Welcome back everyone!

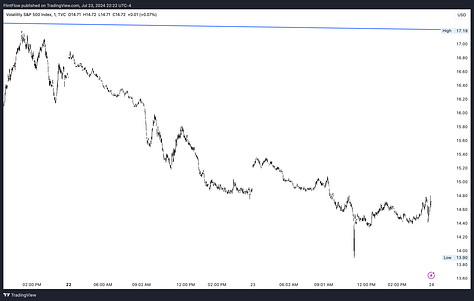

Today's session lacked clear direction, yet it worked in our favor. The E-mini saw upside three times directly off the long level, which remained the low of the session until 15 minutes before the close. Whether trading futures or option contracts, there were three distinct instances where the price rebounded from this level, providing opportunities to capitalize. Additionally, the VIX hit new lows, breaking below 15 for a 14% drop. If earnings continue to align to the upside, we could see the VIX drop to 13, as I anticipate.

Unfortunately, this wasn't the case for TSLA and GOOGL today, as both experienced drops after their earnings releases. Tesla's earnings were particularly disappointing, which I will cover in detail below the posted charts. For the cash session, AMZN and MSFT were the leaders, with the low coming directly off the long level. The tech sector is taking turns finding a bid, which is not ideal as it won't bring the sharp recovery we want to see for new highs.

Tomorrow's gap down will be crucial for bulls to hold; otherwise, I will flip my thesis to short. All of this will be covered in detail inside the chat.

Here are the charts:

Now, let's dive into TSLA's earnings, which fell short of my expectations for strong results—quite the opposite, in fact. Examining the numbers...