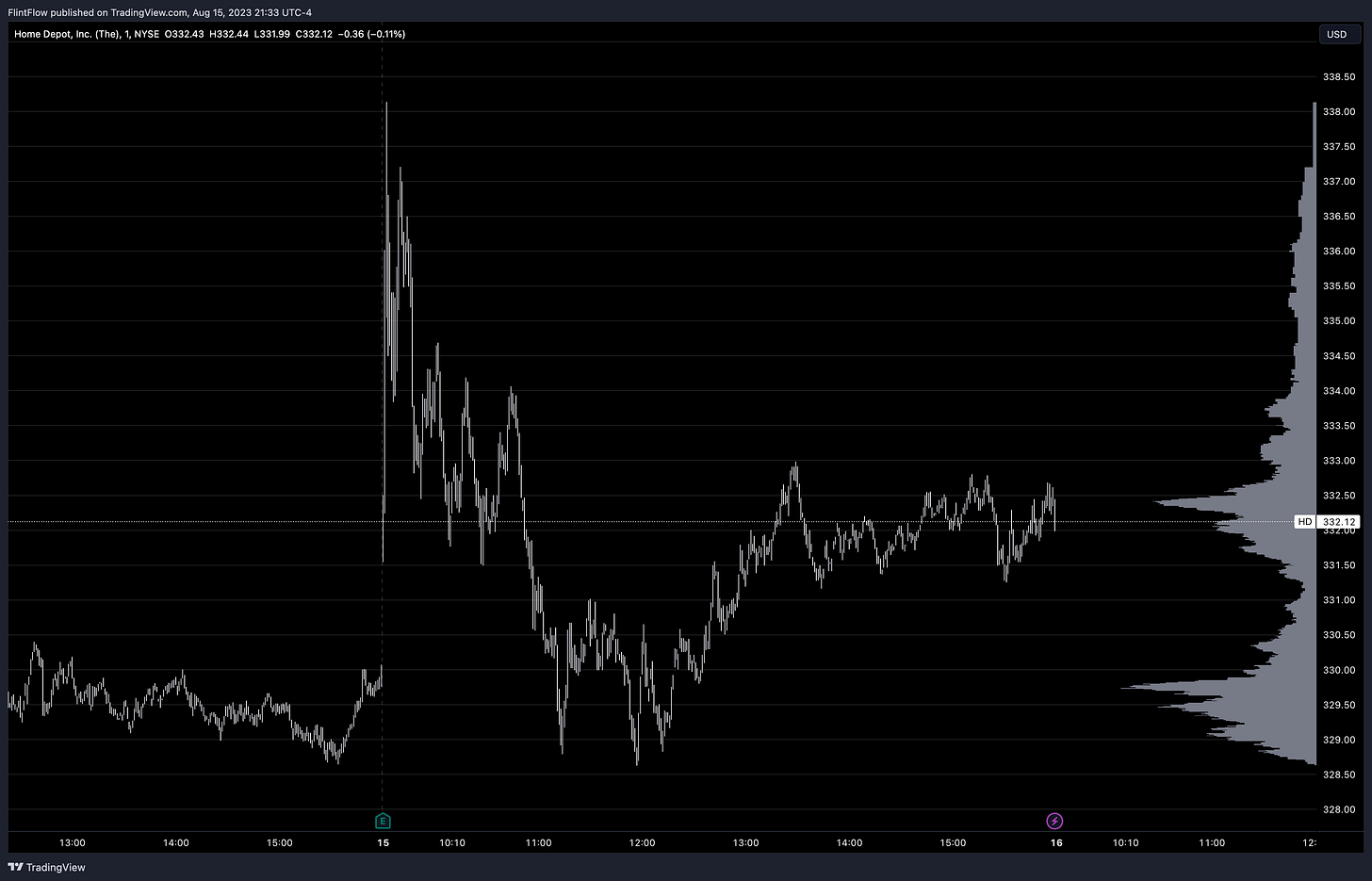

In the realm of retail, Home Depot presented an intriguing narrative. Despite initially responding to a double beat on earnings by selling off, the stock was unable to maintain this trajectory, ultimately triggering a massive spike upon market opening, which then led to a closure in the green.

Another noteworthy contender, Nvidia, remained true to its bullish trajectory that had been consistently projected, exhibiting strength and closing the day in the green.

Tesla, however, had a markedly different fate, experiencing a notable decline after breaking below a short-level threshold, resulting in a +7 handle sell-off.

Meanwhile, Apple struggled to surmount the previous day's highs, a challenge that instantaneously pushed the stock below its defined level, resulting in a +2 handle sell-off.

Sector Performance (Previous Session)

Negative Performers:

The Energy (XLE) sector faced a significant decline of -1.38%, indicating notable challenges within the energy landscape. This substantial dip could be attributed to a combination of supply chain disruptions, volatile fluctuations in commodity prices, and intricate regulatory complexities. The pronounced decrease underscores the sector's vulnerability to external factors, which in turn can signal broader economic hurdles.

The Consumer Discretionary (XLY) sector experienced a noteworthy downturn of -1.07%, indicating a substantial drop in this particular category. This downward trend could potentially reflect evolving consumer spending patterns and shifting behaviors. With its diverse range of industries spanning from retail to entertainment, such performance shifts offer valuable insights into both consumer sentiment and the broader economic landscape.

The Financials (XLF) sector also encountered a notable decline of -1.01%, signifying significant challenges within this sector. These could involve intricate regulatory changes, financial market volatilities, and shifts in investment strategies. Given its substantial role in the economy, the sector's performance could provide cues for wider economic shifts and developments.

The Utilities (XLU) sector experienced a sizable decline of -0.99%, highlighting potential obstacles within this category. This decrease might reflect changing energy consumption patterns, regulatory considerations, and the ongoing transition towards renewable energy sources. The sector's performance sheds light on the dynamic interplay between energy policies and market dynamics.

Moderate Decliners:

Both the Industrial (XLI) and Materials (XLB) sectors saw moderate declines of -0.69% and -0.88% respectively. These sectors are exposed to a range of factors, such as manufacturing trends, supply chain dynamics, and regulatory changes. Despite these dips, the relatively modest decreases could indicate a level of stability in the underlying fundamentals of these sectors, which play pivotal roles in shaping the economy.

The Consumer Staples (XLP) sector faced a decrease of -0.79%, demonstrating a modest decline in a sector that focuses on essential goods and non-cyclical demand. While the decrease is notable, the sector's emphasis on stable products and consistent demand could contribute to its enduring role within the market.

The Technology (XLK) sector witnessed a decline of -0.72%, indicating a setback in a sector known for its rapid evolution and innovation. This dip could potentially be attributed to profit-taking strategies and concerns regarding regulatory changes. Nevertheless, the sector's overall importance in our digital-centric world remains undeniably pivotal, and its ability to drive innovation and influence market dynamics over the long term remains intact.

Positive Performer:

The Real Estate (XLRE) sector experienced a relatively modest decline of -0.19%, suggesting a minor setback in this particular category. Despite this, the sector's role in providing stable income and long-term investment opportunities remains evident. The broader trend aligns with investors' preference for stability, which can be further examined in the context of the upward movements observed in other sectors.