Welcome back everyone!

First, we will cover the recap for today's session including CRWD and LULU earnings, along with the SPX Contracts provided in chat then move on to tomorrow's analysis.

Both stocks met my expectations with substantial rallies. The CRWD contracts, highlighted in the chat yesterday, opened above 9, achieving nearly a 100% rally. Initially, the stock sold off at the open, causing these contracts to drop to 1 before surging back up to 8 by the close. Despite the rocky movement, the strategy proved successful twice. The LULU contracts are expected to see a significant spike as long as the rally holds into tomorrow's cash session.

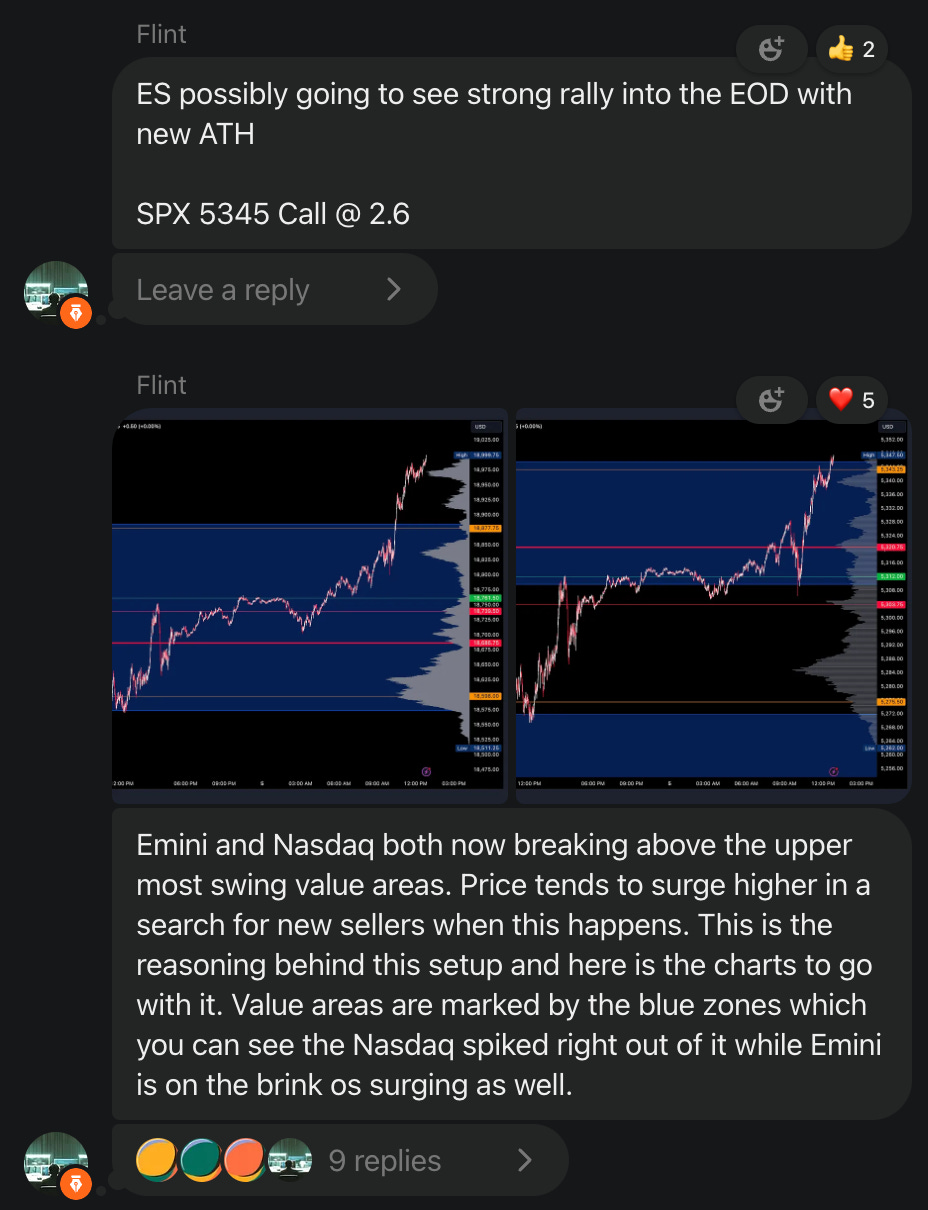

On the SPX side, I provided a crystal clear update in the chat, calling for a trend day as the Emini and Nasdaq broke above the swing value area highs. The contracts, which were recommended at 2.5, soared to 9.6, yielding nearly 300% returns. Here is the update sent out in the chat:

Now lets move on to the rest of the recap!

Indices:

The S&P 500 E-mini Futures had a robust session characterized by an initial dip followed by a significant rally. The price started the day by finding support at the long level of 5312.00, triggering a long trade. The upward momentum continued throughout the session, with the price moving higher and establishing a strong upward trend. The session demonstrated the effectiveness of the predefined levels, with price respecting these levels and providing clear trading signals.

The Nasdaq 100 E-mini Futures experienced a strong upward trend throughout the session. The price action started with a dip, finding solid support at the long level of 18761.50. This support triggered a long trade, and the subsequent rally was impressive, driving the price significantly higher. The session showcased consistent upward momentum, providing multiple opportunities for long trades based on the predefined levels.

Commodities:

Light Crude Oil Futures had a dynamic session characterized by substantial volatility. The price action initially fell below the short level of 73.49, triggering a short trade, but soon found support and reversed direction. The subsequent rally was significant, moving past the long level of 73.73. This upward movement continued for the rest of the session, highlighting the strength of the recovery.

