Good morning, readers!

What a fantastic session we had yesterday in the stock market. Both stocks and indices performed remarkably, and it seems like everything is working in our favor. Even the stocks we identified through the scanner are holding their key orderflow levels. Don't forget to visit Flow State to find out what these levels are.

Shifting our focus to Chipotle and Meta earnings, I'm pleased to announce that both turned out to be profitable for us. Chipotle experienced a drop of over 200 handles, while Meta rallied more than 30 handles. Consequently, contracts on these trades will yield massive returns. Let's continue riding the trends as stocks keep showing their strength and the volatility picks up. It's incredible how well the trend followers are doing, and it's safe to say we're making serious profits.

Emini, Nasdaq, Gold, and Oil all followed suit and rallied as expected, staying in line with the current trend. As I've been emphasizing, it's essential to avoid counter-trending and exercise caution when feeling that a move is overdone. Stepping aside in such situations is the best course of action to avoid potential losses. We wouldn't want to be caught in the way of a powerful market movement.

In the recent Flow State, I discussed the possibility of some selling in the context of Oil rising and Gold giving us clues that something might be lurking. However, until we witness an actual impact on the economy, these signals should have little to no effect on the overall direction of the market. As of now, the indices are still situated within upper value areas and continue to push towards new value areas higher. This market isn't showing any signs of weakness.

Earnings

Events

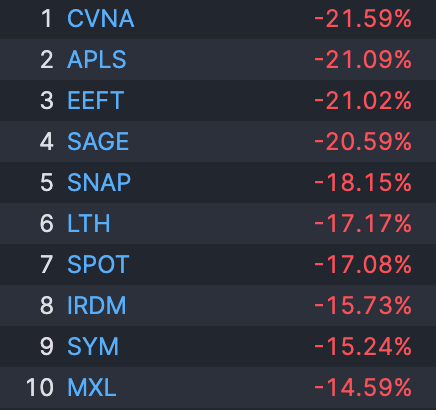

Scanner

Session Outlook

ES

Trend: UP - Focus on VAL Longs

Trend Pivot: 4400

Value Area: 4375-4495, 4527-4605