Welcome back everyone!

First, we will cover the recap for today's session, then move on to tomorrow's analysis.

Indices:

Once again, the indices exhibited a directional move above the critical long levels, which served as key intraday support for both the Emini and the Nasdaq. Neither index managed to reach the long targets, but they both posted significant gains for the session. Another opportunity arose toward the end of the session, where I anticipated buyers would enter the market at the lows, just above the long level. The price bounced sharply from this point, rising into the close. It was at this juncture that I recommended SPX calls at 1.95, which subsequently saw their premiums rise above 4.5.

Commodities:

Oil experienced a significant decline from the short level, but it did not reach the target price. The short level continued to act as strong resistance throughout most of the session.

Gold encountered sellers stepping in precisely at the short level, which marked the day's high before the price sold down directly to the short target, setting the low for the day.

Stocks:

To kick this off, I want to first cover Disney, which, after posting its earnings, experienced a strong sell-off right down to the earnings release (ER) target.

ANET also saw a strong move after its ER report, nearly reaching my target of 301.21.

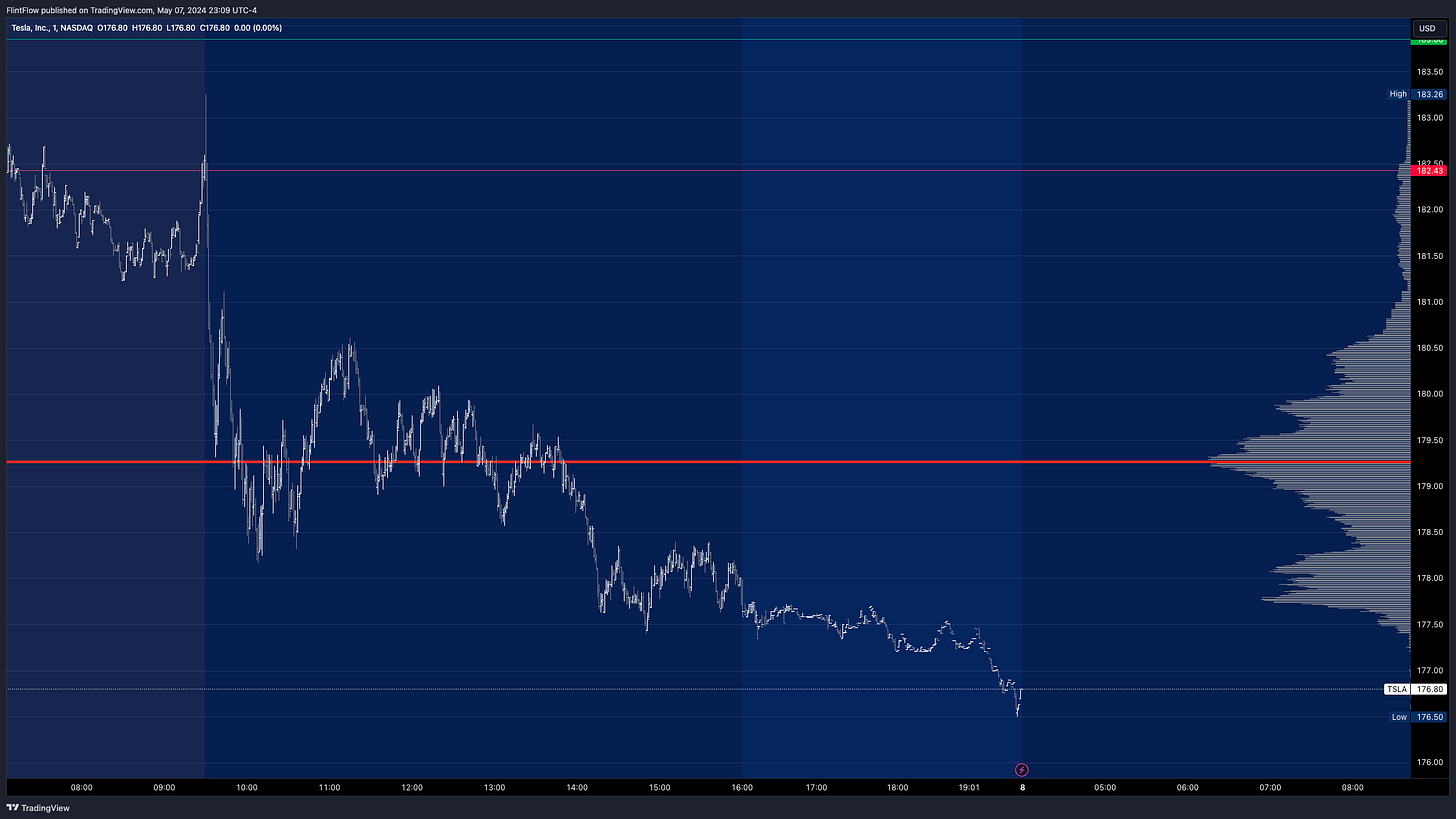

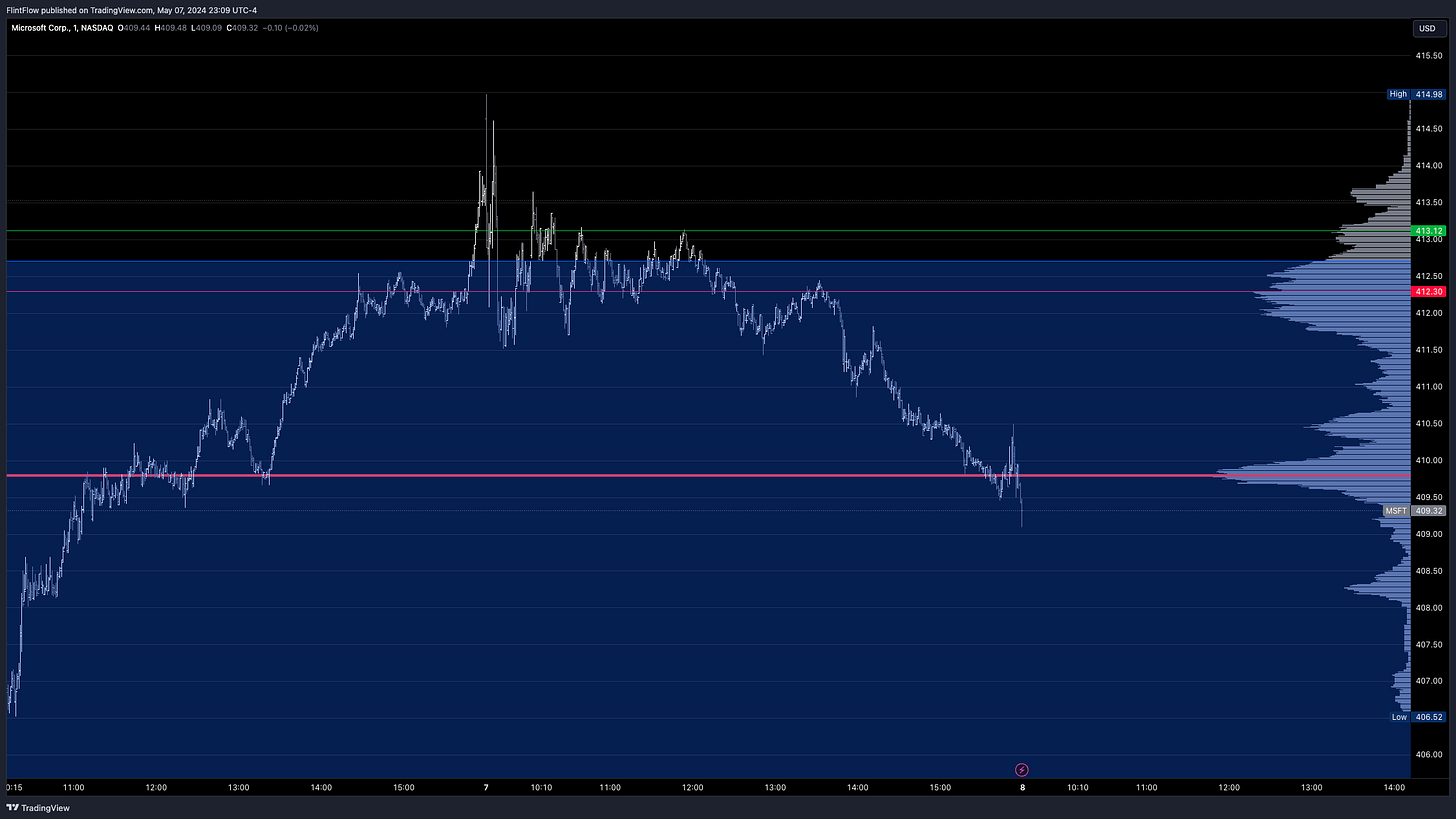

