Daily Plan 7.5.23

Good morning readers!

I hope everyone had a safe and enjoyable Fourth of July. As for the newsletters, there isn't much to add at this time as market conditions have remained relatively unchanged for several weeks. However, there are a few new stocks that have caught the attention of our scanner, and the list of these stocks is provided below. For guidance this week, I recommend referring to Monday's Weekly Outlook. During Monday's half session, there was little to no change, so we can expect similar expectations for today. It is worth noting that we have the release of the FOMC Minutes scheduled for today, which could potentially impact market dynamics.

If you want to read the full report from the FED, go here: Link

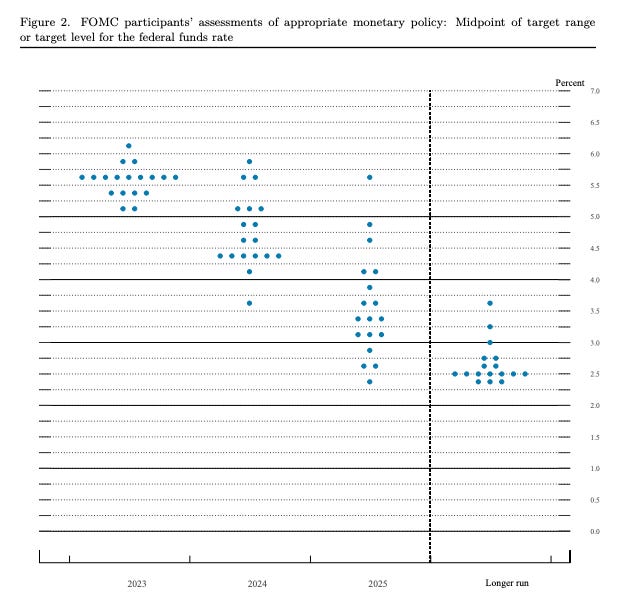

In summary, the Federal Reserve (FED) has acknowledged the presence of significant uncertainty and has indicated a wide error range within their models. While this revelation may have dampened confidence to some extent, there have not been any indications of data inconsistencies that would raise concerns. Thus far, the data aligns with our projections, and we anticipate further improvements in GDP and the unemployment rate, coupled with a decrease in the Core PCE (Personal Consumption Expenditures) index. These topics are likely to be discussed in today's FOMC Minutes as we seek insights into the Fed's outlook and policy considerations.

Scanner (Finviz)

On Radar: MARA - XPEV - CUK - IONQ - YNDX

MARA: Holds above 12 and this can make a trip u[ to 18-20. Clean value area built on way up from 9. 12 will keep this uptrend valid for attempts to push prices higher.

XPEV: Nearly the same setup as MARA in which i want to see value area for this uptrend to remain valid. Price needs to remain above 11.2 for attempts higher up to 18.

CUK: Strong uptrend with stock up 100% in weeks. I see this momentum continuing as long as price can remain above 14. Stock currently sits at 17 which I think can see a move up to 25.

IONQ: Holding value very well but I want this to remain above previous value area down at 9-11.10. If we remain above VAH then I see price moving up to 17-18 handles. Stock is currently sitting at 13.37.

YNDX: Strong move higher in recent weeks but now starting to unfold to the downside. If price can remain below 2550, I think we can break recent lows for a sell down to next value at 2150. Upon breaking 2275 this can unleash heavy selling.

Events

Earnings

None.

Session Outlook

ES