Welcome back everyone!

Lets dive into the recap for todays session then move on to tomorrows analysis.

Recap of chat:

Overall, there was not much new today, other than the Amazon contract being called out along with the end-of-session SPX calls.

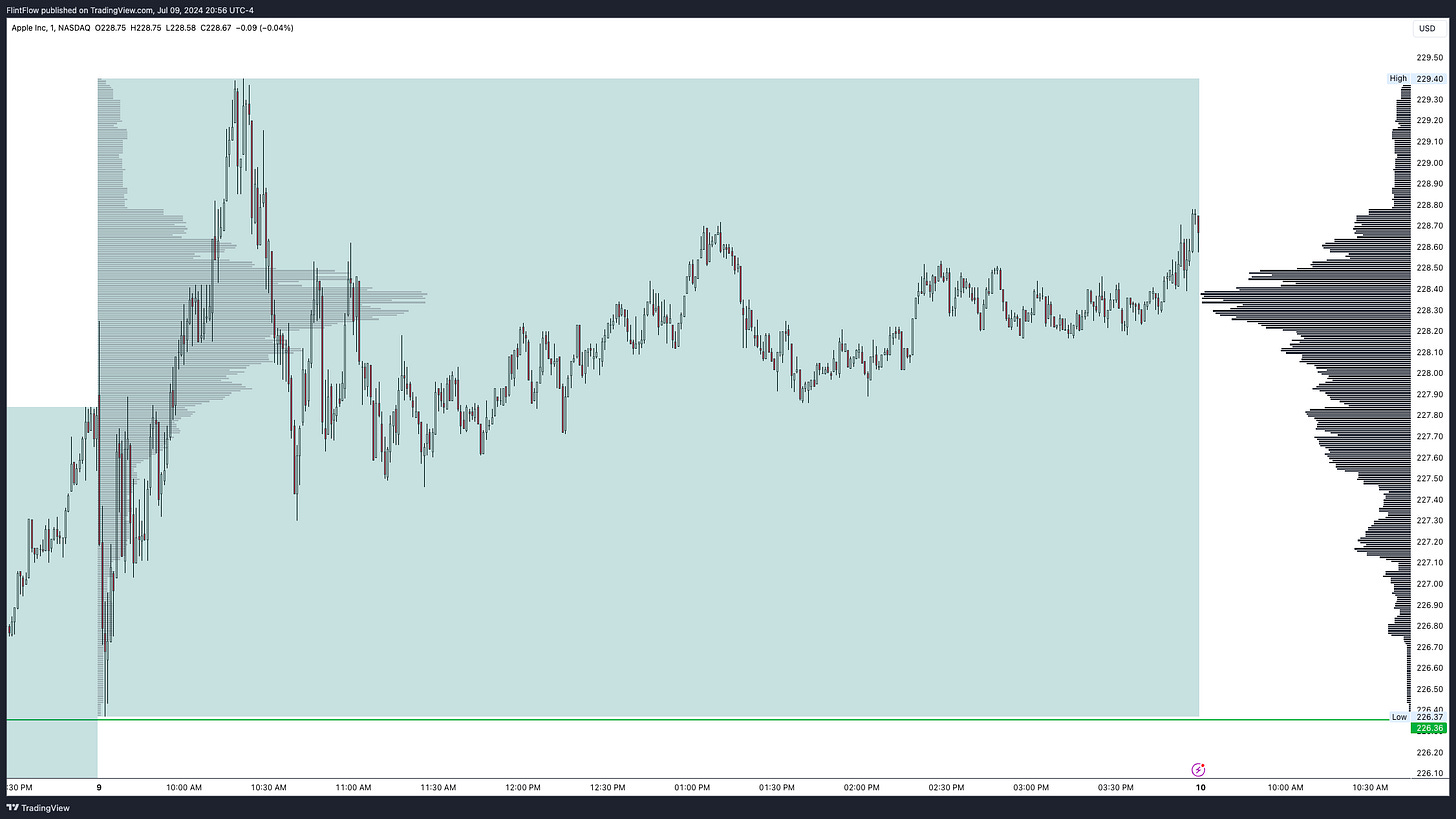

First, let's take a look at the AAPL and TSLA charts from the previous session's swings. Both of these contracts have already seen moves over 100% and are setting up for higher legs tomorrow. Not only have the swings worked out, but the intraday levels posted last night were nearly the session's lows for both. If you missed out on the contracts in the previous session, there was a clear opportunity to join in at the lows based on the long levels.

Expanding on this, the Amazon contract announcement indicates a potentially significant development that could impact the market. Monitoring this could provide insights into future market movements. Additionally, the impressive performance of AAPL and TSLA contracts underscores the importance of paying attention to intraday levels and market swings. These movements show strong momentum and the potential for continued upward trends.

Next, I want to cover Amazon, which has remained pinned at the 200 level after I called on Bezos to sell at this price. It has been crystal clear that this is where he is selling, as the volume buildup shows a major spike directly at 200. No other price in the vicinity has even relatively close volume. See the chart below:

Now let’s move on to my thoughts for tomorrows session!