Welcome back everyone!

Today was a phenomenal session with the indices and SPX firing off with volatility. I will cover the indices in the below section and leave this part solely for the SPX trade called out in chat today.

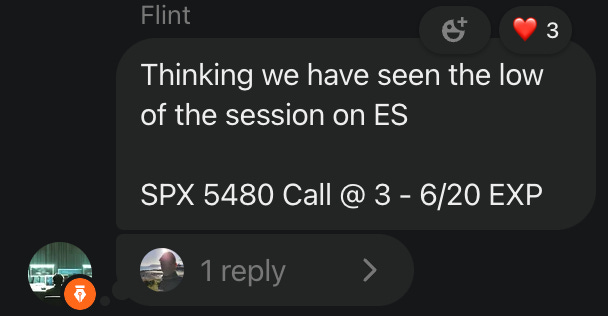

As soon as the Emini sold down to the short target which I expected to see a strong rebound up to 5560 which was the short level. Once price began to bounce my focus was on SPX calls that would be not far OTM contracts to see go ITM on a spike to the upside. This is exactly what happened which brought over 200% on the contracts. I called them out at 3 and then hit a high above 9!

Indices:

E-mini traded between the long level at 5,564.50 and the short level at 5,559.50. Price was not able to continue above the long level, offering little to no upside. Price then traded down through the short level, continued its decline, and successfully hit the short target at 5,532.00.

Nasdaq traded between the long level at 20,256.00 and the short level at 20,235.00. Price was not able to continue above the long level, offering little to no upside. Price then traded down through the short level, continued its decline, and successfully hit the short target at 20,081.00.

Commodities:

Oil saw lower volatility today with only a small bounce from the long level. Overall opportunity was limited for the session while relatively having the longs at the low.

Gold rallied sharply overnight bringing a massive spike up through the long target. In the coming weeks we are due for a move right back up to ATH for a huge rally.

Stocks:

Apple sold sharply below the short level and even exceeded my intraday expectations of downside. I think this will see a strong bounce in tomorrows sessin pulling price right back in this weeks balance.

Nvidia saw some upside from the long level before collapsing below and breaking the short level. On both sides there was plenty of opportunity with upside remaining quite limited jsut because the gap up into the open.

Tesla sold down right from the short level offering over 6 handles of downside. This brought a strong move for put contracts on this week expiration.

Amazon saw strong bid today with a monster rally from the long level. Price broke above the long level at the open fueling a strong spike before selling back down to the long level. Price once again sprung up setting a new high on the session bringing in a net 3 handles of upside.

Now let’s move on to my thoughts for tomorrows session!