Welcome back everyone!

First, we will cover the recap for today's session including CRWD earnings, then move on to tomorrow's analysis.

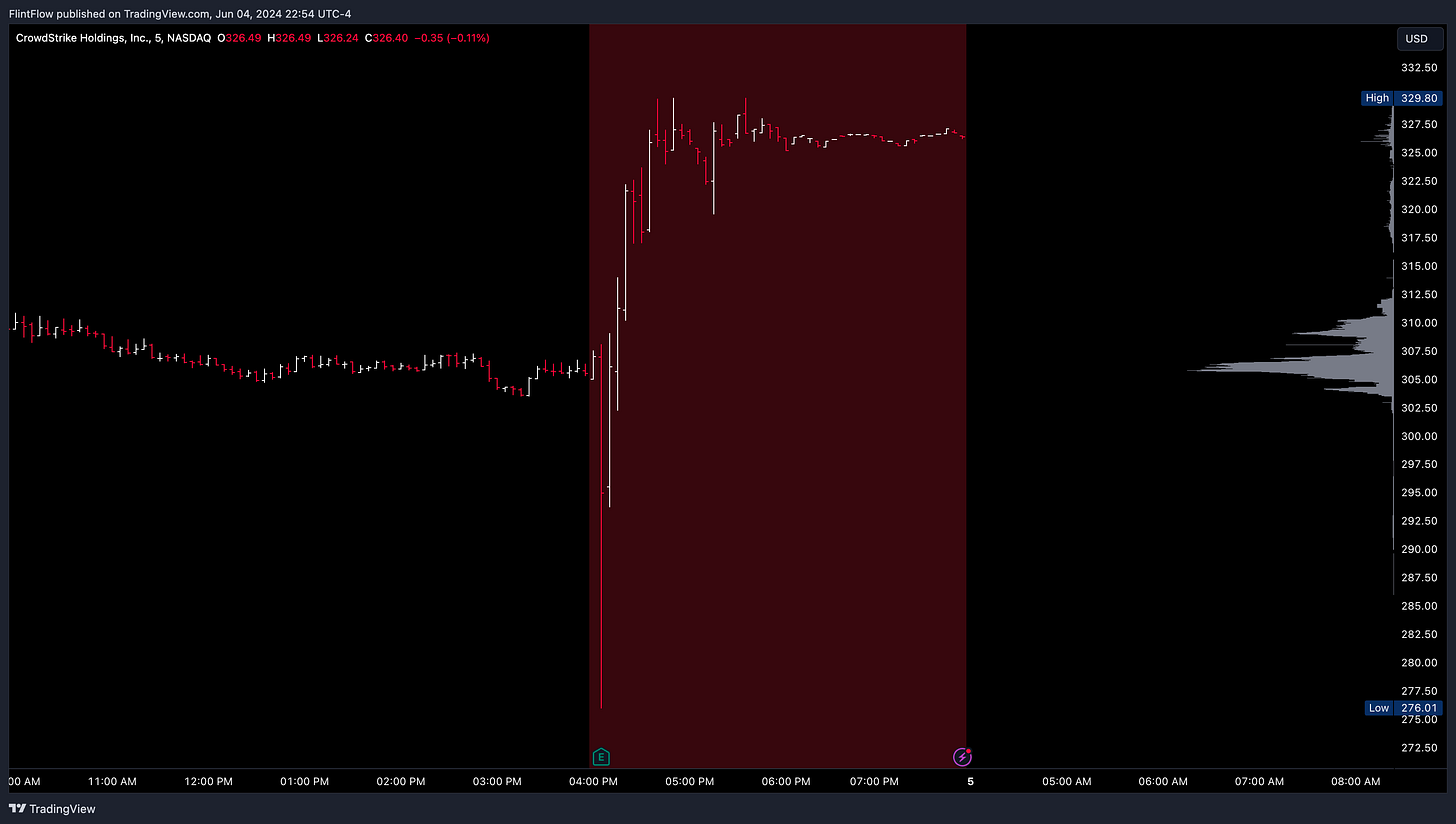

Here were my expectations for CRWD earnings:

CRWD: Bullish - Target 361

Then I sent out an update in chat covering contracts that can be utilized for such a spike:

As you can see by the chart below price is moving up but short of my target, being conservative the 340 contracts should do well at tomorrows open.

Indices:

The S&P 500 E-mini Futures had an active session marked by a significant sell-off followed by a strong recovery. Early in the session, the price reached the short level at 5303.75, triggering a short trade. The subsequent decline was substantial, falling short of the target. Following the sell-off, the price found support and started to recover, eventually reaching the long level at 5312.00, triggering a long trade. However, the recovery rally fell short of reaching the long target. The session demonstrated the effectiveness of the predefined levels, with price respecting these levels and providing clear trading signals. The significant moves were well within the expected levels, allowing traders to capitalize on both the short and long opportunities.

The Nasdaq 100 E-mini Futures experienced a volatile session, initially marked by a strong sell-off that found support at the short level of 18606.50, triggering a short trade. The price then began to recover, moving significantly higher and surpassing the long level of 18640.25, which activated a long trade. The upward momentum continued, but the rally fell short of reaching the long target. This session highlighted the dynamic movement within the market, where predefined levels offered clear trading opportunities. The short level provided a crucial support, and the subsequent recovery allowed for strategic long trades, though the ultimate target was not reached.

Commodities:

Light Crude Oil Futures experienced a volatile session characterized by early selling pressure, which led to a significant decline. The price action initially triggered a short trade at the short level of 73.84. However, the price movement fell short of reaching the short target. Throughout the session, the market showed some recovery attempts, but these were relatively limited, as the price continued to oscillate within the established levels without achieving a strong directional trend.

Gold Futures experienced a dynamic session, starting with a pronounced sell-off that triggered a short trade at the short level of 2365.9. The decline was significant, but the price movement fell short of reaching the short target. Following this, the market found support and began to recover, eventually moving higher but without enough momentum to approach the long level.

Stocks:

Apple had a session marked by considerable volatility, with the price showing multiple swings throughout the trading day. The market opened with a decline, finding support and gradually moving higher, hitting the long level at 193.20. Despite the fluctuations, the price action demonstrated significant intraday movement, offering opportunities for short-term trades without clear directional bias. This reflects a market where intraday strategies might have been more effective, given the absence of strong directional momentum.

Amazon had a session characterized by significant volatility and notable price swings. The trading day began with a decline, which found support at the long level of 177.12. Following this support, the price rallied, demonstrating intraday strength and reaching higher levels before consolidating.

Microsoft experienced a session with clear upward momentum, characterized by multiple intraday swings. The trading day began with steady movements, eventually finding support at the short level of 413.53 before reversing direction. The price action then rallied significantly, reaching and surpassing the long level at 414.61.

Make sure to show some love by dropping a like if you enjoy reading this post!