Welcome back everyone!

First, we will cover the recap for today's session, then move on to tomorrow's analysis.

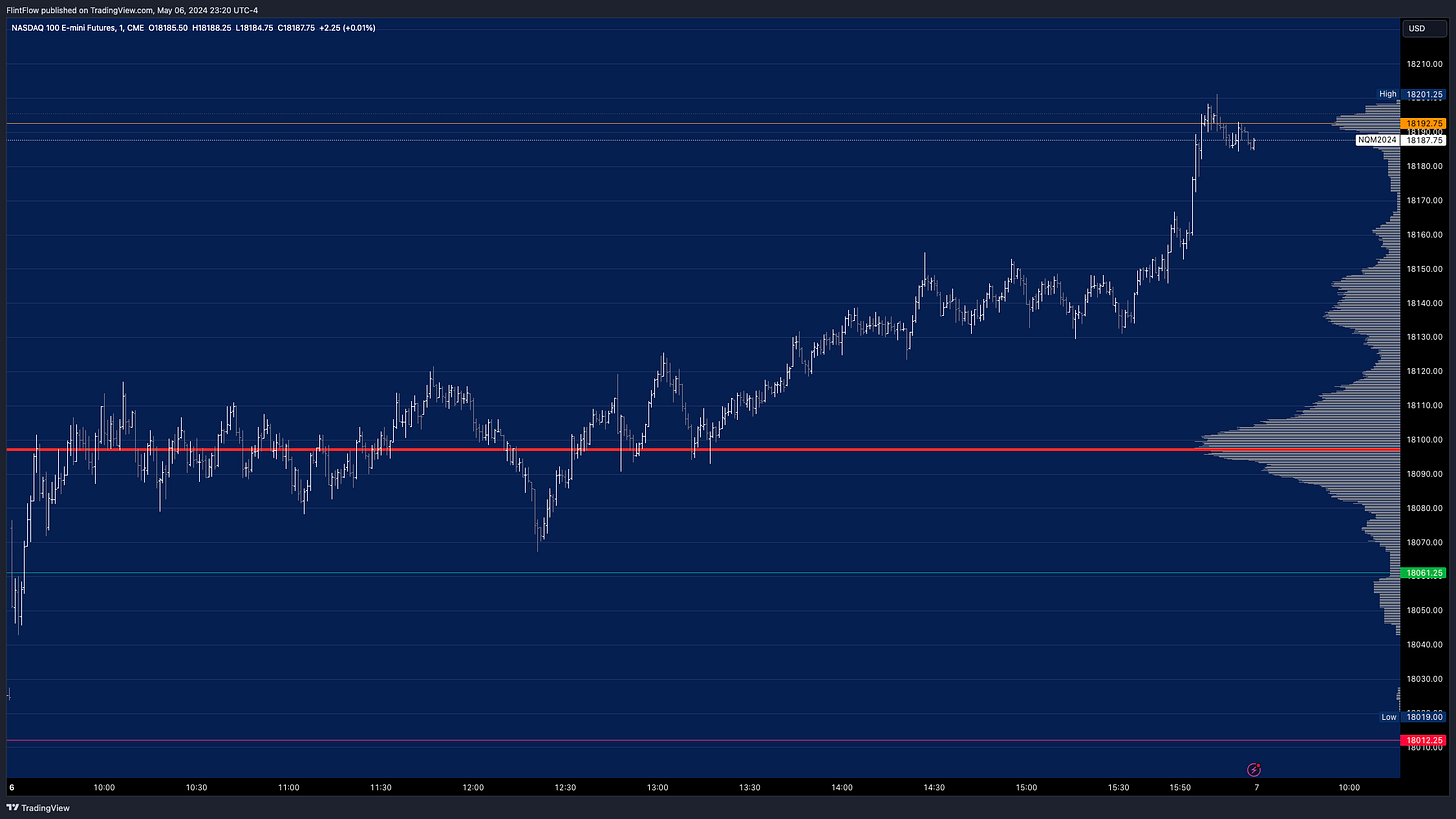

Indices:

We kicked off the week with a bang as both indices surged toward their long targets. This significant move not only brought upside to futures but also to the SPX contracts highlighted at the end of the session. In the last hour, I seized a clear opportunity to enter 0DTE contracts on the SPX. Throughout the session, we witnessed a consistent upward trend. The market structure revealed a Low Volume Node (LVN) at 5190, which I identified as a key support level. Indeed, it proved to be crucial as the price dipped precisely to this mark before rebounding to new highs, reaching my target of 5207, which corresponds to the swing value area's Point of Control (POC). The SPX contracts we highlighted soared from 0.6 up to 7.5, achieving a 1,150% gain by the close—a monumental success discussed extensively in the Substack chat. This chat has been a significant enhancement to the offerings within this newsletter. Furthermore, last week’s AAPL put contracts also saw a remarkable increase, doubling in value today for another outstanding performance.

Commodities:

Oil prices declined sharply from the short level after a failed attempt to break above the long level. Unfortunately, the price fell short of the short target but still experienced an 80-pip drop within minutes during the session.