Now, let's discuss the stocks with levels posted in the Daily Plan section. TSLA, NVDA, and MSFT all experienced downside, falling below the short levels and triggering a strong rally in option contracts for this week's expiration. Both MSFT and NVDA sold down from the swing Value Area High (VAH), which is why the short levels were placed there in last night's newsletter. The swing Value Area Low (VAL) / VAH setups offer the best risk-reward ratio with a higher accuracy to work out in our favor.

On the other hand, there was notable strength in other stocks as well. GOOGL, META, AAPL, and AMD all saw strong upside movements above the long levels. Despite weakness in the semiconductor sector, AMD managed to hold stronger, which I believe is solely due to the fact that its structure wasn’t indicating sellers as NVDA's was. GOOGL’s continued strength to the upside was evident within a swing timeframe at the Low Volume Node (LVN). AAPL's upside came solely from a gap up, followed by a sell down to the long level, offering another opportunity for upside into the close.

Make sure to show some love by dropping a like if you enjoy reading this post!

![4K Blue Ridge Mountain sunset [OC][4096 × 2160] : r/wallpaper 4K Blue Ridge Mountain sunset [OC][4096 × 2160] : r/wallpaper](https://substackcdn.com/image/fetch/$s_!IULN!,w_1456,c_limit,f_auto,q_auto:good,fl_progressive:steep/https%3A%2F%2Fsubstack-post-media.s3.amazonaws.com%2Fpublic%2Fimages%2F06e1d2f9-0d9b-46c9-8700-ff6d47cbe4be_4096x2160.jpeg)