Welcome back everyone!

First, we will cover the recap for today's session, then move on to tomorrow's analysis.

Indices:

The Emini and Nasdaq started off the morning with a sell below the short levels, nearly reaching the short targets. Although the target was not met, this was an excellent call, as we captured nearly all the downside. Later in the session, I was looking for a sell from 5215, which came after the close and, unfortunately, did not allow the end-of-day contracts to be effective. Besides the contracts not working, there seems to be a trend where futures move to my targets early in the session and then set up another opportunity later in the session for 0DTE to surge.

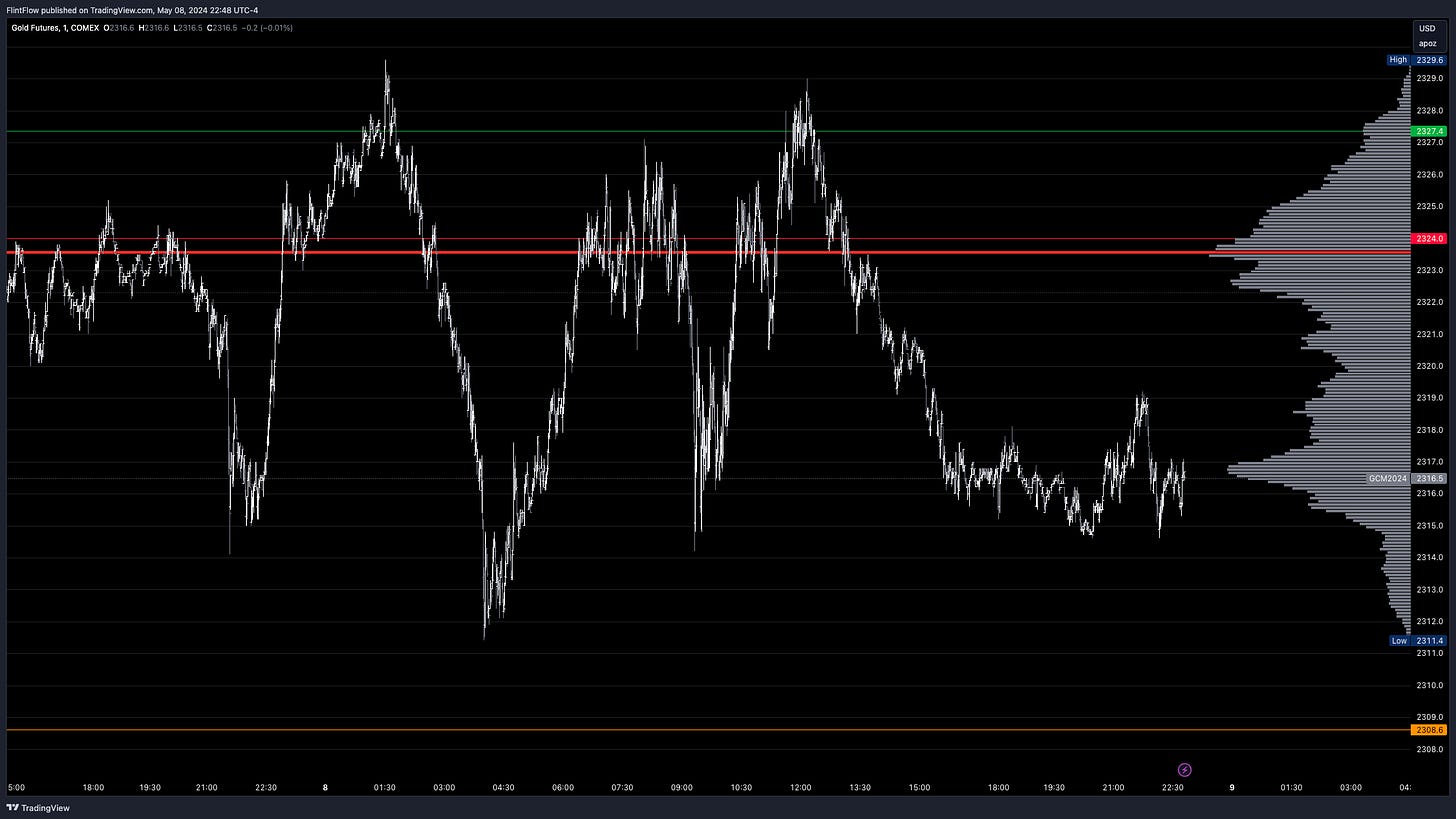

Commodities:

Oil experienced a sell from the short level once again, setting the low at the short target. The price then reversed, climbing all the way back up to later breach the long level. This marked a significant shift from sellers controlling the market below the swing VAH to then breaking above for a potential rally going into tomorrow's session.

