Welcome back everyone!

First, we will cover the recap for today's session then move on to tomorrow's analysis.

Here is what was covered inside chat today:

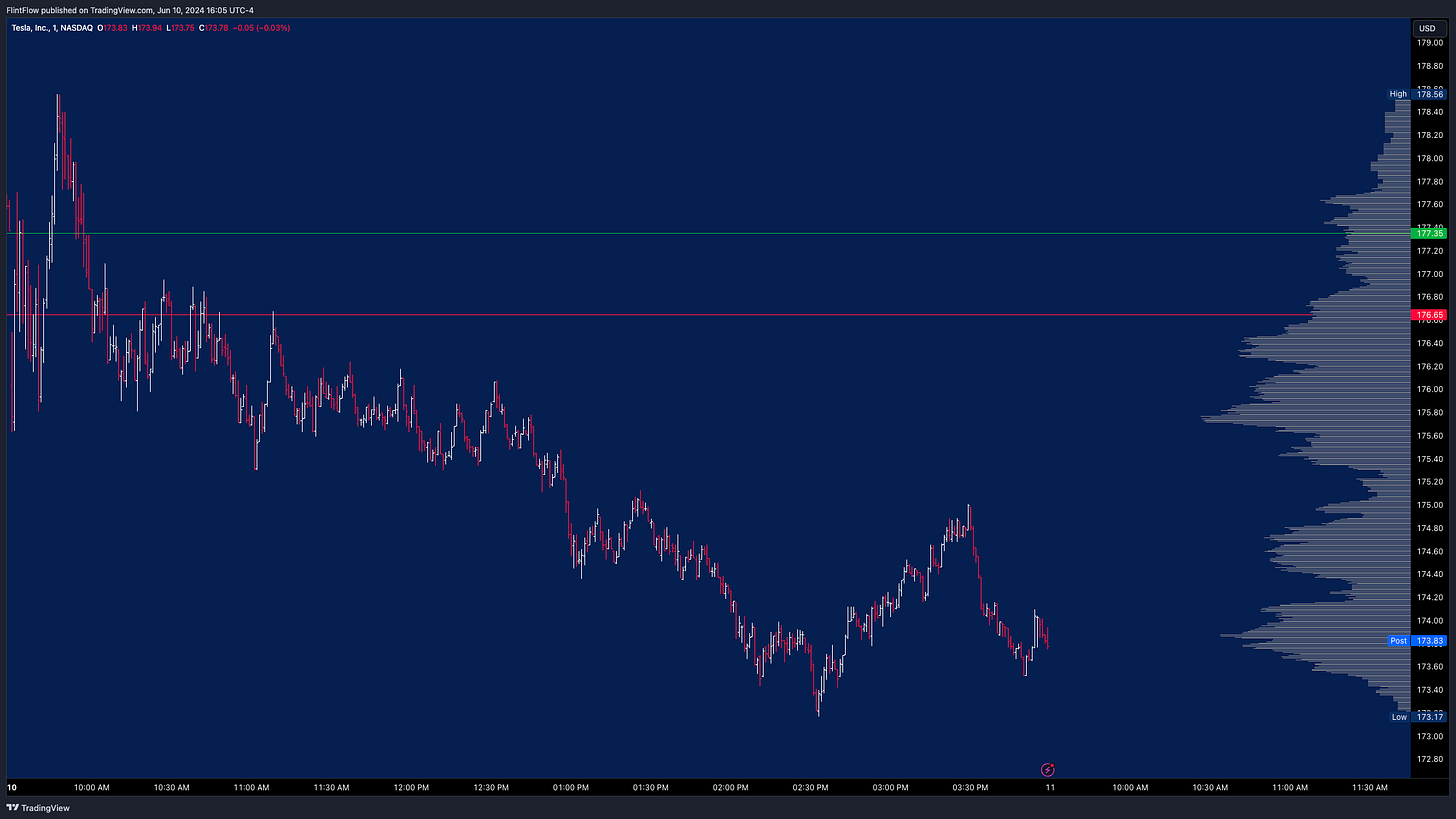

TSLA

Puts were called at the HOD this morning offering nearly 100% on intraday Put contracts.

SPX

As soon as i sent this out, price spiked upward bringing the contracts priced at 1.2 all the way up to 4.8 in two minutes. Instant 300% gain posted on these Calls.

Now lets move on to the rest of the recap!

Indices:

The S&P 500 E-mini Futures had a session marked by significant volatility and notable upward momentum. The price initially fell below the short level of 5342.00, triggering a short setup. However, the market found support and reversed direction, rallying strongly to surpass the long level of 5362 and triggering a long setup. The upward movement continued, and the price fell just short of hitting the long target of 5378.25.

The Nasdaq 100 E-mini Futures experienced a session with significant volatility and notable intraday swings. The price initially fell below the short level of 18979.25, triggering a short setup. However, the decline found support and the market reversed direction, rallying to surpass the long level of 19005.50 and triggering a long setup. The upward movement continued, reaching higher levels achieving the long target.

Commodities:

Light Crude Oil Futures had a session marked by strong upward momentum and clear trading setups. The price initially found support at the long level of 75.40, triggering a long setup. From this support, the market rallied significantly, surpassing the long target of 76.72 and continuing to climb. The session showcased the market's responsiveness to predefined levels, offering a well-defined long setup that resulted in substantial gains.

Gold Futures experienced a session marked by significant fluctuations. The price found support at the long level of 2320.00, triggering a long setup. However, the upward movement fell short of reaching any predefined targets, highlighting the session's range-bound nature.

Stocks:

Apple experienced a volatile session with significant movements around the predefined levels. The price initially hit the long level at 196.00, triggering a long setup, but it fell short of reaching any higher targets. Later, the price action reversed, testing the short level at 196.20 and demonstrating a robust move downward. Although the price showed some recovery, it ultimately remained far below the short level.

Amazon saw a productive session, with the price respecting the predefined levels. The price hit the long level at 184.19, triggering a long setup offering 3 handles of upside.

Microsoft saw a session where the price moved upwards after hitting the long level at 422.80, triggering a long setup. Price continued to new highs for the entire session bringing in a net 5 handles of upside.

Tesla experienced a session where the price hit the long level at 177.38, triggering a long setup. The price initially respected this level but ultimately moved downwards, indicating a setup opportunity. At the highs i felt that we could see some selling step in intraday which brought a crystal clear short setup all the way into the close.

Make sure to show some love by dropping a like if you enjoy reading this post!