Notable levels from yesterdays session (Stocks & Futures)

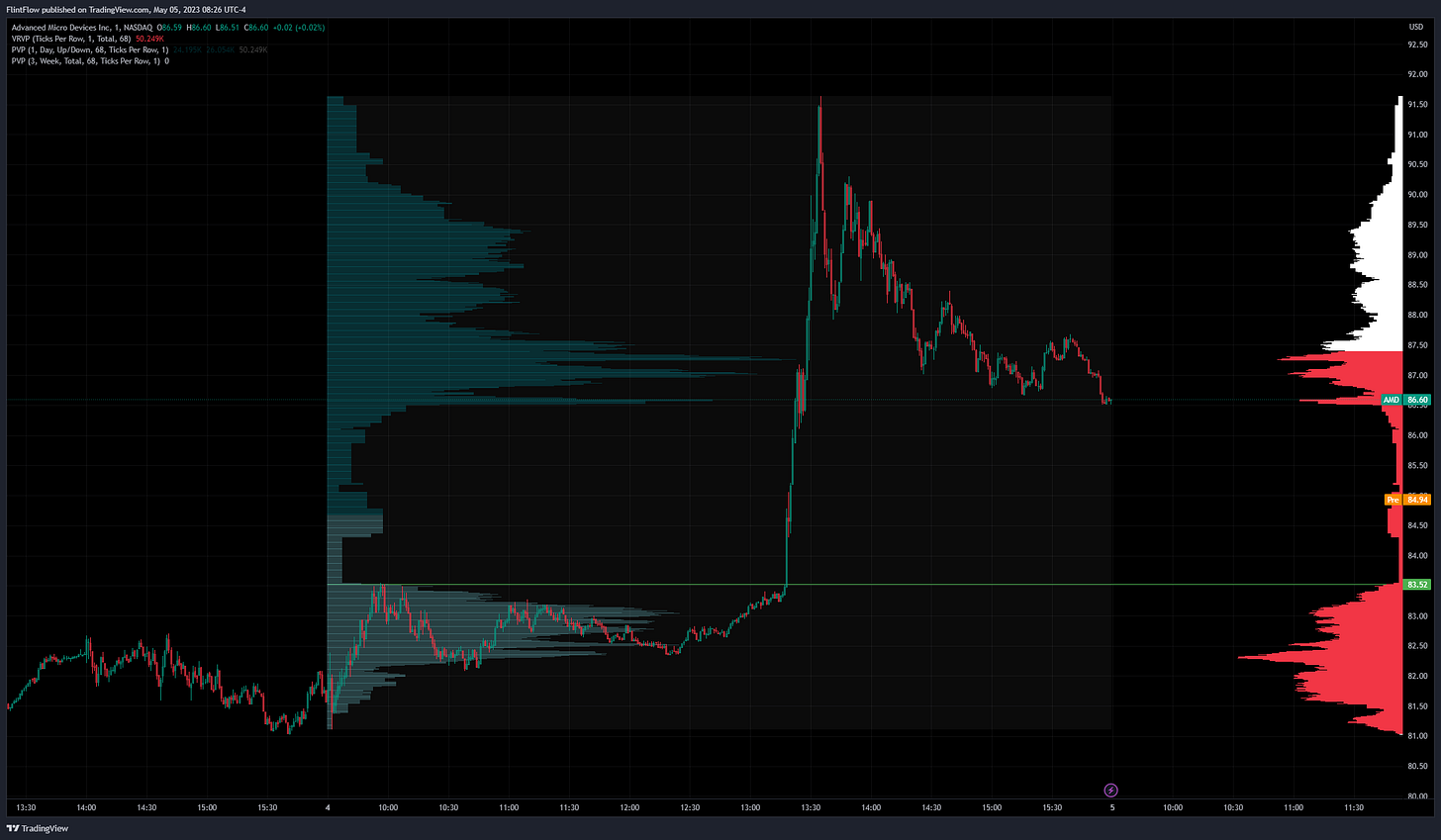

AMD 0.00%↑: Massive rally once above long level as MSFT 0.00%↑ came forward on a partnership with AMD to help finance expansion into AI Processors. Catalyst dropped as soon as we broke above long level.

