Daily Plan 6/6/23

Good morning traders!

Hope everyone had a great session yesterday and were able to come out on top. There was many setups with most coming right at the open once again. Apple hit ATH which was called by me last month but was not able to hold above bringing heavy sell into the close. Lululemon continues sell post earnings breaking below short level once again after selling all the way down to 324 target. Amazon, Google, Microsoft all had strong rallies which were 3 of the main stocks on watch yesterday. Zero time in this market to be second guessing entry. Before jumping into todays thoughts let’s touch on yesterdays levels.

Previous Day Recap

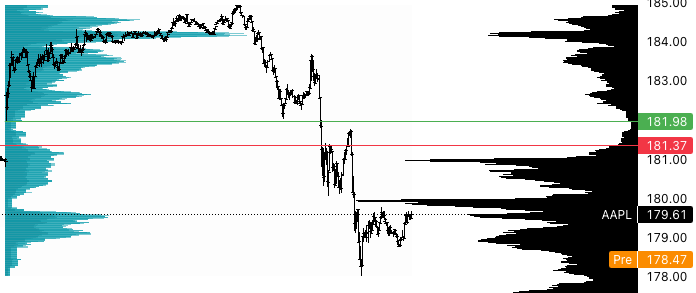

AAPL

[182.5 Calls 2.4 > 4.4]

[182.5 Puts 3 > 5.1]

TSLA

[217.5 Calls 5.7 > 8.15]

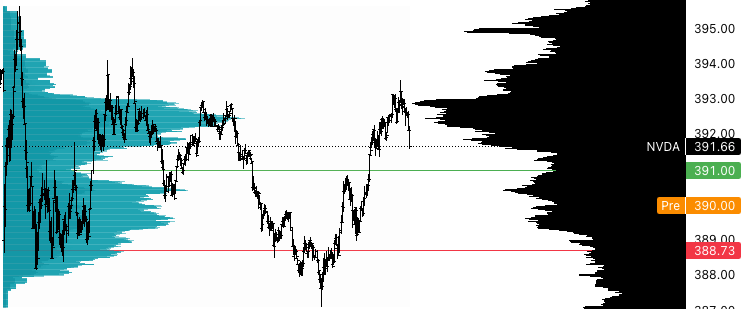

NVDA

[390 Calls 8.5 > 11.65]

Puts had no continuation.

MSFT

[335 Calls 3.22 > 5.5]

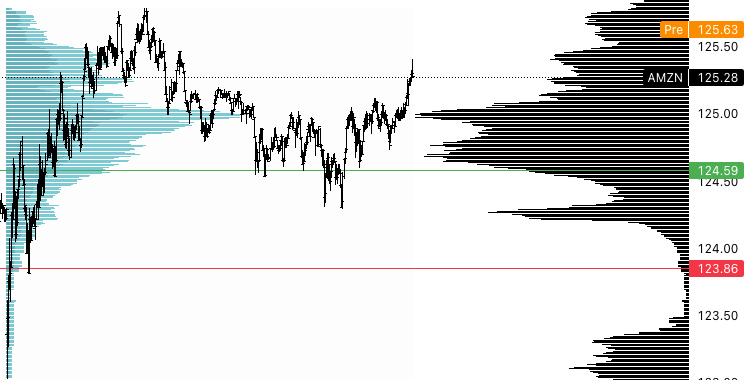

AMZN

[124 Calls 2.1 > 2.85]

Gap below short level with reclaim to break long level.

AMD

[117 Calls 2.8 > 3.8]

Gap below short level with reclaim to break long level.

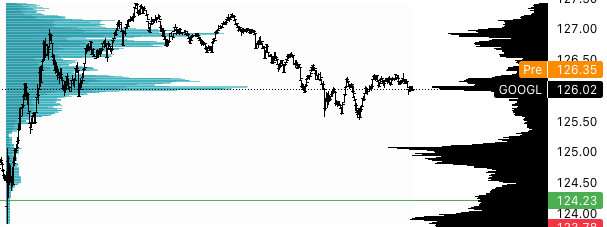

GOOGL

[124 Calls 1.54 > 3.95]

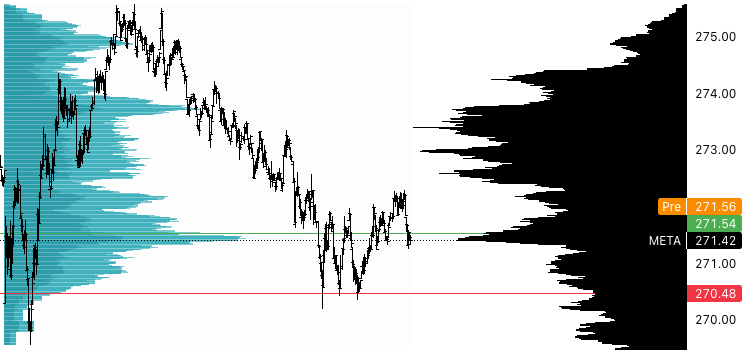

META

[270 Calls 5 > 7.55]

EoD Telegram Updates

Price never broke out of 4273-4284 as expected EoD but there was still opportunity to capitalize on the chop.

First contract ran over 100% but lows were bought to cut off further returns. This was the case for the other two which never got outside of the two levels provided above. They produced 40-60% runs but price never ventured to my targets so these were taken off for losses giving back most of the first contract.

Last two were combined into the bottom image.

If sticking with just SPX yesterday it may have been a tough session if you missed the rally in the morning. Although stocks were very robust many will be focused solely on SPX which I do not think is reasonable at all. I would start getting into swing positions on top of intraday then take much less size on the intraday trades. Even if these swings were on SPX but in this case you must not let a current position give any bias to your intraday positions.

Moving on to todays S&P500 thoughts…