Welcome back everyone!

First, we will cover the recap for today's session then move on to tomorrow's analysis.

On the earnings horizon, AVGO opened with the 1550 calls surging to 16.5k, which could have been bought at the previous close for 2.7k. Although premiums were high, making the initial cost substantial, each contract ultimately brought in a net gain of $13,800. Here is what was posted earlier in the week:

Conversely, ADBE was a miss as I expected selling, causing the call contracts to expire worthless.

During the cash session, I called out TSLA puts, aligning with my expectations regarding the shareholder vote, which was approved today. I anticipated that the price would spike following the vote and then drop at the open. Shortly after the open, I recommended put contracts at 2.2, which rallied above 4 in today's session and are poised for another rise in premiums in tomorrow's session.

Now lets move on to the rest of the recap!

Indices:

E-mini session displayed a notable move where the price respected the predefined levels. Initially, the price broke above the long level of 5,423, continuing its upward trajectory but falling short of the target.

Nasdaq session saw the price breaking above the long level of 19,561. The price then rallied, moving significantly upward, but fell short of reaching the target.

Commodities:

Oil session saw a strong sell below the short level. Price closed the session at the lows but fell short of reaching the short target.

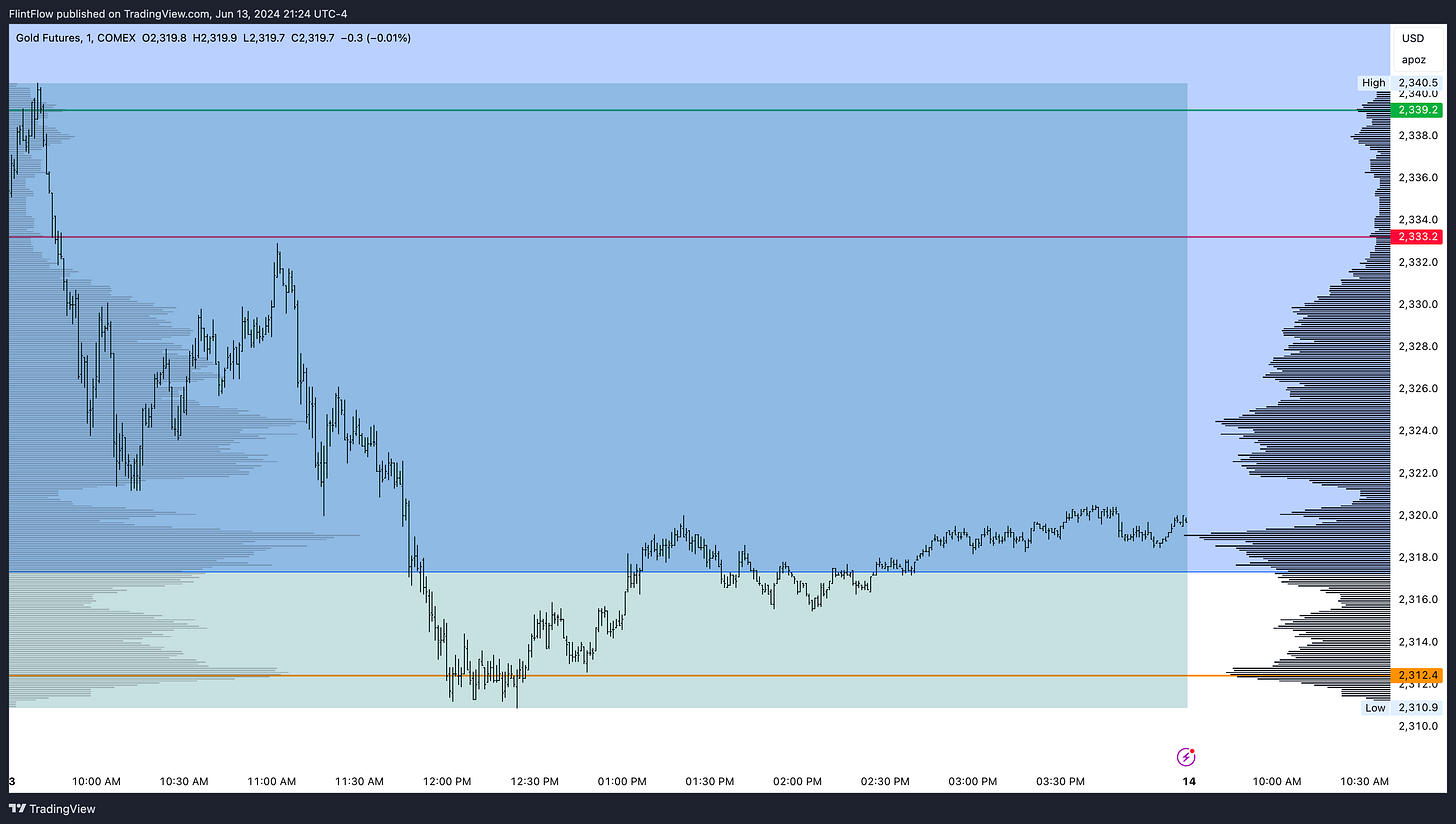

Gold session saw the price breaking above the long level of 2,339.2 but falling short of reaching the long target before selling back down to the long level. Subsequently, the price bounced nearly all the way back up to the long target, demonstrating significant respect for the predefined levels. This setup highlighted the effectiveness of these levels in providing clear signals for setups.

Stocks:

Apple session demonstrated price breaking above the long level of 213.64 offering strong upside at the open. Price then sold back down breaking below the long level and short level but saw no extension which was in line with the bounce back on the indices.

Amazon price broke below the short level of 186.15 and continuing downward for the entire session. This was a significant sell dropping nearly 3 handles to the low of the day.

Nvidia displayed a clear rally, holding above the long level of 126.55 and continuing its ascent. Price never sold down to the long level in the session with a close at the highs.

Tesla initially moved downward, moving in line with my shareholder thesis covered earlier in the week in chat. While price was above the long level on a volume profile stance, my expectations at the open for a sell came out on top.

Make sure to show some love by dropping a like if you enjoy reading this post!