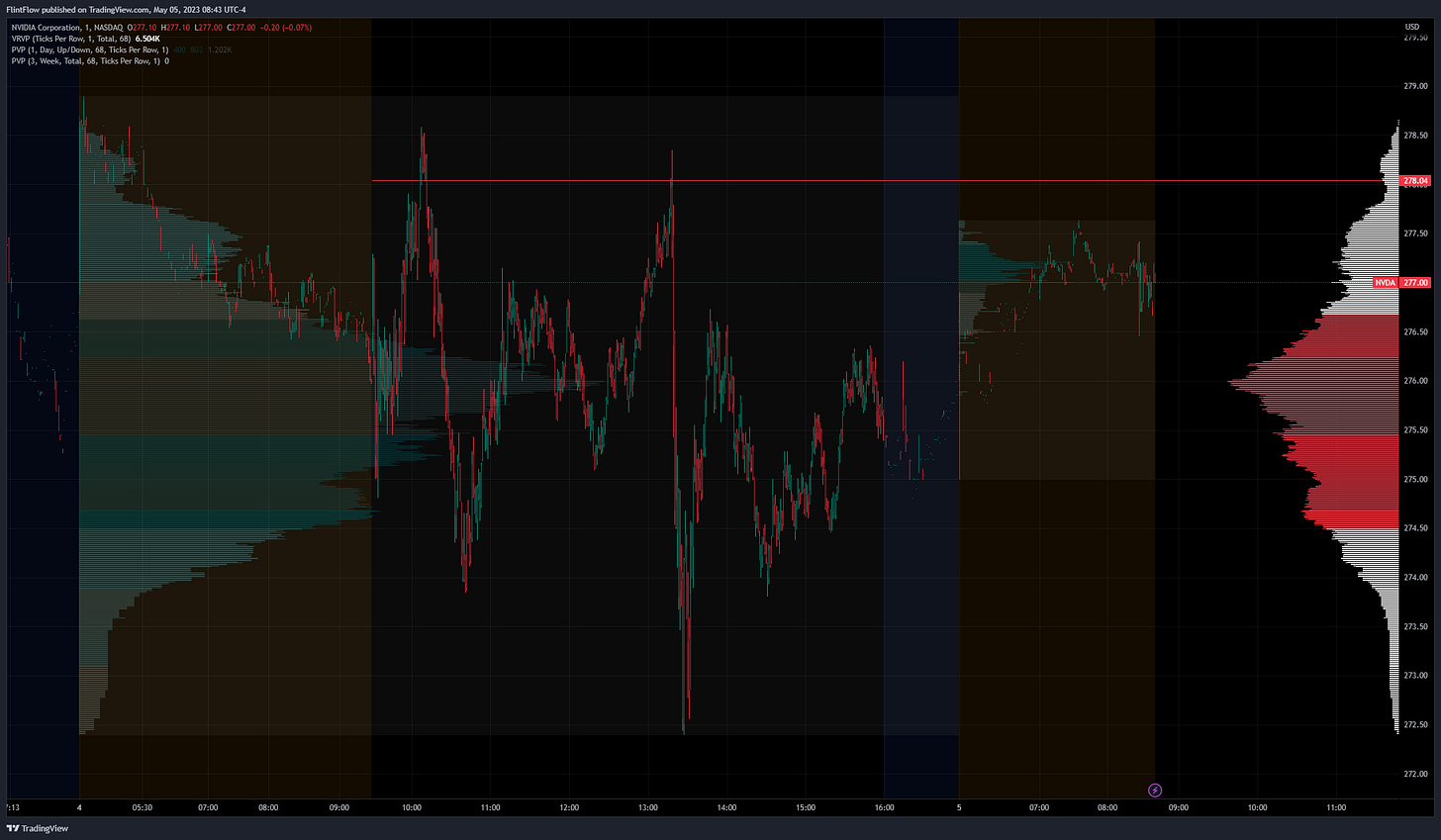

NVDA 0.00%↑: Two sells from 278.04 Short level which was nearly the exact high once AMD / MSFT partnership came out. Overtime more and more you will notice that many of the catalyst will drop as soon as its time to test another area of value. In this case AMD saw a massive spike to the upside.

META 0.00%↑: Zero budge above 238.38 short level offering 4 handles in upside on shorts.

ES: 4095 Short level was nearly the HOD with one sell at the open and another once we rallied off lows 4058 short target.

NQ: 13084 Short level was HOD at the start of the session offering +82 handles in upside for shorts.

