Daily Plan 7.6.23

Good morning readers!

Yesterday presented several winners worth discussing, particularly in terms of their performance throughout the sessions and their adherence to predetermined levels. I highly recommend not only mapping out the levels on your trading platform but also evaluating how the stocks fared in each session based on those levels. This analysis can provide valuable insights into which levels were most effective and which ones were not respected as expected.

Let's start with META, which experienced a remarkable rally of 15 handles in a single session, surging all the way up to the 300 target OVN. This stock has been one that I have emphasized, citing its potential for a significant upward squeeze, which ultimately proved to be true. I continue to see further upside potential in this stock, contingent upon Emini and Nasdaq garnering buying interest at the market open.

Speaking of Emini, it came within a single handle of reaching the long target at 4495, once again delivering a stellar session with a clear direction. As many traders have observed, we have sold through the previous session lows OVN and are currently trading at 4454. At present, we find ourselves in a state of uncertainty, as we reside in a value area that can be considered a "no man's land." In order to pave the way for higher prices, the bulls would ideally like to fill this area with volume. For weeks now, relying on pivots has proven effective in staying on the right side of the market, and we will persist in identifying these pivotal prices based on their value.

Nasdaq, on the other hand, plummeted directly to the long level before swiftly surpassing the long target and embarking on an impressive rally of over 180 handles. This particular level stood out as a crucial area that buyers needed to defend, and they successfully accomplished that objective. The reason behind their strong defense lies in their reluctance to push prices beyond the current value area, especially when the market is trading at highs. By doing so, they aim to preserve the integrity of the ongoing uptrend. Consequently, we will once again monitor this level closely and exercise patience, waiting for prices to revisit it.

Turning our attention to GOOGL, it displayed strength right from the opening bell, much like META. With a mere three-handle spike above the designated level, it exhibited minimal downside movement throughout the session until OVN. Rather than attempting to predict which stocks will experience substantial price movements, it is far more valuable to analyze them based on their respective value areas. However, it's important to note that time also plays a role in this analysis, which can only be acquired through consistent practice and diligently monitoring the market session after session, for an extended period of time. As I always emphasize, being in tune with the market requires consistent dedication, and only traders who show up consistently can truly achieve this level of attunement.

Lastly, GNRC serves as an illustrative example of a stock that swiftly declined by nine handles in a single session once it broke below a key level that was identified in the Weekly outlook. This case exemplifies what can happen when a stock breaks a strong uptrend. It is crucial to be prepared for a similar scenario to unfold with Emini and Nasdaq, as selling pressure could potentially permeate the entire market.

Scanner (Finviz)

On radar from yesterdays and active: MARA - XPEV - CUK - IONQ - YNDX

MARA: Holds above 12 and this can make a trip u[ to 18-20. Clean value area built on way up from 9. 12 will keep this uptrend valid for attempts to push prices higher.

XPEV: Nearly the same setup as MARA in which i want to see value area for this uptrend to remain valid. Price needs to remain above 11.2 for attempts higher up to 18.

CUK: Strong uptrend with stock up 100% in weeks. I see this momentum continuing as long as price can remain above 14. Stock currently sits at 17 which I think can see a move up to 25.

IONQ: Holding value very well but I want this to remain above previous value area down at 9-11.10. If we remain above VAH then I see price moving up to 17-18 handles. Stock is currently sitting at 13.37.

YNDX: Strong move higher in recent weeks but now starting to unfold to the downside. If price can remain below 2550, I think we can break recent lows for a sell down to next value at 2150. Upon breaking 2275 this can unleash heavy selling.

Not interested in adding any new names to the scanner as there is so much opportunity touched on so far. To add, no setups are worth putting the extra work into yet.

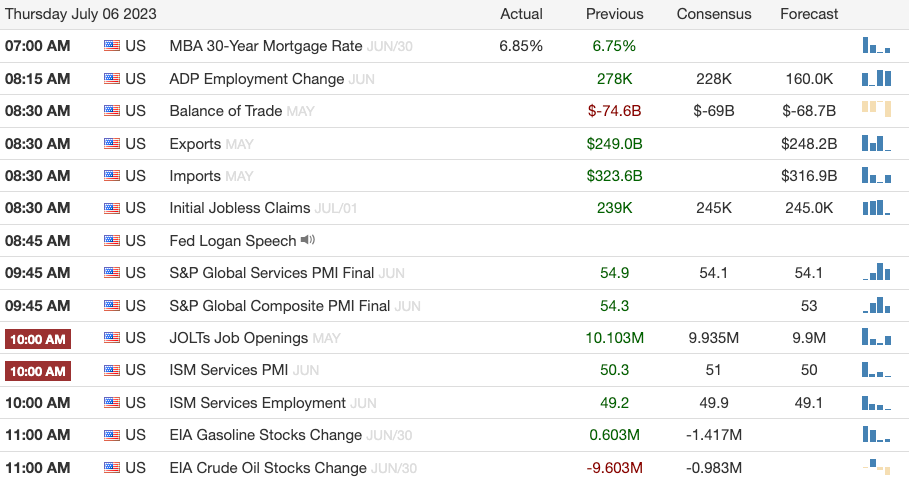

Events

Earnings

None.

Session Outlook

ES