Welcome back everyone!

Lets dive into the recap for todays session then move on to tomorrows analysis.

First off, Carnival beat earnings but missed my expectations, so the contracts expired worthless. On the other hand, FedEx posted a robust report, boosting the stock price well above my earnings target, which was posted in the newsletter for the last two days. The 270 strike calls closed the session at 4 and will open up above 27 for over 600%. Here is what was posted for the last two days:

On the levels basis, the Nasdaq was far superior to the Emini, as its price respected the levels while also showing stronger direction. This aligns with the semiconductors bouncing back in today's session, specifically NVDA. Here is a chart showing the long level (19828) with the long target (19970), which was the high of the session, posting a net gain of +142 handles.

Now we can take a look at NVDA, which had a picture-perfect session. This was not only due to the levels posted last night but also the contracts called out last week at Friday's low. Contracts were called out in the chat at 2.1, which saw a move all the way up to 4.85, representing a gain of over 100%. Here is the chart, including the intraday levels, showcasing the move that boosted contract prices.

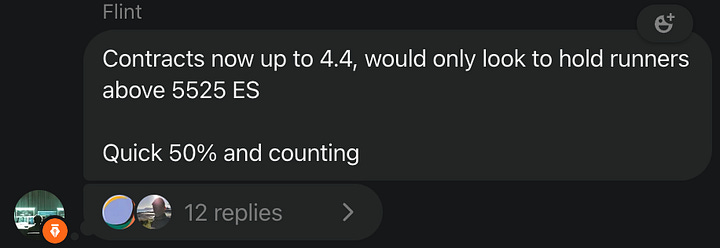

Turning to the SPX contracts called out in the chat, which brought in a net gain of 300%. At the session's lows, I expected a rebound back near the highs. Soon after, the price broke above the ES long level for a move through the high of the day. The calls provided at 3 moved all the way up to 13, representing a gain of over 300%. Here are all the updates sent out in the chat regarding SPX:

This is what was covered in the chat today. Now, let's move on to my analysis for tomorrow, which is exclusive to subscribers.