Welcome back everyone!

Lets dive into the recap for todays session then move on to tomorrows analysis.

Recap of chat today:

First, I want to review the AMZN swing that was discussed in the chat yesterday. Near the highs, I anticipated that the price would continue to rise, which triggered a long setup via call contracts. These contracts saw nearly a 100% rally with potential to continue higher throughout the week. Here is what was shared in the chat:

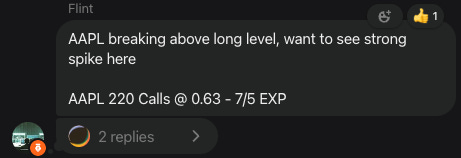

Additionally, AAPL experienced a sharp rally, causing the contracts called out yesterday to spike. The move was over 200% from when the update was sent out, with the contracts hitting a high of 2.09 after being called out at 0.63. Here is what was shared in the chat:

Lastly, SPX had a significant move that aligned with my expectations. By the end of the day, the price was poised for a strong spike, leading to a substantial increase in the value of call contracts. A common trend day setup was in play, setting up an end-of-day (EOD) pump. In the final minutes of the session, SPX contracts spiked all the way up to 5, achieving nearly a 400% increase. Here is what was shared in the chat:

Now let’s move on to my thoughts for tomorrows session!