Good morning traders!

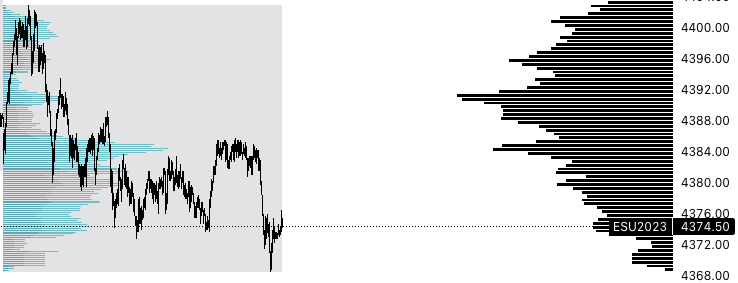

Yesterday's session proved to be highly informative, as the newsletter provided yet another day of clear guidance. The Emini market, however, experienced minimal buying interest throughout the session. While there was a slight upward movement towards the 4402 level, it lacked follow-through, ultimately resulting in a break below the 4394 short level. As a consequence, the Emini market continued its downward trajectory and concluded the session at 4370. Although the overall direction was accurately predicted, the downside movement remained relatively limited on that particular day.

Emini Intraday - ES

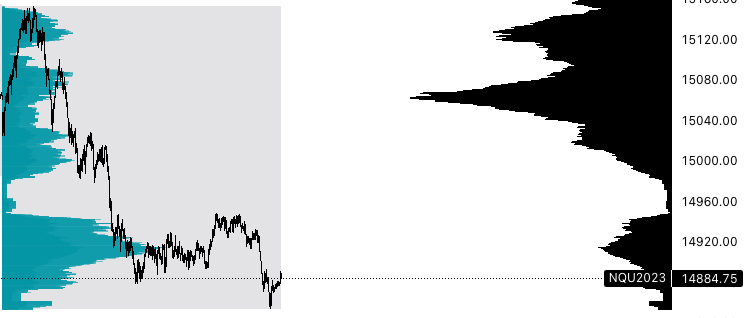

Shifting our focus to the Nasdaq, we witnessed another remarkable performance. Despite the absence of any upward movement above the short level, the price swiftly turned downwards once it fell below 15114. This led to a significant sell-off, with the index plummeting approximately 260 points to the 14850s. Both indices are currently exhibiting a short-term bearish trend, with new lows being established in comparison to the previous week. It is worth noting that we are approaching a crucial Low Volume Node (LVN) level, which, if breached, could trigger a substantial wave of selling. To obtain the precise LVN levels for both the Emini and Nasdaq, please refer to the details below.

Nasdaq Intraday - NQ

Moving to the stock section of the newsletter, it is evident that Meta, Nvidia, Advanced Micro Devices, and Tesla displayed considerable weakness yesterday. While some stocks managed to hold above key levels supporting the uptrend, it would be premature to assume that the rally has come to an end. Once the majority of these stocks drop below their respective key levels, it will provide a higher degree of confidence that a significant downward movement in the indices is imminent.

In times of heightened volatility, it is essential to utilize the Value Areas as key reference points. Specifically, on the Nasdaq, the Value Area Low (VAL) stands at 14741. Therefore, should yesterday's lows be breached, it would be prudent to consider selling towards the VAL level, as it could serve as a significant support level.

Previous Day Recap

AAPL [187.5 Calls 1.3 > 1.99]

TSLA [247.5 Puts 5.5 > 10.03]

NVDA [420 Puts 7.8 > 21]

MSFT [332.5 Calls 3.9 > 5.5]

AMZN [129 Calls 2.23 > 3.5]

AMD [113 Puts 2.61 > 6.15]

GOOGL [120 Puts 1.45 > 2.4]

META [287.5 Calls 4.5 > 10.8]

Subscriber requested:

UNG [475 Calls 4.3 > 7.8]