Gold Futures experienced a highly volatile session with significant price action. The day began with a downward movement, but the price found support above the short level of 2365.9, avoiding a deeper decline. Following this, the market stabilized and then surged, breaking through the long level of 2354.3 and continuing to rally strongly. The upward momentum was robust, marking a significant recovery from the earlier lows.

Stocks:

Apple experienced a session with notable volatility and several intraday swings. The market began with a moderate move upwards, hitting the long level at 195.11. Throughout the session, the price exhibited multiple peaks and troughs, reflecting a lack of clear directional bias but offering numerous short-term trading opportunities. Despite the fluctuations, the price action stayed relatively balanced around the predefined levels, indicating a session where traders could benefit from intraday strategies to navigate the ups and downs effectively.

Nvidia had a strong session marked by consistent upward momentum. The price action started the day steadily and maintained a clear bullish trend, with the price moving higher throughout the session. The long level at 1158.71 provided solid support, from which the price continued to rally. The market demonstrated sustained strength, offering ample opportunities for traders to capitalize on the long side.

Amazon had a session marked by significant upward momentum and multiple intraday swings. The trading day began with a dip, but the price quickly found support at the long level of 178.87. This support triggered a robust rally, with the price climbing steadily throughout the session. Despite some fluctuations, the overall trend remained bullish, providing ample opportunities to capitalize on the upward movement.

Microsoft experienced a session of strong upward momentum with notable gains. The trading day started with a gradual increase in price, and the market maintained a clear bullish trend throughout the session. The long level at 416.34 provided a key support, from which the price rallied significantly, reaching a session high of 424.07.

Make sure to show some love by dropping a like if you enjoy reading this post!

![4K Mountains and Lake. [3840x2160] : r/wallpapers 4K Mountains and Lake. [3840x2160] : r/wallpapers](https://substackcdn.com/image/fetch/$s_!gXgJ!,w_1456,c_limit,f_auto,q_auto:good,fl_progressive:steep/https%3A%2F%2Fsubstack-post-media.s3.amazonaws.com%2Fpublic%2Fimages%2Ff5d3bf52-1e25-4585-8089-89e7629a0a51_3840x2160.jpeg)