Gold, on the other hand, saw sellers emerge below the short level but fell just short of reaching the target. The session brought four selling opportunities, each offering a minimum of 9 handles.

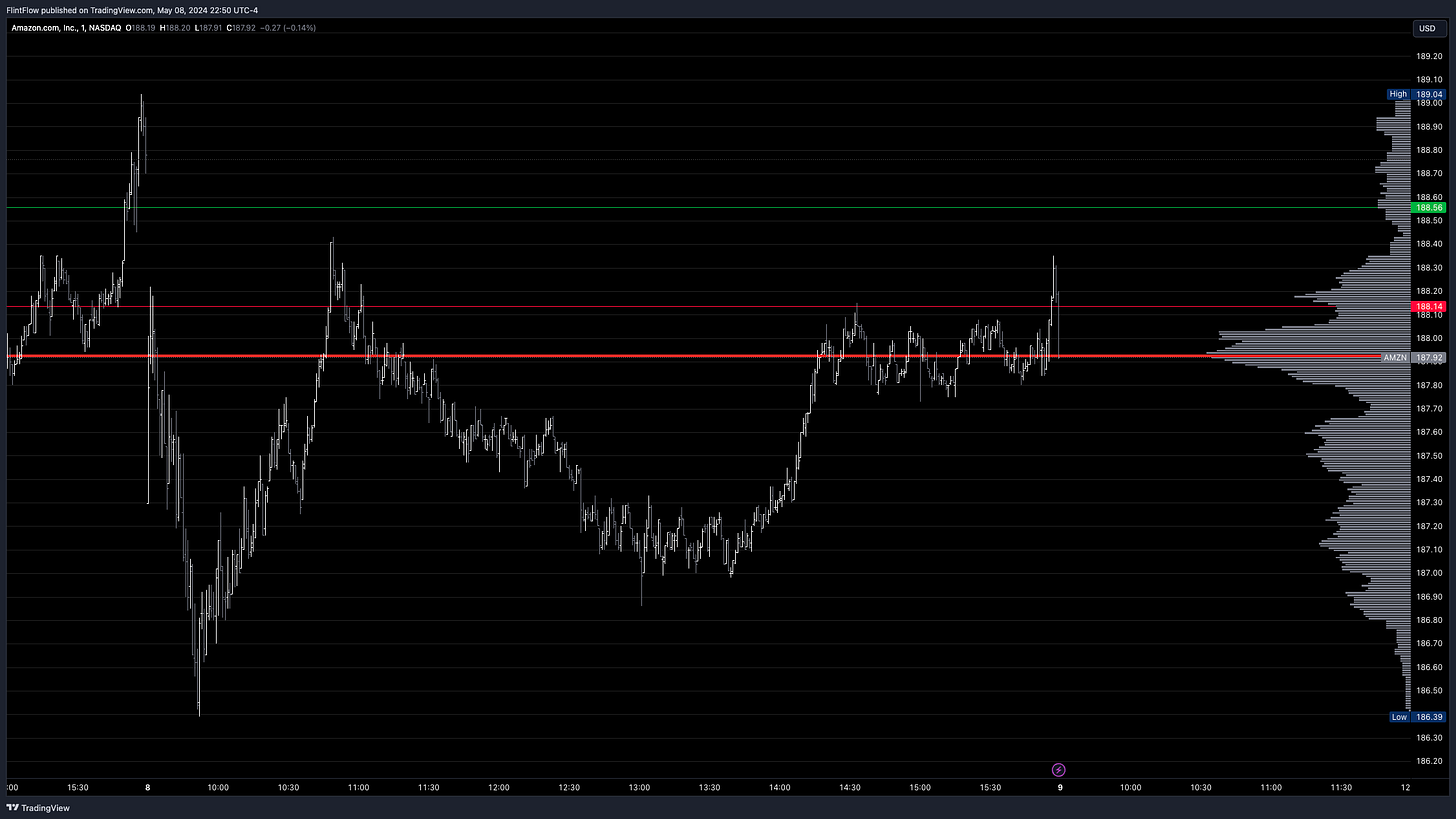

Stocks:

There was a mix of strong selling and strong buying in the stocks' intraday levels posted last night. GOOGL, TSLA, and AMZN all experienced selling below the short levels. TSLA and GOOGL both saw gap downs that set the session's low, leading to a strong rally into the close.

META was the standout stock of the session, maintaining strength even after a gap down at the open. As soon as the price broke above the long level, there was a significant surge, propelling prices 8 handles higher in a sharp spike.

Make sure to show some love by dropping a like if you enjoy reading this post!