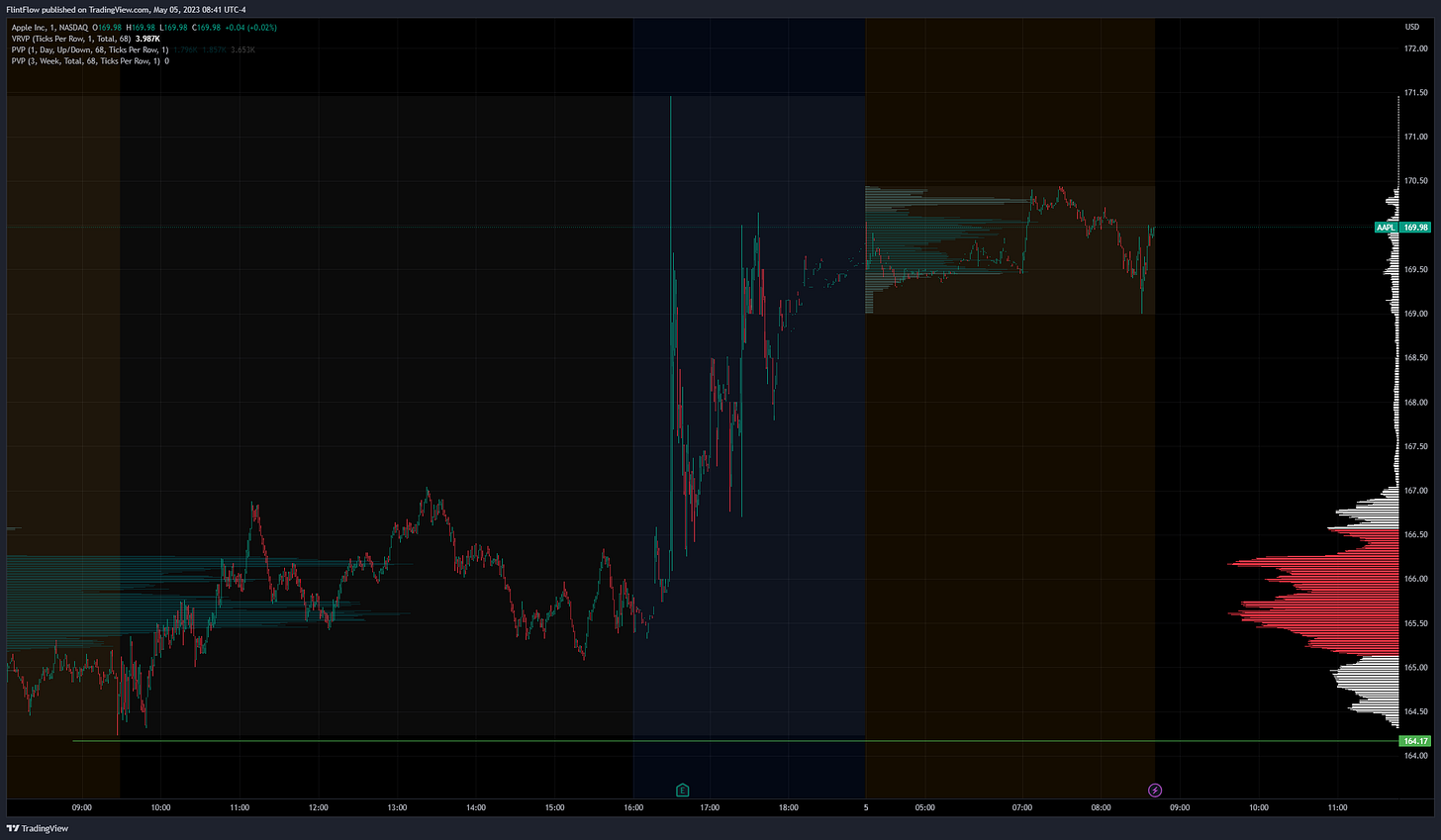

AAPL 0.00%↑ : First I want to show what was said in yesterdays Daily Plan while also noting that I was one of few Bulls on ER and the session as a whole. I was crystal clear on being bullish all session even if Emini was not able to catch a bid.

So far OVN we have made a clear attempt to take back 4095 VAL for a potential trip up to 4153 POC for todays session. As long above 4108 I can not be bearish and will look for longs to the other side of value. Apple earnings today and I think we saw plenty of profit taking yesterday which continued through the night. This report is the most anticipated release of the year! For today, I think they will bid price back up to 167 AAPL -0.31%↓ bringing bid to Emini. Even if we do not see a reclaim of 4108, Apple will more than likely remain strong.

Long level never broken, profit taking flows in on shorts and drifted price right up to 167 target. Post earnings stock is now 171!

