Good morning traders!

Stunning session yesterday as we navigated prices before and after FOMC.

First, NQ rallied +114 handles from long level to 15000 target. Then once FOMC was underway the indices began to sell offering a solid opportunity to take a scalp short which produced another 80 handles!

Once indices struggled to move lower then i was waiting for opportunity to long for a reclaim of the FOMC highs. There were a few pointers to a rally coming while we were at lows. Here is one of them:

Nasdaq rallied +190 handles into the close and Emini rallied +35 handles while both recovered the entire FOMC sell.

Nasdaq alone provided +384 handles in one session!

Plenty more winners yesterday which will be included in the recap but i want to point out how strong Nvidia was yesterday above long level. Stock moved 28 handles above level to 433 after blasting through 420 weekly target. Contracts spiked from 7.3 > 25.73.

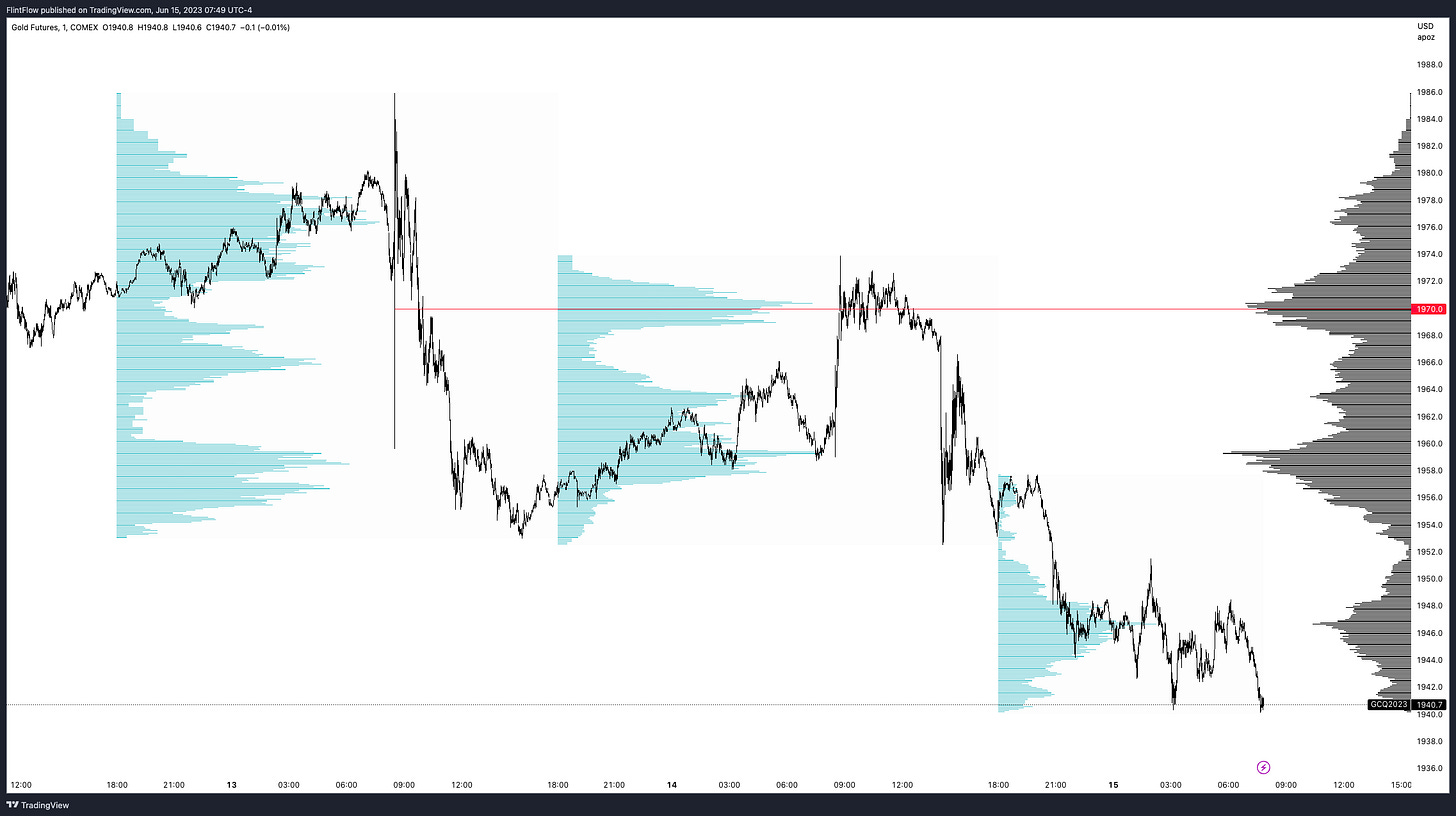

Another name will be Gold, tremendous sell below 1970 orderflow support which I called for a 40 handle sell. Gold is trading at 1940 at the time of this post, down 30 handles. One lot in Gold is up $3,000!

Previous Day Recap

AAPL

[182.5 Calls 1.57 > 2.35]

TSLA

[260 Puts 4.85 > 11.45]

NVDA

[405 Calls 7.3 > 25.73]

MSFT

[332.5 Calls 3.39 > 6.3]

AMZN

[127 Puts 1.81 > 2.84]

AMD

[126 Puts 1.44 > 2.61]

GOOGL

[123 Puts 1.04 > 2.2]

META

[270 Calls 4.11 > 6.62]