Welcome back everyone!

First, we will cover the recap for today's session then move on to tomorrow's analysis.

Here is what was covered inside chat today:

TSLA

Selling continued from the previous session, leading to a significant sell-off this morning. Contracts have rallied up to 7.8 after being recommended in the chat yesterday at 2.5. See below for details:

NVDA

Today marked a robust session of selling below the short level outlined in last night's newsletter. I also provided an update in the chat with corresponding contracts, offering nearly a 100% return intraday. See below for details:

ORCL

Oracle reported earnings after the close, resulting in a massive spike up to my earnings target. Before the close, I recommended Call contracts in the chat to align with the bullish target posted last night. See below for details:

Now lets move on to the rest of the recap!

Indices:

The E-mini displayed the effectiveness of the predefined levels, with the price respecting these levels and providing clear setup signals. The price reached the long level at 5352, triggering a long setup offering 34 handles of upside.

The Nasdaq showcased a clear response to the predefined levels. The price respected the long level at 19032.75, triggering a long setup and moving significantly reaching the target for 143 handles and more.

Commodities:

Oil saw the price move in alignment with the predefined levels. The price interacted with the long level at 77.55, triggering a long setup that demonstrated a strong upward movement that fizzled out later in the session.

Gold session showcased significant price movements respecting the predefined levels. The price interacted with the long level at 2,324.8, triggering a long setup. Overall price fell short of the long target but did offer 23 handles of upside.

Stocks:

Nvidia illustrated the adherence to the predefined levels, presenting setup opportunities. The price approached the long level at 122.50 but did not sustain the upward momentum. Conversely, the price sold below the short level at 121.28 triggering a short setup which was called out inside chat nearly bringing 100% to intraday contracts.

Apple showed significant movement with a notable rise in price. The price moved upwards towards the long level at 192.96, triggering a long setup, and continued to climb, exceeding the swing VAH. A major rally once broken bringing in a net 15 handles of upside.

Tesla exhibited a significant selling, falling below the short level at 174.04 and triggering a short setup. This offered a tremendous intraday short along with bringing the contracts called out yesterday a major percent gain.

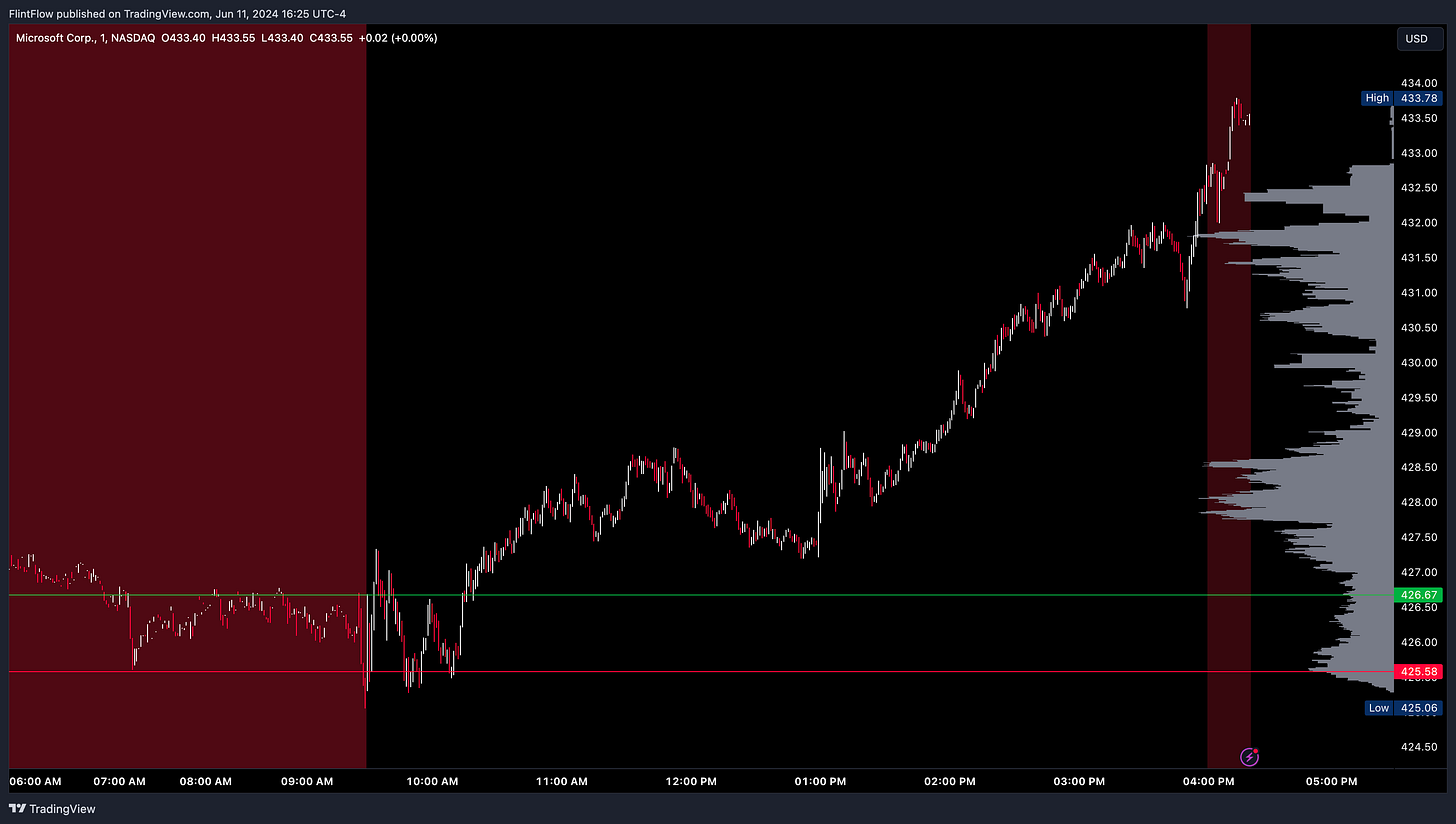

Microsoft demonstrated a robust upward movement after initially dropping below the short level of 425.58, which triggered a short setup. However, the price quickly recovered, breaking above the long level of 426.67, and continued to climb 6 handles into the close.

Amazon session saw the price initially falling below the short level of 186.15, triggering a short setup that extended into a sharp decline.

Make sure to show some love by dropping a like if you enjoy reading this post!