Recap of yesterdays events

US Continued Jobless Claims: 1.805M

US Productivity Preliminary: -2.7%

US Unit Labor Costs Preliminary: 6.3%

US Mar Trade Deficit $64.23B; Consensus Deficit $63.1B

Feb Trade Bal Revised To Deficit $70.64B From Deficit $70.54B

Mar Exports $256.15B, +2.1%; Imports $320.38B, -0.3%

Events

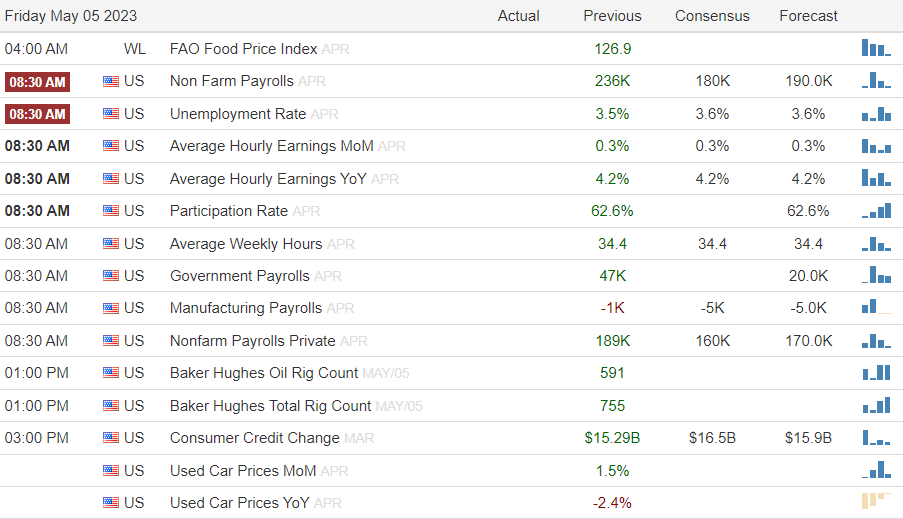

NFP: 253K (Est. 180K)

Unemployment Rate: 3.4% (Est. 3.6%)

Avg Hrly Earnings MoM: 0.5% (Est. 0.3%)

Earnings

S&P500 Thoughts

Emini has now taken back the VAL 4095 which trading above this I can’t be short. Above targets 4153 POC which we have seen great Apple earnings to gap prices up +30 handles to now 4105.

NFP saw a higher print above previous and expectations along with another drop in unemployment. The FED is trying to get this number up yet the economy keeps pumping expansion making this job only 10x harder. the FED is not jumping the gun on hikes as they have stated these takes months to settle in.

Hike for a while then collapse all at once, we are waiting for a crack in the economy.

Not seeing it yet.

Traders are now pricing in a 25bps hike in June right after pushing a possible rate cut into the year end. This is in line what I think and this will continue to hike if this data remains this strong.

Upon breaking and holding below 4095 I want to target yesterdays lows around 4060s.

Value Areas

4095 - 4192 / POC 4153

3880 - 4048 / POC 3951

Daily Plan 5/5/23

These are setups I see from Volume Profile perspective, any trade taken by you is accepting all risk at stake! Always know what is at risk before entering any trade. The purpose of these are to show what a Volume Profile trader is looking at.

ES Long 4105 > 4140 / Short 4090 > 4065

NQ Long 13113 > 13203 / Short 13076 > 12989

SPY 0.00%↑ Calls 408.08 > 410.97 / Puts 406.62 > 404.3

AAPL 0.00%↑ Calls 169.7 > 173 / Puts 168.96 > 166.13

TSLA 0.00%↑ Calls 162.12 > 167.42 / Puts 159.67 > 155

NVDA 0.00%↑ Calls 276.02 > 279.71 / Puts 274.29 > 270.11

MSFT 0.00%↑ Calls 305.29 > 308.36 / Puts 303.73 > 300.92

AMZN 0.00%↑ Calls 104.44 > 107.02 / Puts 103.72 > 102.18

AMD 0.00%↑ Calls 85.6 > 87.84 / Puts 84.44 > 81.79

GOOGL 0.00%↑ Calls 104.69 > 106.23 / Puts 104.2 > 102.58

META 0.00%↑ Calls 236.18 > 240.07 / Puts 233.48 > 231.2

-Flint

Disclaimer: This post is not trading or investment advice, but for general informational purposes only. This post represents my personal opinions which I am sharing publicly as my personal blog. Futures, stocks, bonds trading of any kind involves a lot of risk. No guarantee of any profit whatsoever is made. In fact, you may lose everything you have. So be very careful. I guarantee no profit whatsoever, You assume the entire cost and risk of any trading or investing activities you choose to undertake. You are solely responsible for making your own investment decisions. Owners/authors of this newsletter, its representatives, its principals, its moderators and its members, are NOT registered as securities broker-dealers or investment advisors either with the U.S. Securities and Exchange Commission, CFTC or with any other securities/regulatory authority. Consult with a registered investment advisor, broker-dealer, and/or financial advisor. Reading and using this newsletter or any of my publications, you are agreeing to these terms. Any screenshots used here are the courtesy of Ninja Trader, Think or Swim and/or TradingView. I am just an end user with no affiliations with them.