Welcome back everyone!

First, we will cover the recap for today's session, then move on to tomorrow's analysis.

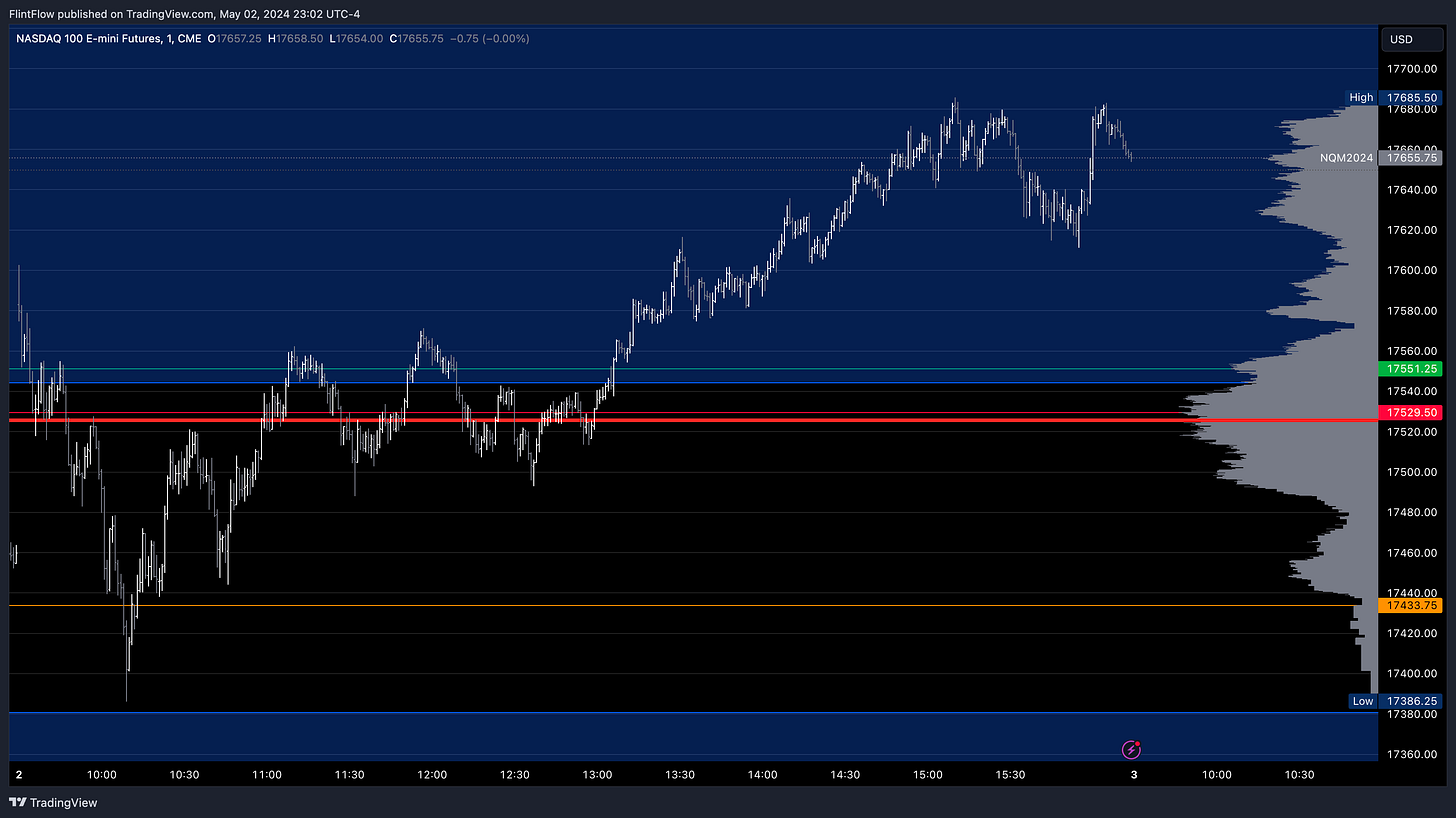

Indices:

The indices once again hit both the long and short targets on the Emini, with the Nasdaq meeting the short target but falling short of the long target. Both indices managed to hit their targets in after-hours trading once Apple significantly exceeded earnings expectations. Unfortunately, I had anticipated that Apple's stock would decline post-earnings, but this was not the case. If the price does not drop significantly tomorrow, then I believe this rally was not solely driven by buybacks. The current price reflects the market consensus at any given moment; there is always a reason why it is trading at that level. It was a strong week for earnings overall, with two more companies set to report tomorrow. Additionally, the option contracts on the SPX were profitable, with one sell earning a 200% return on the contracts and another drop breaking recent lows at the close, leading to an additional 100% increase in premium. Ideally, the price would have dropped to 5077, but buyers intervened at 5081, thus missing that opportunity.

Commodities:

Oil experienced minimal movement today, hovering just above the long level and remaining above the short level as well. The price consolidated between these levels, filling in volume at the Low Volume Node (LVN).

Gold, on the other hand, gapped down at the opening, bringing the price directly to the short target before it found support at that level for the remainder of the trading session. This support at the short target indicates a potential stabilization point for gold prices, suggesting that investors might be viewing this level as a favorable entry point or a bottom for the current market cycle. down bringing price right down to the short target before finding support at the target for the remainder of the session.

Stocks:

Today, there was notable strength across many stocks, although a few exhibited weakness for most of the session. GOOGL, AAPL, AMZN, and NVDA all continued their upward trajectory, moving above the long levels, as illustrated in the charts below.

Conversely, TSLA and AMD were the weakest stocks in today's session, with a wave of sellers stepping in below the short levels. Prices remained nearly below these levels for most of the session. Although both stocks eventually broke above the short levels, they showed no strength above the long levels, indicating a lack of buyer momentum to sustain an upward move.TSLA

Make sure to show some love by dropping a like if you enjoy reading this post!

![410+] Sunrise 4k Wallpapers 410+] Sunrise 4k Wallpapers](https://substackcdn.com/image/fetch/$s_!Eq66!,w_1456,c_limit,f_auto,q_auto:good,fl_progressive:steep/https%3A%2F%2Fsubstack-post-media.s3.amazonaws.com%2Fpublic%2Fimages%2F788f0d19-030d-4ed7-8851-82b5d9defc52_3840x2400.jpeg)