Gold, on the other hand, rallied from the long level, pushing the price up to the target which nearly set the session's high. However, there was no continuation above the swing Value Area Low (VAL), which will likely act as a significant resistance level throughout this week. I believe that as long as the price remains below this level, the upside potential is limited. If this resistance holds, we might see a reversal of today's gains, with prices potentially retreating sharply.

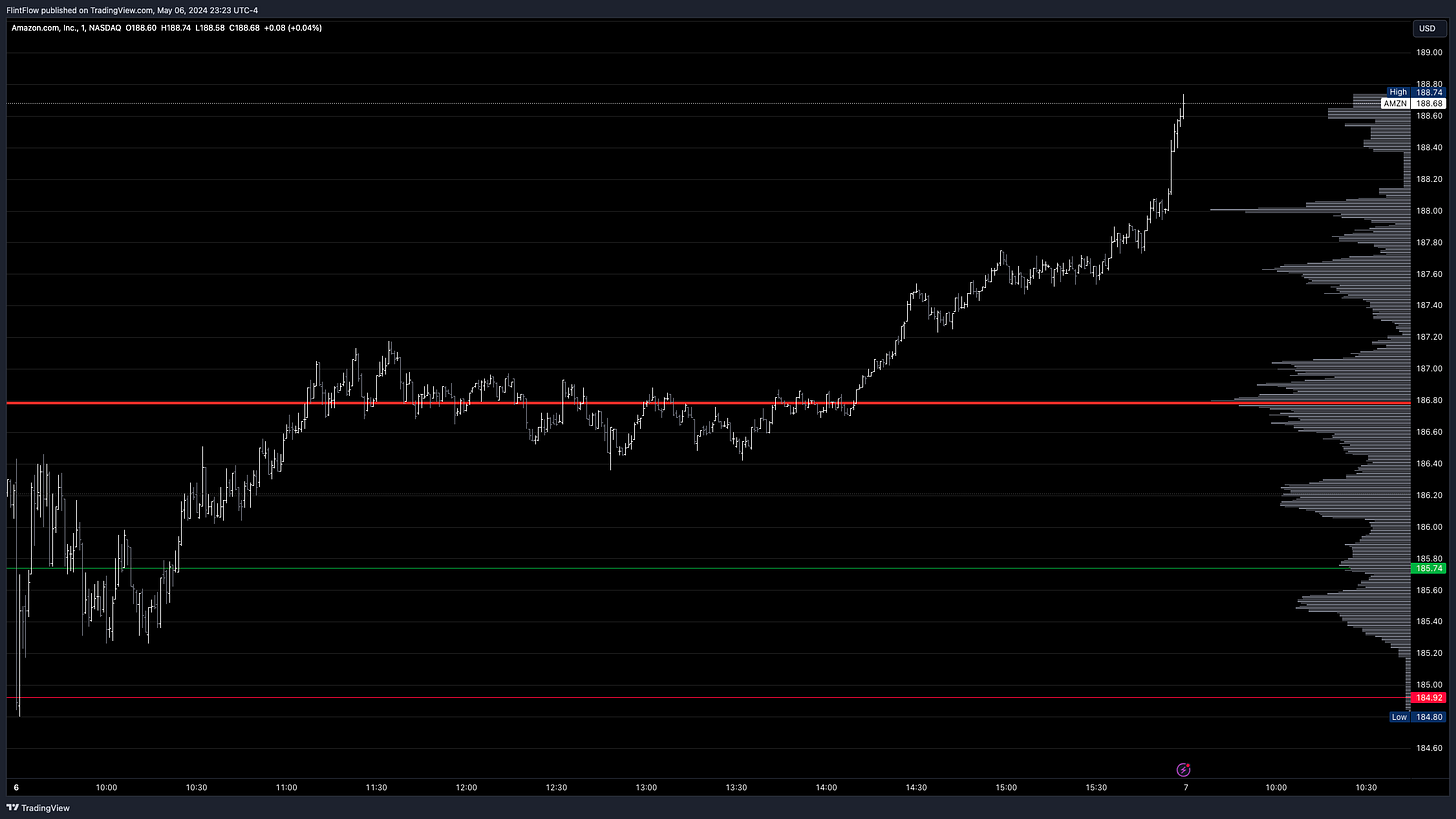

Stocks:

MSFT, TSLA, AMZN, META, NVDA, and AMD all experienced strong rallies above their respective long levels. NVDA, MSFT, and AMZN particularly followed the bullish scenario I outlined in last night's video. These stocks were poised for substantial upside and reached my maximum upside targets for the session, complementing the end-of-day rally within the indices. MSFT is currently above the swing Value Area High (VAH), suggesting potential for continued upward movement throughout the week. Conversely, NVDA needs to break above the swing VAH, which I will use as a short level in tomorrow's session. This represents a key resistance point, so I will prioritize the short setup before considering any further upside.

AAPL was the only stock to exhibit sustained weakness below the short level, aligning with my thesis for the week as I had highlighted Put contracts last week with this week's expiration. These contracts have appreciated by 100% in today's session, with potential for further decline below the swing Value Area Low (VAL). Breaking this support level is crucial; however, as long as we remain above it, buyers will likely remain active. If we do not break below in tomorrow's session, I believe we may have reached the recent low, setting the stage for a move above the Earnings Release (ER) highs.

Make sure to show some love by dropping a like if you enjoy reading this post!